Time to get down and dirty in readiness for the July 2019 FOMC meeting

NB. This was posted earlier today to ForexFlow subscribers so some charts may be out of whack with current prices.

So, here we are then. Months of anticipation and speculation could be decided by close of business Wednesday evening. Will it be a cut or a kick from the Fed?

My view remains that a cut is not warranted by the data we’ve seen. It’s really only inflation that’s missing the Fed’s goal and even then, it’s not really at dangerously low levels. The trade disagreements have been hitting manufacturing and sentiment, which showed up in the GDP report via weak investment numbers. That’s not something a rate cut will fix and it needs the trade disputes to be resolved. On the flip side, we know that the service side of the economy isn’t suffering as much and has shown it is able to improve. The consumer and employment remain strong. The US is moving at many different levels and the Fed’s task is to balance it all out and set rates accordingly.

I would still be promoting an unchanged announcement from the Fed if it wasn’t for Powell’s comments a couple of weeks ago, where he basically dismissed the strong jobs market as not “running hot”. That was the kicker to suggest a cut is coming. But, be under no illusion that there is still some scope for the Fed to remain on hold, and those chances are still way higher than the market currently expects (which is zero). Tomorrow’s PCE report is going to be huge and could be a final deciding factor. Either way, a 50bp cut is not in the frame. When the likes of Bullard are shying away from one, you know that it’s unlikely to happen.

The big price risk for us traders is whether the Fed fulfils the markets expectations or if they don’t. With cuts priced in, the downside looks quite limited, which means the greater risk is that we see a bounce in USD if the Fed deliver what’s expected and no more, or even deliver less.

How do we trade it?

There’s several scenarios and trades that I’m looking at.

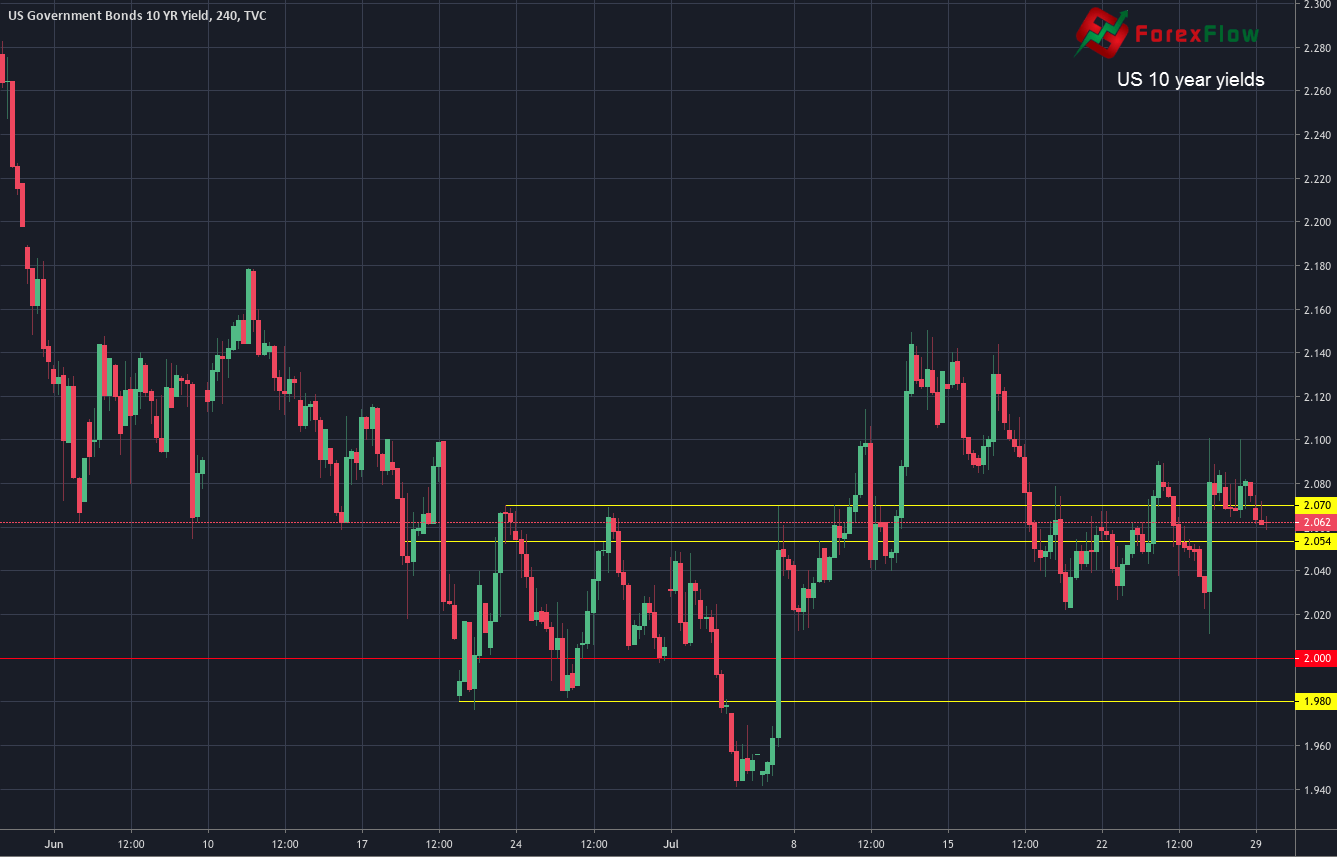

Bonds

This could be one of the cleanest Fed trades. It’s found its “pricing” level (roughly 2.00-2.10%) and if the Fed deliver a 25bp cut and suggest it’s a one-off then yields will rise, so a short play is what I’m looking at.

The scope for yields on a one-off cut theme is a run up to 2.20% at least, and the price action has shown roughly where the real dovish expectations sit, and that’s the high to mid 1.90’s

FX

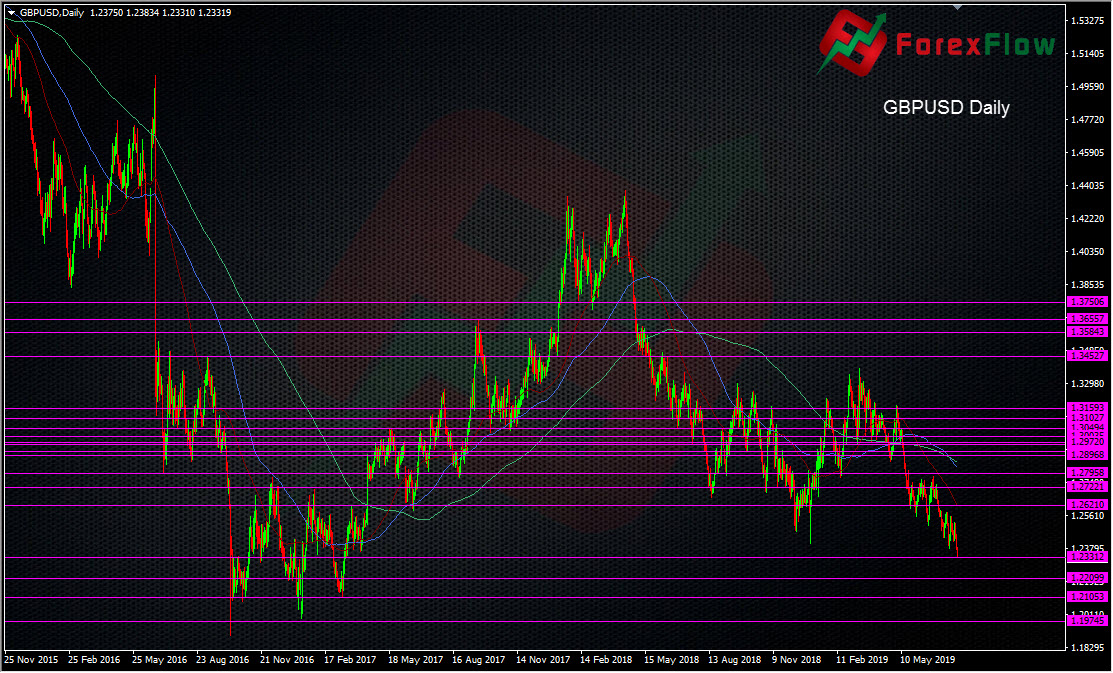

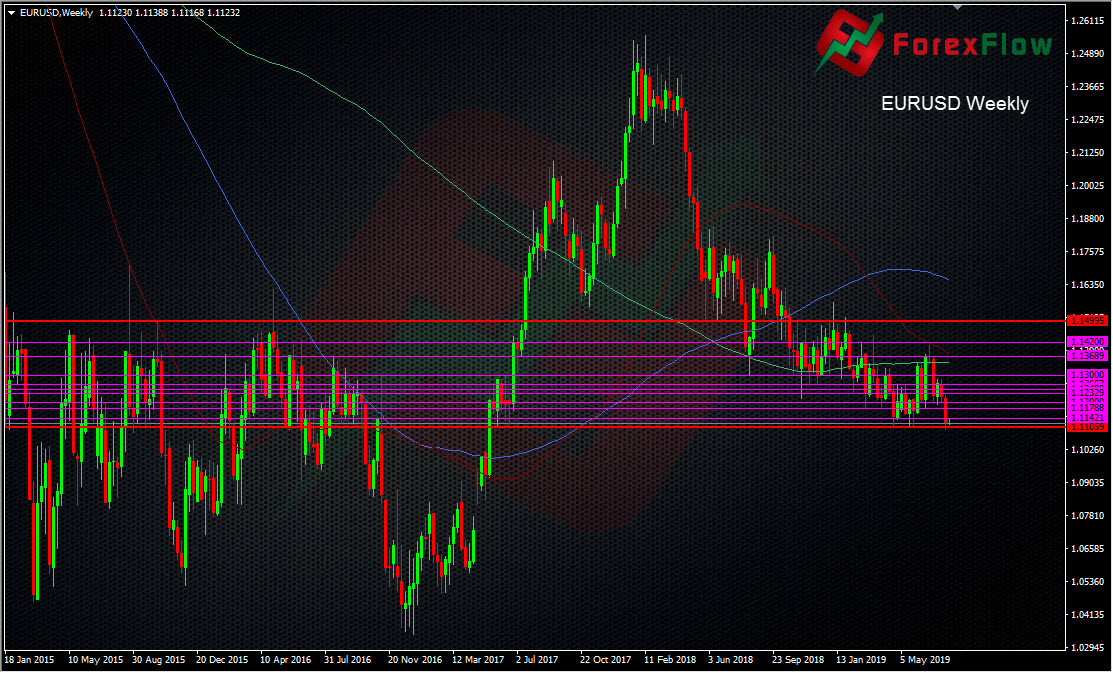

GBPUSD and EURUSD are the two pairs I think offer some of the best rewards, mainly due to the underlying stories for GBP and EUR.

GBP is well locked into the new Brexit mood from Boris and his new government and EUR is facing the possibility of the ECB easing again. That could give us a great fade opportunity if the Fed is as dovish as the market wants, because that would send these pairs higher, and once the Fed news is all digested, the roving market eye will revolve back to what’s going on in the UK and Eurozone, and that’s a bearish picture right now. So, my second trade strategy will be an ‘after the event’ strategy to fade any pops in these pairs.

For GBPUSD, anything 100 pips or more is likely to be hit, so anywhere into 1.2500/20 or higher should be a good place to start scaling.

If the Fed isn’t a dovish as expected then GBPUSD is in for some real trouble and we could be headling for 1.20 pretty quickly.

Down below we’re getting into the 2016 lows for support with most of it coming in in and around the big figures.

For EURUSD it’s a similar theme. A dovish Fed could see us popping back up and sellers coming in. Into 1.1300 would be a juicy level but given the lack of vol in this pair, the low 1.12’s may contain.

What is at risk is the strong 1.11 level, as we’re so close. There’s a lot of action in play there right now and I’m eyeing for a break trade at the moment, which I may even run over the FOMC. So, it’s shorts on a pop higher and a break short if it falls. If we do break 1.11 then again, we could be in the express elevator down.

To summarise

My opinion on what the Fed may or may not do doesn’t matter because they will do whatever they wish, so to find the best possible trades I have to ignore my thoughts and weigh up what the market is pricing and how the game might change after. In the case of both GBPUSD and EURUSD, there’s very little justification to see these pairs rise meaningfully whatever the Fed does (outside of them saying anything very extreme (dovish)), so really it’s a case of planning a break trade lower or trading after the event. The latter is the less dangerous trade as it allows me the time to ponder what’s going on, and the former can be kept fairly low risk in the case of being wrong.

My thought process is to stack up all the pros and cons for each idea and then decide whether I want to act or not. Very little of that exercise is based on my “opinion” of the Fed, and purely on what the market is likely to do vs how it is priced.

This event is one of those that’s got a lot of market focus and many traders will be thinking about trying to catch a big move. I’m not, I’m thinking about how safely I can trade this by minimising the increased volatility risk, and then I’ll look to try to maximise any possible profits. This is not an event to try and be a hero and punt for a possible jackpot type win.

As I’ve mentioned, the PCE report Tuesday is a potentially big event also as that will bring the last round of repricing. It presents a lot of risk to any Fed trade so my decision now is whether to start scaling into some of my strategies now, or wait until I know what that data says.

For a visual representations of this post here’s a video I did for the Investing Channel today.

Lots to think about and lots to still decipher so get your plans in place now and that will allow you to know your risk in advance and plan for it. I wish you good luck and safe trading. As always, the fastest trading updates and analysis will be compiled in our Live Trading room so if you want trade the FOMC with some of the best traders in the game, come and join us.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022