Market expectations for where USDJPY might go to are growing

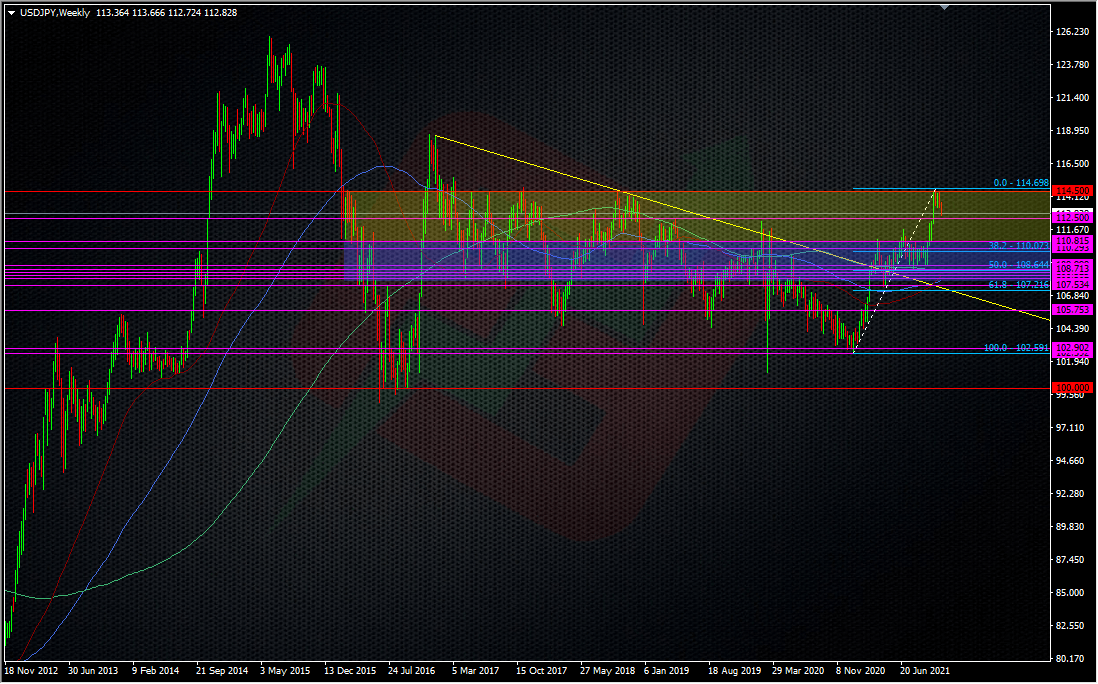

Reading a lot of analysis on USDJPY and 112.50 and 112.00 are in a lot of trader’s crosshairs, perhaps uncomfortably so.

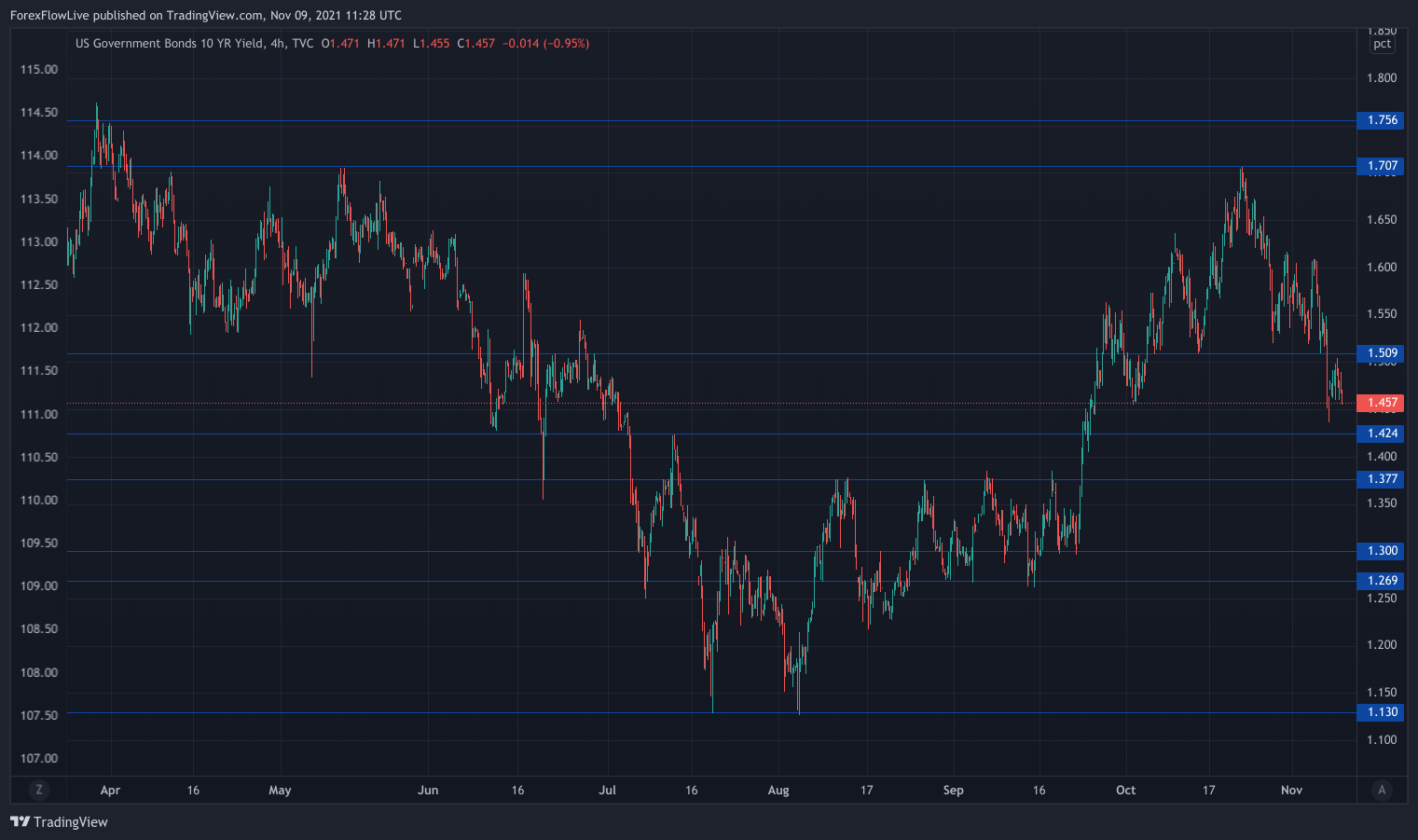

The central bank expectation reset goes on and now we need to see how things develop. US yields aren’t helping with 10’s looking troublesome below 1.50%.

I’m expecting USDJPY to fall into another tight range through the end of the year, and into 2022, unless there’s any significant developments. Think of the 108-111 of this year. Where that develops is yet to be decided. 111/112-113/114 could be the new range (yellow box) but below 111, the risk is we go back in the older box (Blue box). Somewhere in between might be likely also.

From a wider perspective, we’ve confirmed a big rejection of the huge 114/115 resistance area, so a pullback to at least the 38.2 fib of the year’s rally would not be a surprise, or unwarranted.

I tend to get a bit worried when there’s so many people all talking about one or two levels as that can invite trouble, so while I like the 112.00/50 levels also, I may look to play them with a bit more caution than I would normally, and maybe set myself just under (if playing long), in case there’s a flush out. I prefer to trade like a shepherd rather than a sheep 😉

I fear for FX volatility into the end of the year and into next, and/or until the data starts to get the market getting expectant about rate hikes again, or about it forcing the hands of central banks. I think we’re in a phase of prices needing to find their comfortability levels again, so all we can do is wait and see what develops. If we do see vol dropping off again, then we go back to playing the ranges while trying not to get stuck in the middle.

For my long-term USDJPY longs, I’m working to avoid getting sucked into what might just be a temporary setback from the 114’s highs. I banked some into those highs so I’m not overly concerned. If we do slip under 111, I might get a bit more concerned but otherwise, I’m going to look to play any ranges from both sides on a short-term basis, while looking to add to the core long when going s/t long. As usual, I’ll be updating my strategy in our trading room, alongside all the other traders trading this and many other pairs, with a variety of strategies.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022