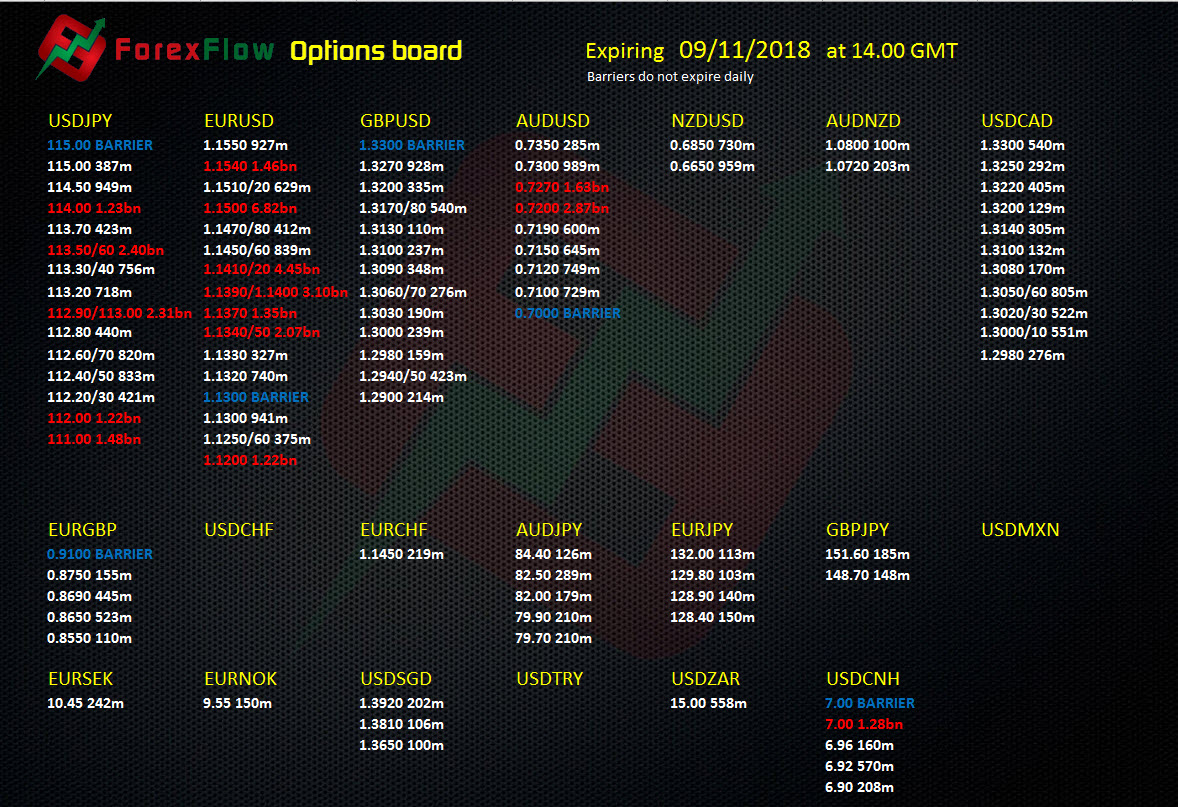

Forex options expiring at the 10 am (15.00 GMT) New York cut 9 November 2018

A sea of red today on the board, with over 10bn going off in an 80 pip range in EURUSD 1.1340-1.1420, and then on top of that, nearly 10bn off 1.1500-50. Sometimes when it’s this busy in the expiries it can have a neutral effect on the price because there’s so much coverage, afterall, who will go after what strikes? Remember, don’t think it’s just one or two players in the battle, these options can be made up of hundreds of trades, and be part of many different strategies that don’t necessarily need defending or attacking.

What we also need to see is the composition of these options (whether Calls or Puts), then at least we might be able to see if there’s a bias for a possible attack or defence. A comprehensive breakdown of the big expiries can be found on our trading platform.

For more information on how these option can effect the market, read this post: An explanation of Forex options and their impact on currency markets.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022