Highlights of the September 2018 US Fed FOMC monetary policy meeting 26 September 2018

- Prior 1.75% – 2.00%

- RAISES TARGET INTEREST RATE TO 2-2.25 PCT, SEES ONE MORE RATE HIKE THIS YEAR AND THREE IN 2019

- REMOVES FROM STATEMENT DESCRIPTION OF MONETARY POLICY AS REMAINING ACCOMMODATIVE

- SEES FASTER ECONOMIC GROWTH THIS YEAR AND SLIGHTLY FASTER GROWTH NEXT YEAR IN NEW ECONOMIC PROJECTIONS COMPARED WITH JUNE PROJECTIONS

- SEES SLIGHTLY LOWER PCE INFLATION IN 2019 COMPARED WITH PRIOR PROJECTIONS; PROJECTIONS FOR 2019 CORE PCE AND 2019 UNEMPLOYMENT RATE UNCHANGED

- IN STATEMENT DOES NOT CHANGE DESCRIPTION OF ECONOMY; REPEATS THAT JOBS GAINS HAVE BEEN STRONG AND HOUSEHOLD SPENDING AND BUSINESS FIXED INVESTMENT HAVE GROWN STRONGLY

- REPEATS EXPECTS FURTHER GRADUAL INCREASES IN FED FUNDS RATE WILL BE CONSISTENT WITH SUSTAINED ECONOMIC EXPANSION, STRONG JOBS MARKET AND INFLATION OBJECTIVE

REPEATS RISKS TO THE ECONOMY APPEAR “ROUGHLY BALANCED” - SETS INTEREST RATE PAID ON EXCESS RESERVES AT 2.20 PERCENT, KEEPING IT 5 BASIS POINTS BELOW TOP OF FED FUNDS TARGET RANGE

- VOTE IN FAVOR OF POLICY WAS UNANIMOUS

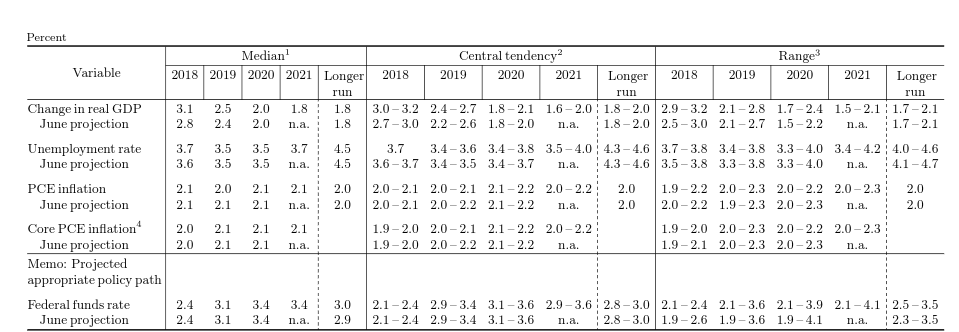

Forecasts

- 2018 GDP up a touch to 3-3.2% vs 2.7-3.0%

- 2019 2.4-2.7% vs 2.2-2.6%

- 2020 1.8-2.1% vs 1.8-2.0%

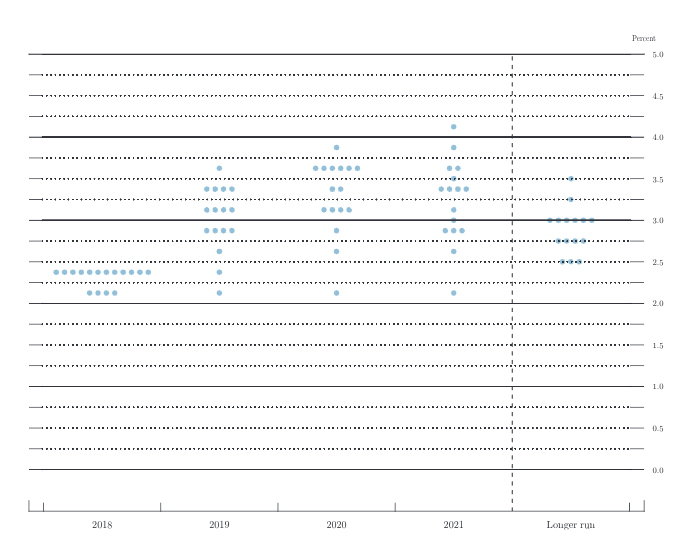

Dots pretty much confirm 3 hikes in 2019

Latest posts by Ryan Littlestone (see all)

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022