CHF in a world of its own?

CHF buying has been steady and persistent all of 2019 really, and the latest selling into the end of 2019 and early this year goes against the general risk picture. While JPY pairs have bounced on the favourable risk picture, the swissy is doing the opposite and raising plenty of questions.

There’s talk about them pulling back from possible intervention after being added to the US FX manipulation list but they’ve been on it before and only came off in May 2019. Being on the list hasn’t stopped the SNB doing their thing anyway.

There has been talk that they’ve been selling out some of their US stock holdings, which as of Q3 2019 sat at over $94bn. Could the SNB be taking profit in these moon shoot stock moves and repatriating the money?

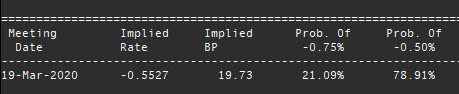

Is the market pricing the SNB reducing negative rates?

We could also just have some market players testing the SNB’s intervention resolve and seeing how far they’re willing to let CHF strengthen.

Lots of questions but too few answers, so how do we trade it?

You should never bank on the SNB to intervene, and they don’t do ‘hard and heavy’ when they do but knowing that they may be floating about behind the scenes means that short CHF positions at least put you on their side, rather than against them. That doesn’t mean you can’t go long Swissy, just make sure you know the risks of doing so, like any other trade. I don’t really know what’s going on so I can only really trade the technicals.

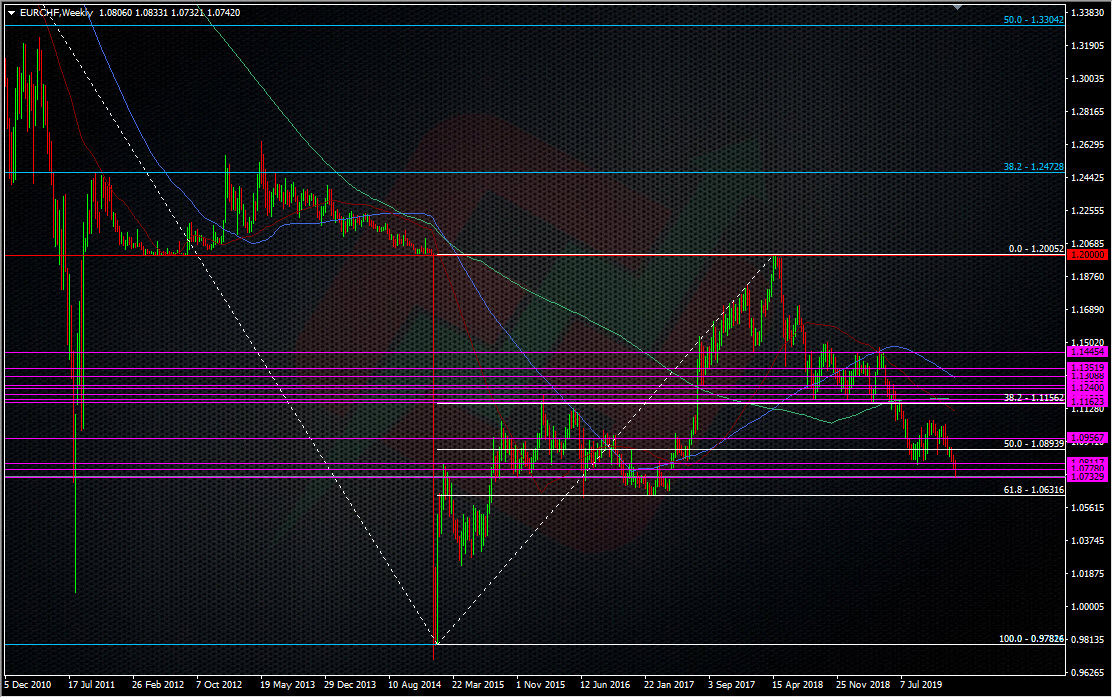

We’re pretty close to some decent old support levels in EURCHF so I’m starting to build a small long position into those. I’ve already started and will add as we go. Because I’m not certain why CHF is being bought so much, I’m going light on this trade.

So, this is more of a tech trade than fundamental trade, unless or until we get any greater clarity on what’s going on. I still may job it on the short side as levels present themselves (see the action at 1.0830 recently) but otheriwse I’m playing this one from the long side into the 61.8 fib. A break of the fib and the 1.06 handle will see me assessing the trade. Until then, I have a disaster stop in at 1.0550.

We’ve had a lot of conversations in our trading room about CHF, and those are part of the reason I’m getting in this trade. That’s the benefit of having other traders to talk to hear other ideas and views, which can help reinforce one’s own ideas, or highlight risks that might not have been thought of. There’s nothing better than getting a different opinion or view on a trade or plan, and that’s something that helps my trading immensely. If that’s something you think would help your trading, come and join us here.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022