Tough trading conditions continue in EURUSD

A trader’s lot is a tough lot most of the time and the market conditions are making it quite tough now.

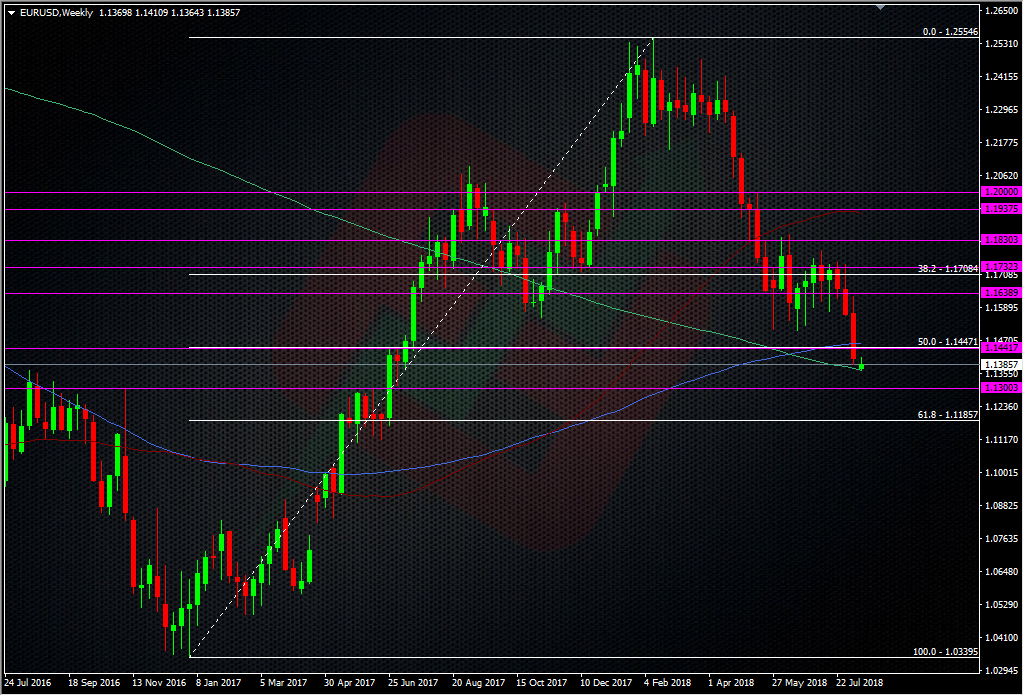

Take EURUSD. If you’ve ridden the short train from above 1.15, you’re laughing, though you had to wait a while for the break. Now we’ve had this leg lower and all the news from last week (most of which is still ongoing) suddenly EURUSD has gone to sleep. So, what do you do? You don’t want to chase this latest move at a possible bottom, yet you don’t really want to fight it because it looks so strong.

You therefore have to adjust. For right now, (partially) put aside the wider picture and stick to what’s happening. We’re stuck between 1.1365 and 1.1400/10.

You can either trade between the lines or try going with a break. The low is being backed up by the 200 WMA. If 1.1400/10 breaks, the 100 WMA (1.1462) might play hardball. It’s also not far from the broken 50.0 fib of the 2017 swing at 1.1447.

As we’ve seen recently we can swing from big wild headline moves to falling asleep for hours. That can be very hard for some traders to follow because our brains get locked into each scenario. That can mean you start using the wild scenario to try and trade the sleepy scenario (e.g thinking that every move is going to be 50-100 pips), and vice versa. So, as above, learn to read the conditions and price action and let that tell you how you should be trading.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022