Trading the option barriers brings profits once again

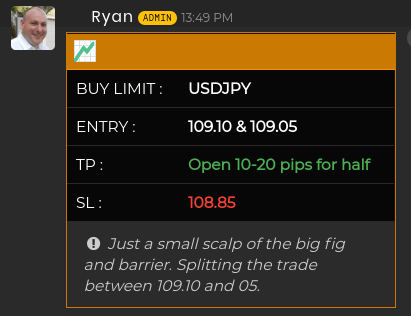

Protection of option barriers in USDJPY at 109.00 helped put a bottom in place yesterday. Barriers are often great levels to trade in front of because they can add to the support or resistance picture at any level. I did just that yesterday in our trading room.

I TP’d half at 109.25 and had an overnight TP on the balance at 109.70, which was hit.

How should we trade barriers?

As above, they should really be just another ingredient we put in the mix when thinking about levels. We still need to assess the market sentiment and mood, and yesterday it was pretty dour with all the US/China headlines flying about, hence, I went with a smaller trade than usual. Then, it just became a case of seeing if USDJPY had been stretched too far and how stiff any barrier defense would be, on top of the big figure bids in play too.

We also need to think about the currency pair barriers are in. For example, there was a barrier in AUDUSD at 0.6950 but I had already discounted that in our room because the ’50’ barriers are often smaller than the ’00’s but also AUDUSD barriers generally tend not to be overly big. However, the old 0.7000 barrier certainly played a big part all the way back to Oct 2018, and fresh ones were put on after the Jan flash crash.

So, it becomes a case of using experience to know when and where to use barrier information as part of a trading strategy but the real key to it all is knowing the information in the first place. That’s something I take very seriously because in trading, knowledge is power. Current ForexFlow subscribers know about 12 active barriers across many pairs. When we trade near them we can also match that up against our institutional market orders so we know where things like stops are sitting. The more informed we are, the better the trading decisions we can make on risk and managing strategies, and the greater our ability to make profits.

Of course, nothing is ever guaranteed in trading so we don’t blindly trade any information we hear about. Barriers are often set well away from current prices so some patience is required to wait for them.

If you want to know about the market information that really maters to your trading, and that can help save you from losses as much as bring you profits, take a look at what we have to offer in our platform.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022