The Euro is looking creaky again

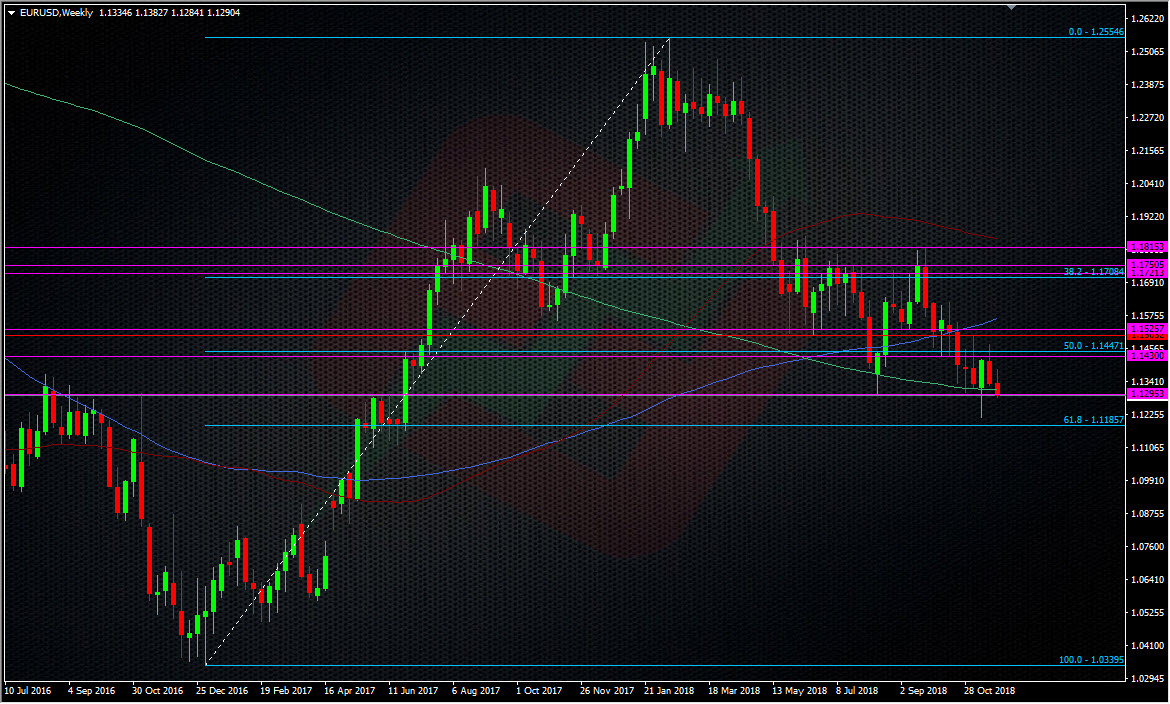

Today’s move under 1.1300 spells potential trouble for the euro. The 1.13 area is a decent level but it’s looking like it’s in the process of breaking. The 200 WMA hasn’t had the price hold below it since 2017, on a weekly basis. That’s being cracked too in this move.

Holding below 1.13 brings the downside into play once again, and the big 1.12 area into focus. We’ve already seen a stiff defence of the level two weeks ago. That pulled up around the 1.1215 area. That protection of the big figure is likely to have stepped up to somewhere like the 1.1220/30 area. It’s a pattern we see often as traders who are protecting a level, then step their orders up to protect the secondary level. In this case, they’ll be looking to keep sellers away from where they bought around 1.1215. That also means there’s likely to be stops lurking under that 1.1215 level too. But, given the close proximity to the big fugure, we can maybe assume they might be just under there.

The 1.1200-1.1500 is the range I’ve been looking to trade so I’m going to watch any move down there carefully. There’s enough action around 1.12 to think about longs to play the range but I am also contemplating a small short into a hold of 1.1300, just to see if we get a push down.

If 1.12 breaks we could expect some fireworks as there’s a lot of eyes on the 61.8 fib of the 2017 move at 1.1186.

In the shorter-term, the minor support levels today are going to solidify as resistance, as will the 1.1330/40 area.

If we do continue this move lower, look for some traffic in the 1.1270/80, then around 1.1255/60.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022