The Brexit pendulum has swung right back the other way and GBP doesn’t like it

May facing another round of calls for a confidence vote, the DUP backing Brexit amendments to make the EU backstop proposal illegal and we’re still far from a deal. It’s all getting too much for the pound.

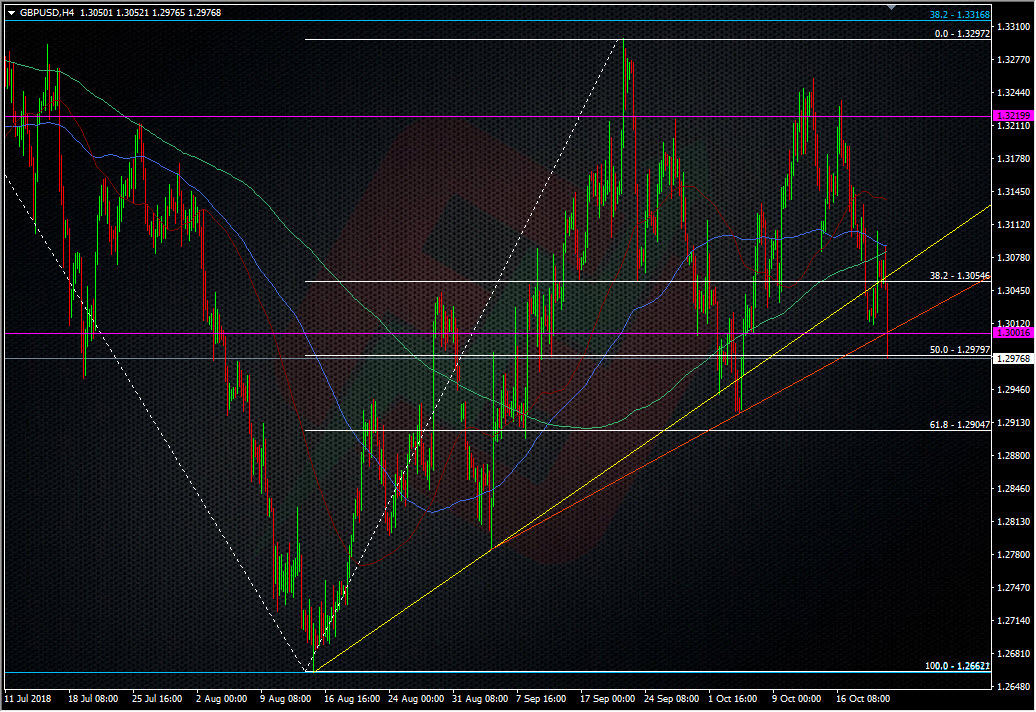

GBPUSD has cracked through several support levels and could be on the way to testing the Oct lows.

Last week in our room we had a conversation about two trend lines that might have been in play. The yellow one has played both sides but the orange looks defective now. It might be worth watching for a reaction on the way back up but more likely, the 1.30 handle will be the main res point now.

The early Oct lows is the closest main support now, and the 61.8 fib of the Aug swing up. Resistance will be coming in at 1.30 and 1.3015/20 but look for signs that 1.2980/90 might show some too. The risks for GBP are high this week, as there’s a host whole host of Brexit politics coming this week;

- Today – 13.30 GMT – Question on the cost of staying in the CU and cost of the draft withdrawal agreement, and a question on the amendability of the meaningful vote

- From 16.00 GMT – Theresa May to brief ministers on the Oct EU summit

- Tuesday 08.15 GMT – The Public Admin and Constitutional Affairs Committee will examine the Brexit “meaningful vote” (remember this vote is not legally binding even if May suffers a defeat on it, hence why so much fuss is over what it’s called).

- From 09.00 GMT – various committees will hold sessions on the implications of Brexit to the justice system, further inquiries into post-Brexit trade priorities and the Health and Social Care com will look into the impact o f a no deal Brexit

- Wednesday – 08.15 GMT – The exiting EU com will look at the current proposals for avoiding a hard border in Ireland

- From 09.00 GMT – The Trade com will look at the impact of UK-EU trade on wider UK trade

- From 13.30 GMT – the Public Accounts com will look at the Dept for Transport’s no deal planning. The Procedure com will take evidence on the motions put forward regarding what ministers will get in the “meaningful vote”

Most of these are just part and parcel of the normal procedures that the UK Parliament go through regarding Brexit. There’s many of these types of sessions from all the different sector departments. However, the Brexit political spotlight is firmly on May this week and we’re likely to get additional reporting on all these events. That adds further headline risk for GBP traders.

I’m still long as my next level was filled into 1.30. I’m still happy to scale in small longs as I won’t get overly worried unless I see a move under 1.2800. If that happens I’ll have to re-assess my strategy and positioning.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022