If it’s not one thing it’s another for the poor old Aussie

A weakening landscape in commodity prices has heaped some bearish pressure onto the Aussie (and other commod FX pairs). The trade war news is still ever present and that is feeding through into other sectors, of which commodities can feel the pinch also.

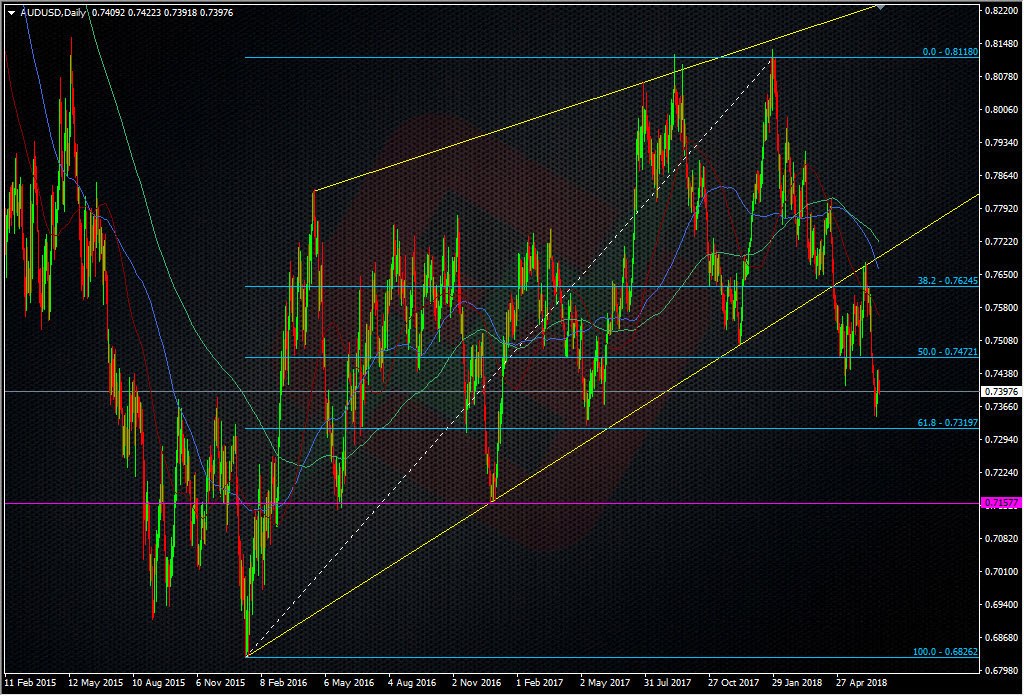

The bounce from the recent lows looks fairly dead cat-ish so we can’t rule out another look down there. The 61.8 fib of the 2015 swing is still a level to watch and a break of there, and the 0.7300 big fig could mean another sharp leg lower.

Looking at this wider view, my ideal trade would be to see if we get a break of 0.7300 with a view of a long down at the double bottom around 0.7150.

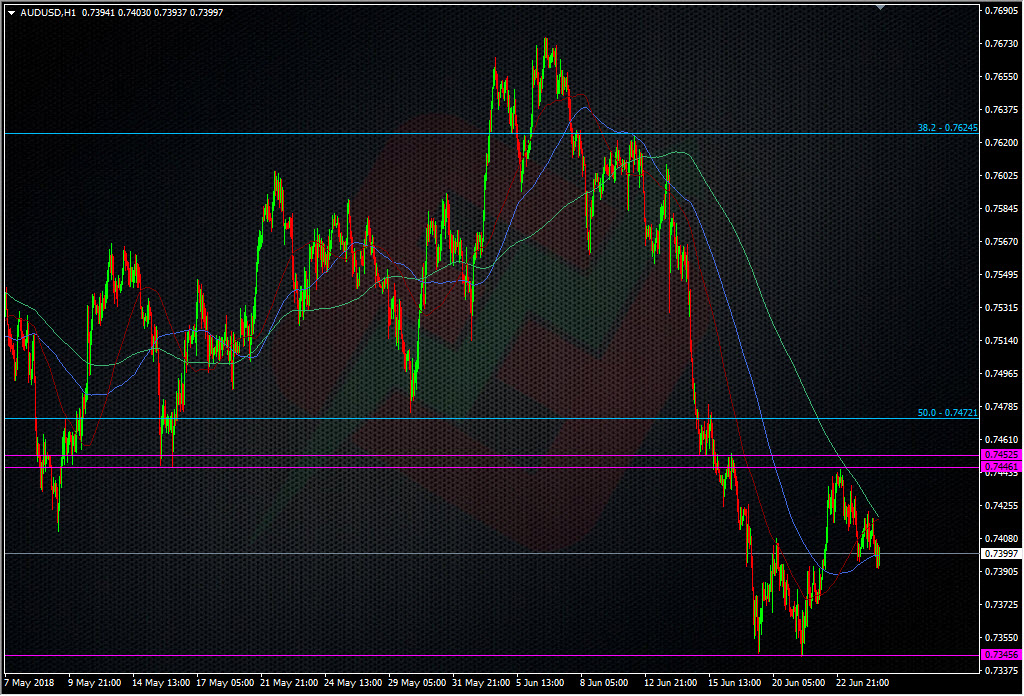

Looking more closely, we’re pretty much in the middle of the June hi/lo’s and those edges are the probably the safest places to trade.

If you zoom in a bit closer, scalpers will be watching the down trendline (and 200 H1MA) from yesterday’s highs, as that’s currently giving some good rewards for tight shorts.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022