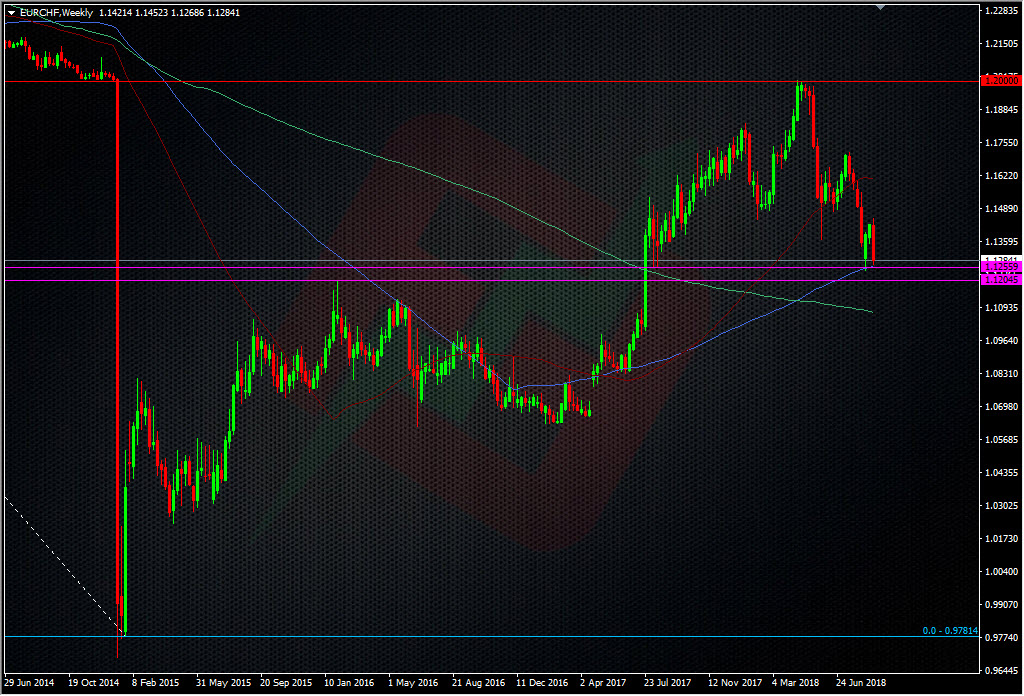

A possible long trade set-up in EURCHF

EURCHF is approaching a potentially strong looking support area around 1.1250 and I’m looking for a long there.

We saw a fairly decent bounce from down here last time and although that’s not an indication of future moves, it is a decent looking tech level.

Obviously, staying on the right side of possible SNB action is a factor but it’s not something I’m going to rely on. If it comes it will be a bonus but the thinking within ForexFlow is that they may not be too far away from stepping in, given the falls we’ve seen so far. The problem for the SNB is that they are facing a stiffer wind with all these EM flows producing a run to safety. That’s a potentially bigger force to deal with than normal market moves. That means they might take more of a smoothing approach to steady the ship and allow CHF to just appreciate slower, rather than trying to push it back. But, as I say, we can’t make the SNB our trading strategy, they’re just another factor in the mix.

I’m currently bid at 1.1260 with a provisional stop under 1.1200. That’s a level I may add again but I’m going to follow the PA closely and if it looks dodgy in terms of flows, I might bail the whole thing early and reassess. As for a profit target, I’ll just keep to my current strategy of taking some off if I see a some early profit and run the rest as far as I can, while locking it in to break even or a profit as soon as possible.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022