Markets see a bit of a divergence in US interest rate expectations

Some of the doom and gloom has come out of expectations for the US economy. Powell & Co may still be preaching patience but they’re also still preaching that the US economy is doing ok. The GDP report yesterday backed that up by beating expectations in Q4. However, while we’re seeing US yields rising as some optimism returns, FFR markets aren’t so sure.

Between the 27th and close of biz yesterday, rate hike odds have only shifted marginally. May & June hike odds stood at 1.7% & 1.6% respectively. They fell to zero but June picked up to 2.8% from 1.6% on the 27th.

There’s been a general shift towards hikes in the latter part of the year but we’re still at very low expectation levels. On the other hand, US 10 year yields keep climbing higher.

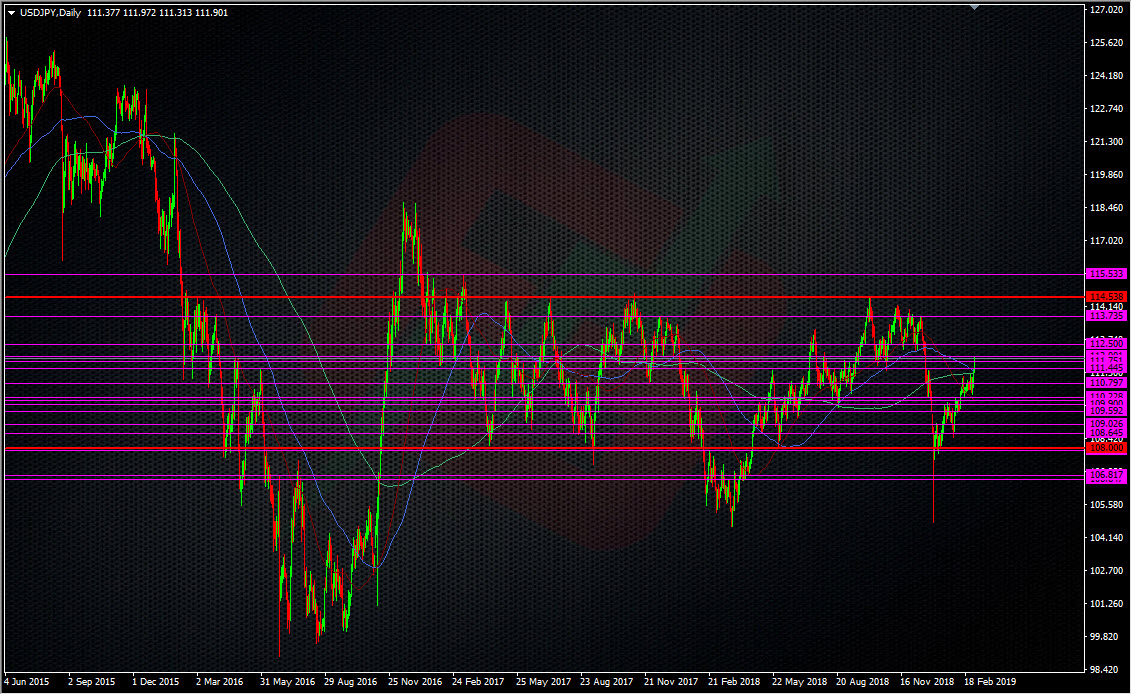

That’s showing that the US is still the most solid major economy of the bunch and the most likely to hike rates again. This is what is giving USD a tail wind right now. The US still edging towards a deal with China will only aid these moves and if a deal is finally confirmed, we’re likely to see 10yr yields put in a proper run on the big 3.0% level. That will also likely come with a sharper rise in hike odds. Both those factors will push USD even higher and we could go right back to testing the upper end of the long-term range around 114.00/50.

Let’s not get too carried away though just yet. We need to monitor the price action and how yields and the hike odds develop. If 10’s get above 2.8% we’ll see increased support in USD. We’ll still get a knee-jerk reaction on any final US/China trade deal and maybe some acceleration after but until then, we’re likely to see things continue to grind, as opposed to seeing any real volatility coming back in. On that front, vols have picked up a touch too but still remain at very low levels. USDJPY 1m ATM vols are at 5.78% currently and had been down to 5.52% yesterday. If we see those climb above 6, again, things might start picking up.

Trading wise, buying dips has become more favourable in USDJPY but there’s still value in shorts against the key resistance levels. I’d be a seller once again into the 114/115 area, should we see it but as usual, I’d judge that trade on the evidence at the time.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022