I’m setting up a long-term trade in USD

I mentioned last week that I’ve been getting an itch for holding some USD (which I scratched somewhat by going long very small in USDJPY at 106.48). At the moment I favour USDJPY because of my view of both sides of the pair (USD & JPY). Japan is still suffering from its long-term issues and the virus has added to those woes. In my mind that means they’re going to lag in any virus recovery and their pre-virus situation wasn’t anything to boast about anyway. I think countries like the UK, Europe & Oz/Kiwi, have better chances of faster virus recoveries, thus make a USD trade against those more bumpy. I’m not fortelling boom times for anyone but markets can move a lot on the subtle differences between the countries. I’m also, not predicting CB moves or anything of that nature.

First things first. When looking at a long-term trade I start with the risks, and for this one there’s many more than normal, so that’s going to factor into my management. If we were coming out of a fundamentally driven weakness, I would be more certain of taking a position. However, this virus situation is completely different. We don’t know how it’s going to continue to evolve, whether there’s going to be vaccines, or even how effective those might be. Economies can be further opening up this month, and be all closed down again next month. I don’t expect any quick moves for this trade and I’m happy to sit on a position for as long as I feel comfortable with it.

I’m favouring USD mainly because of the way the US tends to bounce back from economic setbacks, often far quicker than others. There’s also the fact that the worlds markets are more plugged into the Fed than any other central bank. That means expectations are traded more rigorously than others. That’s often the main driver behind my long-term trades, catch the changes in expectations more so than when a central bank actually acts. Expectations can often run way ahead of action and that can be enough to move a price a hell of a lot.

Because the risks in this trade are greater than usual, I’m taking a slightly different approach to try and factor that in. Usually I plot most of my risk at levels where I’d like to enter and sit and wait but this time I’m going to go smaller than normal adding at any levels I decide, and if all goes well, I’ll add more on breaks back in my direction. For example, I’m looking to buy at various levels down to 100 at maybe half the risk I’d normally place, and if filled and we then bottom, I’d add more as the price breaks back up through whatever levels I identify at that point. I’ll also probably look to shave any core position at various stages, just to put some profit in the bank or to help keep the low risk maintained. Normally on a long-term trade I’d be looking at risking anywhere from 3-5% of my account initially but that can increase or decrease depending on the conditions as the trade progresses. This time, I think I’ll be looking at less than 3% because of my risk view above, and on the part of buying on the way down. I’ll look to increase my risk, if I’m comfortable with the trade later on, on the way back up (if it happens).

Long-term trading takes me out of 99% of the everyday noise. I’ll be factoring in the data but only for what it tells me about the bigger picture. What I can’t and don’t ever do is lay out a whole detailed scenario from now until XXX date in the future because no one knows what might happen in the next 5 minutes, let alone months ahead. All I do is decide what I want to risk, plot that over a price range based on the charts, and manage it as it goes. I’m not rigid either. If I get 2 months into a trade and decide it’s not working, I won’t stay in just because I want to be right. There’s been many a LT trade I’ve folded early because I deemed it not right at that time.

At the end of the day, the price will go where the price will go and I have no control over that. What I do have control over is how I manage that, and that’s all I’ll do from day one.

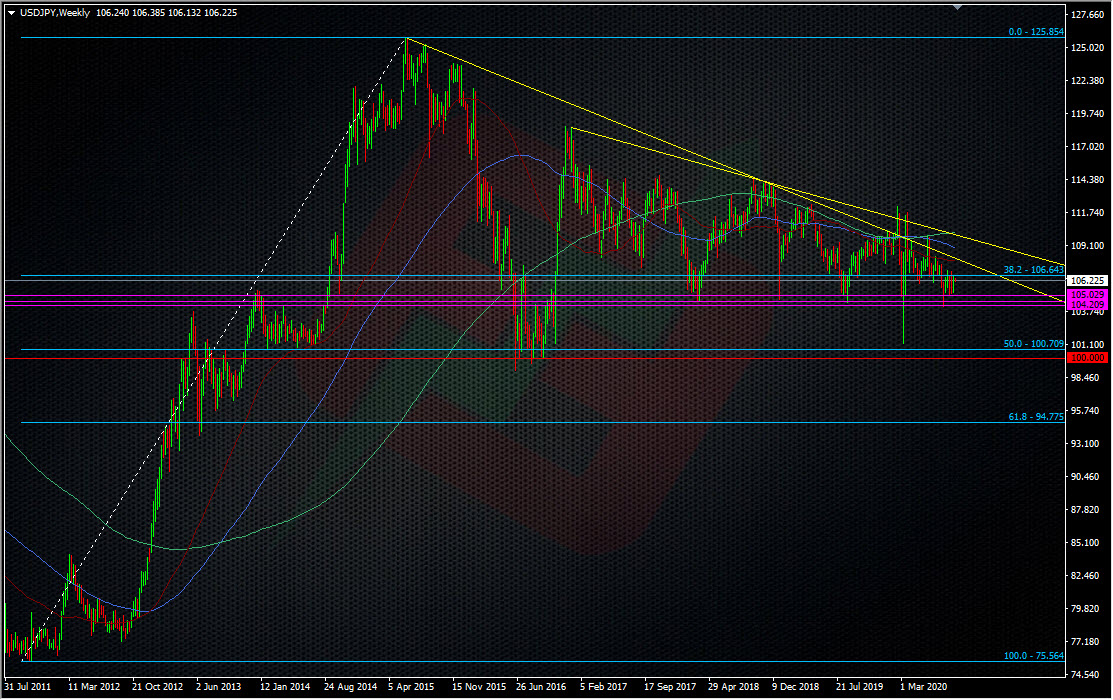

As for the levels, it’s pretty simple. I’ll buy down to 100 and that level will be my first assessment point if it breaks. At that point I may decide to continue with the trade, reduce it or get out altogether. Right now, I’m looking to risk maybe 1.5-2% on buying down to there. I’m looking at small entries down into the low 20′- 00’s of the big figures down to 100, and I may start from 106. I may also trade those levels on a short-term basis, taking profit and leaving some in the long-term pot. I’ll even be happy to short-term trade shorts, if that’s what I feel at any particular time. I can trade S/T and L/T even if the trades are opposite. As said above, I won’t be rigid so each trade will be decided at the time based on my view of things at that time.

As 100 is an assessment point, I won’t have a firm stop level. I’ll have a rough idea of a stop but it will develop over time and as the trade progresses and risk increases. What I will have is a disaster stop, which is one where if something big happens, I’ll have some protection in place. Initially this might be a couple of hundred pips under 100. That will potentially increase my risk (depending on how much of a position I’ve built up) but it gives me some coverage in case of anything big untoward happening. You’ll also notice that I haven’t even touched on profit levels. I never really look at profit levels when I’m building a L/T position because I’m more concerned about my risk rather than reward. What I do for profit levels is plot areas on the chart where the price might do something (hold or break), treating them with the same respect as I do my entry levels.

Technically, there’s some decent L/T support still down around 104/105 but it does look a bit ‘gappy’ under there (hence why I may play shorts on a shorter-term basis). 100 is always a big psychological level and I suspect we’ll hear about barriers and the like if we get close. Under 100 and things will look very dodgy.

Update: 11 November 2020:

As plenty of events have progressed since I wrote the post above, I thought it time to add an update.

We’re pretty much over the US election hump and while there’s still lots going on before Biden takes the hot seat in full, the expected “blue wave” move has either not been as big as expected, or it’s waiting until Biden has the reins properly. The stimulus questions are still there, i.e what are the two political houses going to look like, and thus how any future stimulus deals are going to be fought over? We also need to see what the nature of any new stimulus measures are going to be. Depending on the virus, they could be more virus band-aids than economic boosting programs. The difference between the two is stark for markets, so is very important for us. For me and my trades, I want economic boosting packages, not band-aids, because those tend to boost USD via factors like growth and inflation, and then central bank expectations.

We’ve also just had a big bundle of positive vaccine news from Pfizer and others about possible high percentages of effectiveness against the virus. That has offered us a snapshot of what markets may do once a vaccine is rolled out widely around the world. We had a big risk jump, which then morphed into a bit of a US positive jump. That’s been a nice indication for me because if it does play out that way in 2021, my trade should start moving the right way more significantly as some of the puzzle pieces fall into place (econ recovery, inflation etc). That’s for many months ahead and governments and CB’s still have to deal with the virus now, so there may be turbulent times ahead still.

For my trade in general, I’ve added all the way down so far in USDJPY but admit to being a bit greedy in trying for a low 103 entry rather than adding through 103. That puts my lowest entry now at 104.07.

I don’t think this trade will really start to show where it’s going until well into the new year, so right now it’s all about monitoring the levels, and seeing if I can stay on the horse if it starts bucking. As I say above, this vaccine news euphoria has given me a very tentative sign for possible future moves but I have to manage my trade in the here and now and day to day.

I’ll leave it here for now but will update again down the line.

Update: 6 January 2021

One theme into the end of 2020 was about rising inflation expectations. This is something I’ve been speaking a lot about in the room. My view is that inflation could hit hard this year and that central banks will be well behind the curve. One reason for that is the almost blasé way many central banks are underestimating inflation. To them, it’s not coming for years and they’re seemingly turning a blind eye to it. This is reflected in their current policies and forward guidance. Some of these don’t see rates rising until 2022 or longer. For me, that’s bonkers to even talk like that. Most of the time these clowns don’t know what they’re having for breakfast, let alone what rates will be in 2, 3 or 4 years time. That sort of complacency has bitten many in the arse and CB’s could be setting themselves up for such a bite.

Among those, the Fed is one that’s front and centre for that, especially with their AIT (Average Inflation Tosh). They’re prepared to let inflation run above 2% so that they can achieve a period of average inflation of 2%. That sounds completely bonkers to me as CB’s have a very poor record in controlling inflation. The risk for the Fed is that inflation runs much higher than 2% and they’re left fighting to get the Genie back in the bottle. For example, what happens if inflation runs up to 4% quickly while the average is lagging around 1.5%? How are they going to explain that away while promising to keep rates low?

In these first few trading days, we’ve seen inflation expectation metrics running higher, and the market chatter about inflation is growing. None of that means I’m going to be right but I’m not trading what inflation does, I’m trading what the market expects central banks to do if inflation does appear. On that front we are seeing plenty of inflationary pressures in the PMI data but the caveat here is that it all looks temporary in nature, and that’s easy for the CB’s to brush off. However, fundamentals have a way of turning “temporary” into something longer lasting, so that’s something I’ll be watching for.

I’m not getting excited about any of these early tones coming from the market. As much as they fall the right way for my trade idea, I’m not going to be swung by some short-term chatter three days into the New Year. If things are still this way in a month or two’s time, then that’s when I’ll take more notice.

As I’ve explained above, in the beginning of the post, when I trade for the long-term, all I really do is assign my risk and spread it out over a much wider area. This stops me worrying about any short-term noise in markets. If the inflation snowball starts rolling then great, I’m in the trade. If it doesn’t, no sweat, I’m not running massive risk. Already I’ve been some 360 pips offside on my highest entry but I’m not bothered. Of course I’d like to be in profit from day one but that’s very rarely the nature of the beast in long-term trading. As long as I’m still happy with my strategy vs what the fundamentals or market sentiment is doing, I’m happy to remain in the trade. As I said back in Sep, I’m approaching this trade with a lower risk starting point than I would normally. That was due to all the massive events going on (virus, US elections, Brexit etc etc). Those higher risks mean I wanted to take less risk, and that’s still first and foremost in this trade.

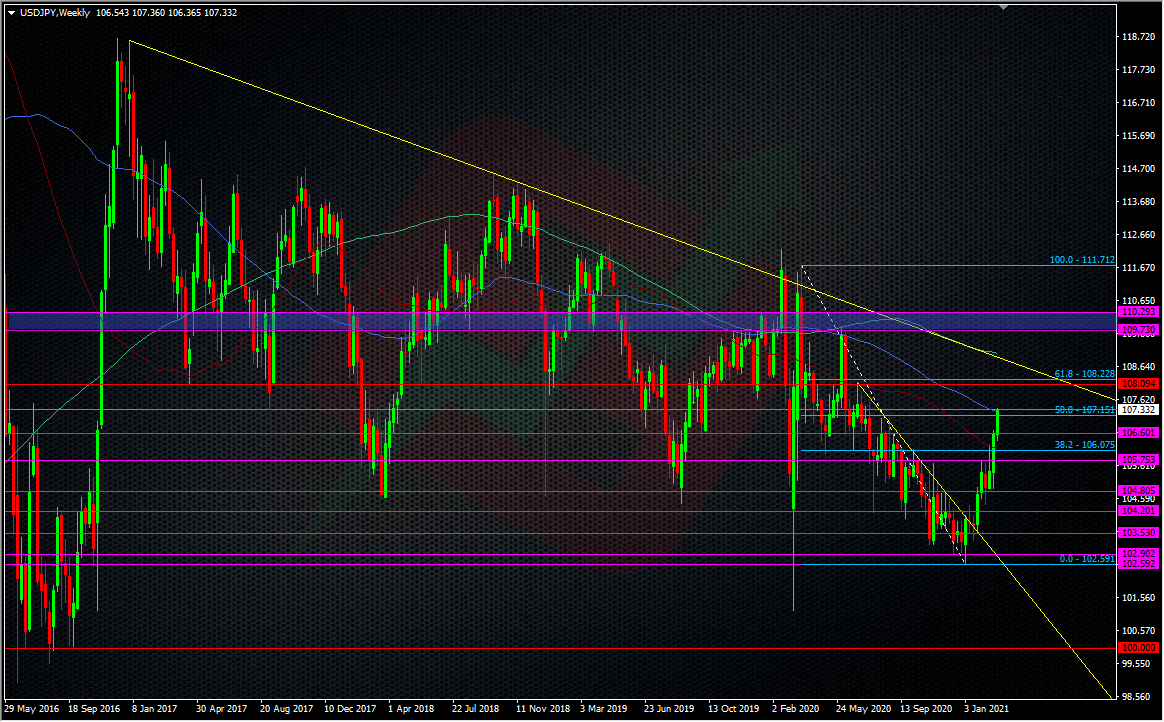

I’ve no great idea of the timeline for anything to come into focus in this trade. This market inflation sentiment we’re seeing right now might disappear by next week, or it might snowball into something bigger and more lasting. I have no control over that. All I can control is my risk and how I want to add to or assess my current position. For now, all I consider is how far I’m willing to continue to cast my trading net to pick up more longs. I still have my assessment point at 100.00 but I won’t make any judgements unless we get there and I know the reasons why we go there. As of now, I’m long down to 103.10 and have an average of 104.83.

That’s it for now and I’ll update in the not too distant future.

Update: 4 March 2021

Well, what a difference a couple of months make eh? The expectations snowball is really rolling now. We’ve seen bond yields smashing higher in the US and across the other majors ,and the market is starting to question the viability of central banks timeline for rate hikes. Just looking at US 10’s and they’ve had a massive move since the latter part of last year.

One of the great things about the ForexFlow community is the wide range of views that get put forward. On bonds overall, one of the areas you guys highlighted was to also watch the “real rates”. Inflation linked bonds are yet another area to watch for rising expectations as they can show a divergence from nominal rate bonds (like the 10’s above). These have been lagging but have recently been showing signs of life. Of course, even looking at those, one must also look at the whole curve to discern what the market is thinking. But, the wider point is that we have a market that was buying bonds to oblivion last year and this year they see less need to, which is causing somewhat of a squeeze of longs.

What we’re seeing right now is further growth of seeds sown late 2020. We had small instances of the types of moves we’ve been seeing now and that’s been enough to see real moves around the asset classes, and that’s happening without any real material changes to inflation itself. This situation is exactly what I was looking for when I started this trade last September, so I’ll repeat again. It doesn’t take the hard data to move to get the market moving. All it takes is market expectations to change. However, that doesn’t mean that I will be ignoring the hard data as the market will need to see evidence stacking up against its expectations or else it could change its mind and everything we’re seeing now will go into reverse. Regarding inflation, that’s something that will need to be monitored over months, so there’s unlikely to be any real fast changes in sentiment, say over 1 data point.

And what of central banks? Some of them have been flapping over what they’ve been calling “unwarranted market tightening”, as yields rally. Some are flapping more than others (see some ECB members, and the RBA). The Fed hasn’t been as strong on it, as of now (as I type this we have Powell at a WSJ Q&A event later, so there’s a risk point there). Powell has even said he expects some temporary inflation but said they have have the tools to address any “unwelcome” inflation. That seems to fall into my thinking of “What will the Fed do if inflation rockets to 4%-?%. How the Fed will decide what’s temporary and what’s not is beyond me. It could lead to some messy times for them vs what the market might think.

On the US stimulus front, we’re still waiting for Biden to finally agree the $1,9tn virus stim package (band-aid measures) before we then move on to the expected $2-4tn economic stim package. That one will potentially be the key to US economic fortunes, which in turn will help growth and inflation, and potentially keep my trade on the rails. That’s for a future update though.

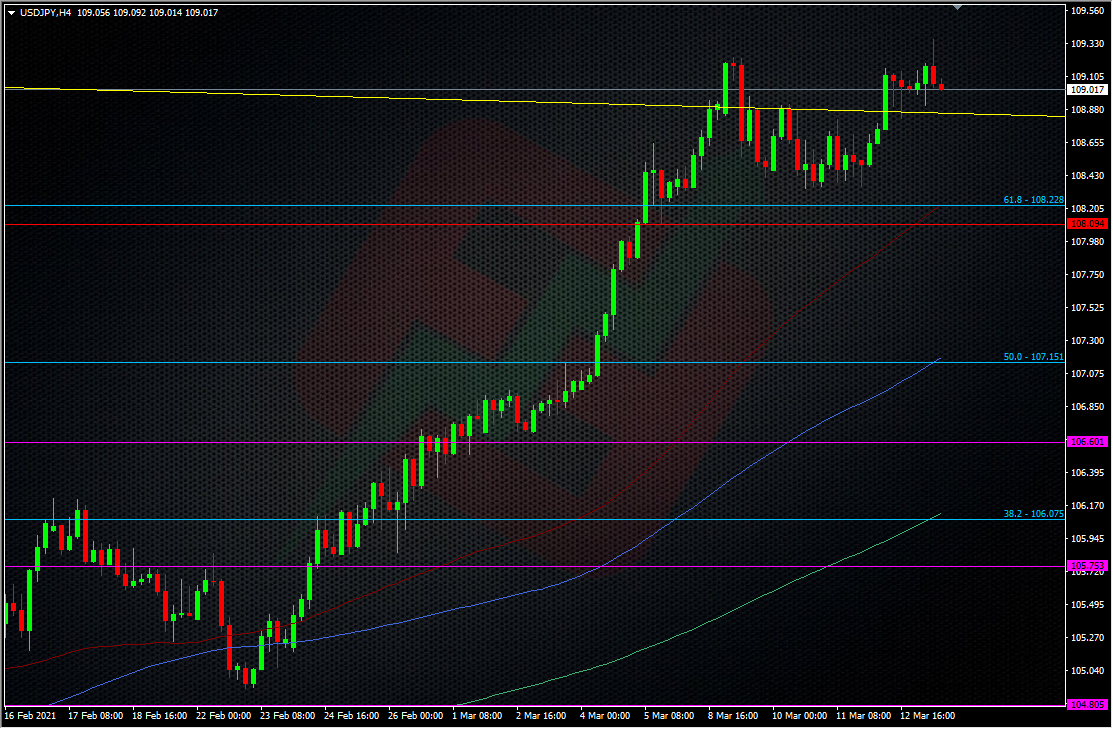

On to my trade itself. Being in a pair that can move so slowly can be a blessing and a curse. On one side, the lower volatility means there’s less big swings, which is good for the blood pressure but on the flipside, it can also mean a longer wait for decent gains. On the tech side, we’ve broken the key 2020 short-term downtrend and are heading towards a test of the wider 2016 downtrend. As of this update, we’ve broken the 50 fib of the 2020 drop, which puts us squarely on target for a test of my next big level around 108. This has been a strong S&R area for many, many years.

We also have the 61.8 fib close to it too. If we manage to break this zone, we’re on for a test of the wider downtrend and 200 WMA around 109, and then another strong S&R zone high 109’s-110’s. As I type, I’m long on a short-term trade at 106.92 taken yesterday, of which I’m looking to add some of that into the core long. As per at the start of this strategy, I’m looking to add into the trade if we break key upside levels. From here, I’ll be looking at how the 108 level reacts (if seen) to decide if I want to start taking some profit, while planning for a break-add. My thoughts about profit really only come into play when the price hits big areas of interest. If things do turn sour, I’ll looks to re-assess the trade (as I always do) and my current key downside levels are at 106-105.75/80, then 105-104.75/80. A break of the latter would very much indicate that this trade is over. As my average is currently 104.83 (not factoring in the 106.92 trade), I won’t be out on a limb if that area looks in trouble.

Overall, I’m happy with the progress so far but I will continue to remain more attentive to the risks to the trade than the benefits, as that’s always my mindset in any trade, i.e manage the risk first, the rest second. There’s a long way to go in this yet 😉

Update: 15 March 2021

Just a quick update as later after the 4th March update I cut some of the core long at 107.92, and cut a tiny slice more at 109.01 Friday 12th March, as the price started moving sideways during the week. There’s still a bid in the pair but things are looking a bit more balanced now. 110 remains the main level above, while 108.30 & 108.00 are the key downside levels.

Update: 28 March 2022

It’s been just over a year since my last update, and what a year it’s been. As I type, USDJPY has been to a high of 124.01. The inflation monster I was worried about way back when I first wrote this post has reared its head in ways that are even bigger than I imagined. But, as I’m fond of saying, it’s a genie that’s very difficult to get back in the bottle when out.

The BOJ are in all sorts of trouble as they continue to ease to oblivion. The rock and hard place has never been more rockier or harder for them as they are not even seeing the massive widespread inflation the rest of the world is, outside of energy prices. Just today they had to try twice to buy bonds to keep yields in check, and the jawboning from officials about the currency has reached level 4/5 out of 10.

As for my trade, there’s been lots of slicing, diicing cutting and adding, especially up through 115 and 120. It seems I keep waking up to a new big figure and the first thing I do is cut some of the position, the latest of which was at 123.14 today. All stops are now sitting around 120.00, and likely to be pulled up higher again if we get firmly into 124. I’ll also be looking to take a big chunk off the rest of the position if we get up near 125.00.

At the moment, this is looking more and more like a runaway train, which is very dangerous. I’m not yet ready to fight this, as I’m already looking well offside in a small 120.50 Put play from last week.

We’ve been thinking that this phase up from 114.50 (or thereabouts) has been mainly Japanese financial year-end moves but this looks like it’s moved well beyond that now.

Where can it stop? Who know’s? This has gone far further than I thought possible (which I won’t complain about obviously), so I’m hanging on for dear life and seeing where it take me. It will turn eventually but I’ll want to see definitve multday highs put in before I even think about trading a turn. And just to show the speed of it, even as I’m typing this at 09.41 BST, USDJPY’s jumped to 124.50 on comments from former Japanese FX guru Sakakibara saying a weak yen isn’t a problem, until it passes 130. That’s another slice off for me at 124.42… All stops up to 121.50.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022