Looking at markets for the week, there’s been plenty of action but no big changes to the trends

For all the headlines and events, most fx pairs are still well within recent ranges. This week’s price action is an apt reminder why we should focus on ranges and the bigger levels, and hold faith in them that they are the low risk places to trade.

GBPUSD was firmely entrenched in a 1.3470/1.3600 range with brief exceptions either side over the FOMC.

My FOMC trade plan turned out ok in the end. It looked a bit hairy over the FOMC, and on the Thursday it kept looking edgy as we stayed in a 20/30 pip range under 1.3500 for most of the day. I ended up getting a bit of luck from the UK talking heads, which finally kicked the quid up properly through 1.3500 and allowing me to take profit. We’ll take those when they come because we’ve all been on the otherside when they go against us haven’t we?

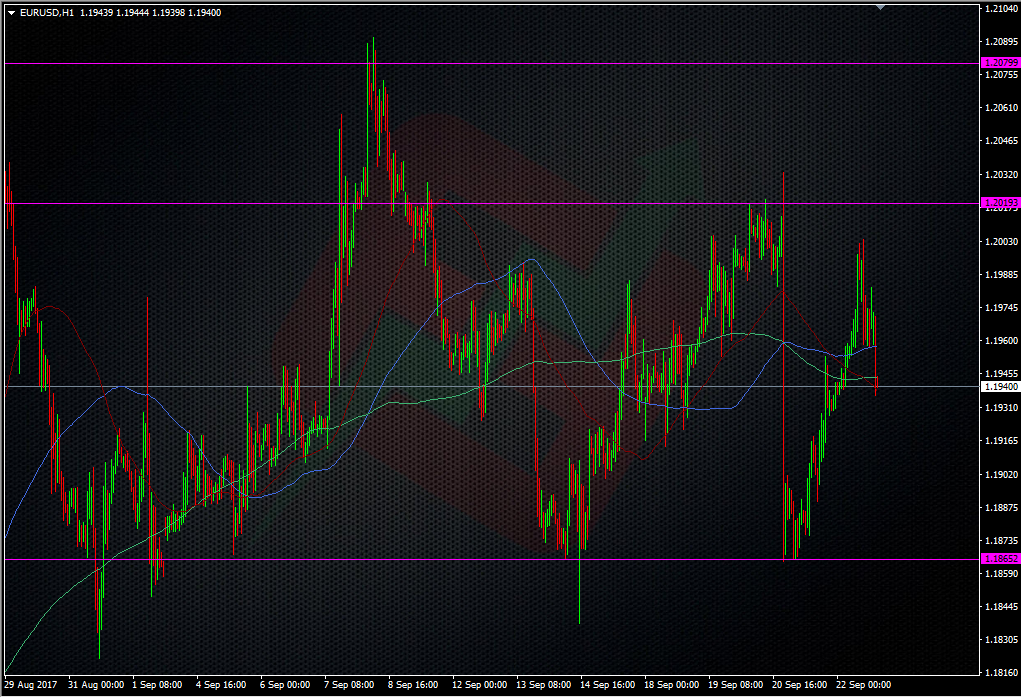

A similar picture in EURUSD.

1.2000 is still the level to break and the dippers are still well evident, as bounces from the 1.1860/65 level shows.

One pair that’s trying to change the curtains and wallpaper is USDJPY.

The Fed gave the pair a boost and a close above 112.00 today could be seen as a bullish signal. That said, I would like to see a real bullish close, not it whimpering across the line. The old 112.50 level had a lot to say and this will be classed as another hold, despite the brief pops above. Again, it’s why we keep such levels on our charts and at the back of our minds, because they can give us great trading points.

This pair is still being pulled very much from the yen side so now that the Fed is past, and everyone thinks they know what’s coming next, that side of the trade could well exert itself once again. With the fatboy 1 and fatboy 2 still resorting to a playground slanging match, it’s still wise not to be overexposed positionally into the weekends.

Sunday could be another busy open as the Kiwi & German elections get digested. There’s not been much risk trading on the German elections, so we shouldn’t see any big hedges unwinding but if it passes wiothout incident, we could see a bid in EUR pairs when Asia opens. Personally I don’t think any moves will be big and range shattering but you never know in this game.

And that leaves me to wish you all a great and peaceful weekend.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022