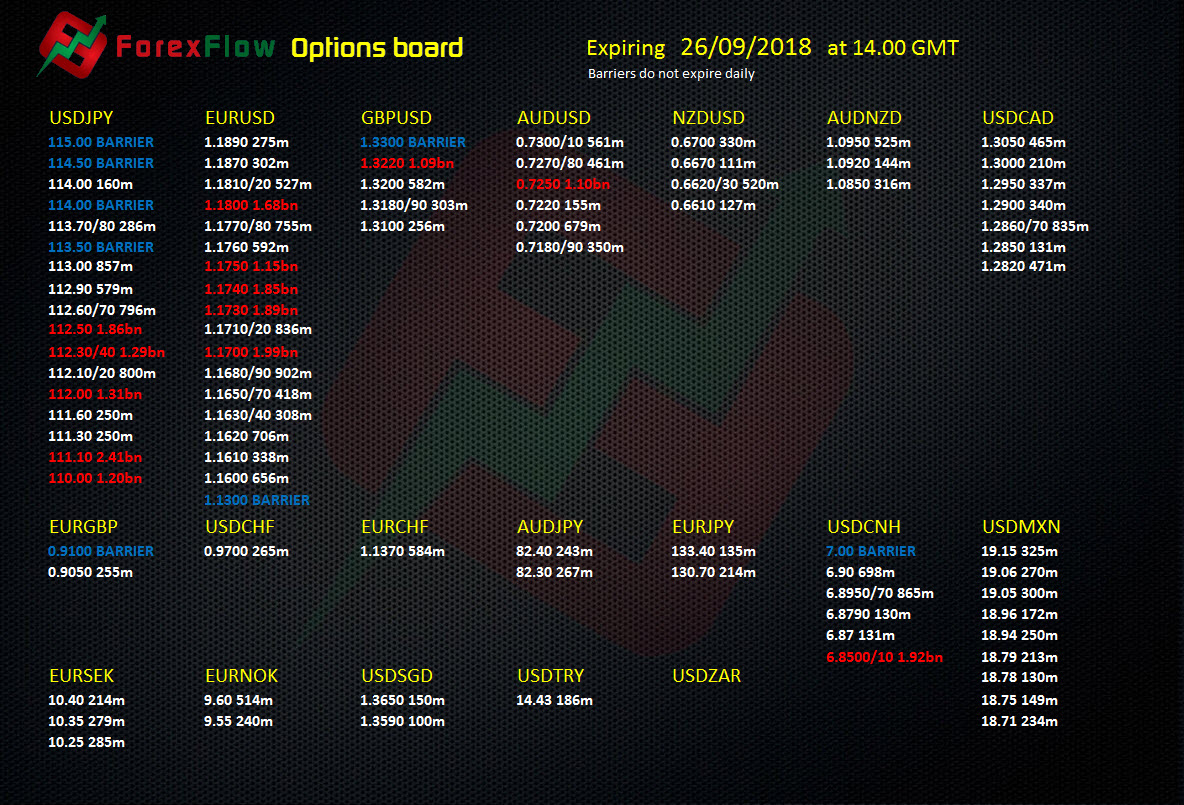

Forex options expiring at the 10 am (14.00 GMT) New York cut 26 September 2018

A big day for the options today and you’d think it might be down to FOMC hedging but it’s very likely not. Today is the value date for spot (trades done today settle after two business days in most currencies). That value date for today is Friday, which is the last day of the month. So, what we’ve got is a load of hedges or speculative options expiring today for month (and qtr) end, the proceeds of which may be traded out. Of course, some of these options could be hedges for positions in the spot market anyway so may just expire worthless. The big cluster in EURUSD is pretty even in the Call/Put ratio so there’s not even a real bias to suggest we’ll see any defensive moves.

I don’t suggest we’ll see any big option related moves ahead of the expiry but we may be glued around these levels as the options traders pin the price to these large expiries while most other traders sit back waiting for the Fed. What we might also get is a flurry of activity on/after expiry if any of these positions are traded out in the spot market.

As always, option expiries are very rarely able to be used for a trading opportunity, unless certain conditions are met. For today (barring other news and events), we’re more likely to see the price stuck and then some choppiness. Only if (big if) something in the expiries kicks the price right out of sync with the day’s ranges, we might have a fade opportunity but that will be a trade to get in and out of quickly so we’re not stuck in something into the FOMC.

For further information on option expiries, please read our explanation of Forex options and their impact on currency markets.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022