What to do when the levels start stacking up

Levels are levels but some are ‘more’ than others, and we’ve been noticing that more and more pairs are developing some strong levels

Here’s 4 pairs that we currently have our beady eyes on in the room.

The most obvious one is EURUSD up here at the 1.1990/1.2000 zone.

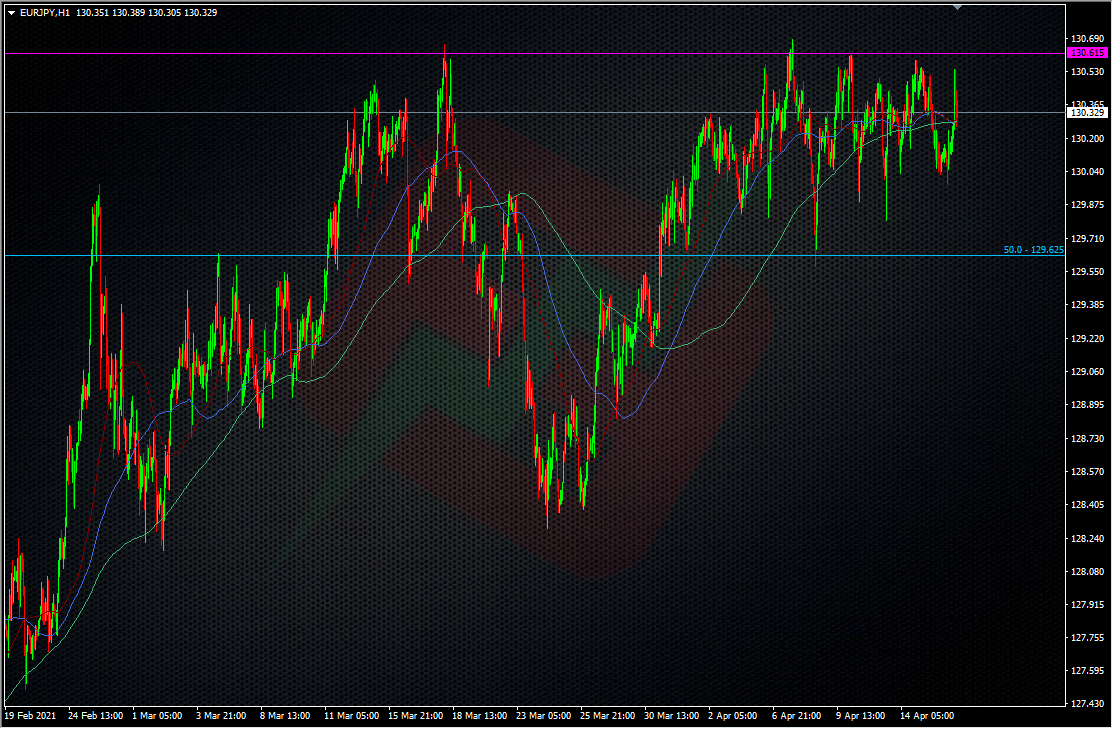

Next, as Kman noted, similar in EURJPY.

Now, we can probably put them in the same basket as they’re over the same timelines.

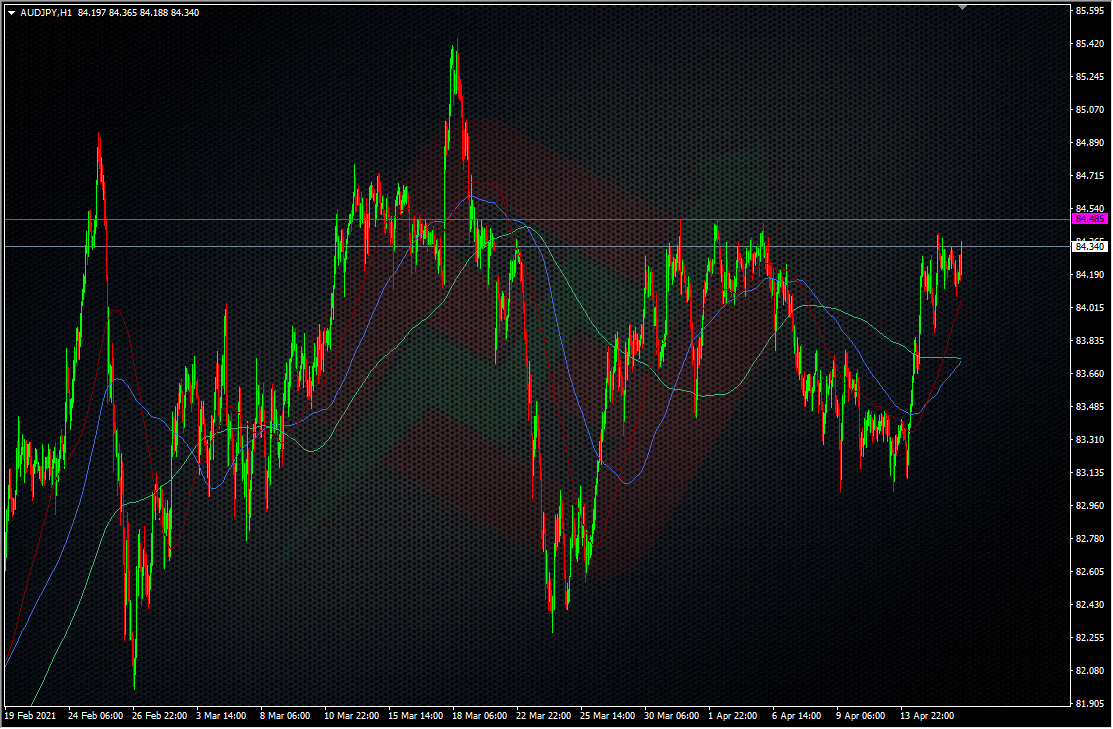

Away from EUR, and AUDJPY is another one.

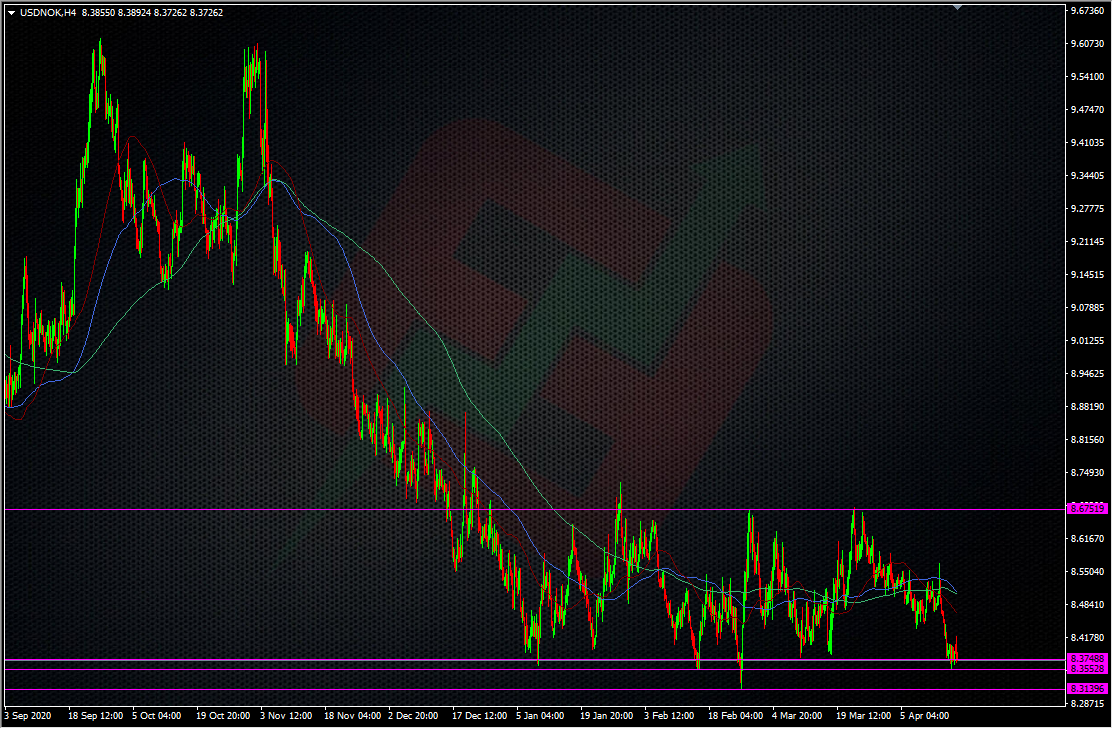

USDNOK is another but over a longer timeframe.

Why is this important?

Levels that are in play for many days, or see many tests offer good ‘lean’ opportunities but when we’re at a point where there’s lots being tested together, that can sometimes bring a cascade effect if they break. Breaks like that can take pairs from non-trending to trending, or give a currency a fresh leg in direction. Break trading can become just as profitable as trading against those levels. Pick your spot for a break entry, maybe with a stop reverse if you were playing against it previously, or wait for a break to be confirmed, so as not to get caught in any quick flush and reverse. My rule of thumb is that the more often a level gets tested and holds, the greater the break may be if it happens, and that’s what I factor into trading against a level, and when I may look to position for a break also.

The fact that there’s more than a few of these in play means that something may happen if they all start breaking, and so we need to keep that in the back of our minds. It’s very easy to get caught up in the short-term noise only to then get caught out when something changes. If we see breaks happening, that could signal something is changing.

We should watch pairs and charts as if looking through a telescope or binoculars, and that means zooming in and out of the timeframes to make sure we have a grasp on the overall picture, and not just one aspect. Reading charts is about building a mental picture of all the levels and areas, and knowing what to expect if prices move.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022