USDJPY is looking dodgy as yen buying picks up

We’re seeing a decent bout of risk aversion as London and Europe look to close up shop. The swissy is seeing some action alongs side the yen and Nikkei futures have tumbled too. At the moment we’re seeing some anxious moments in all things Japan and while the wider market isn’t looking as fearful, at some point they all might join in.

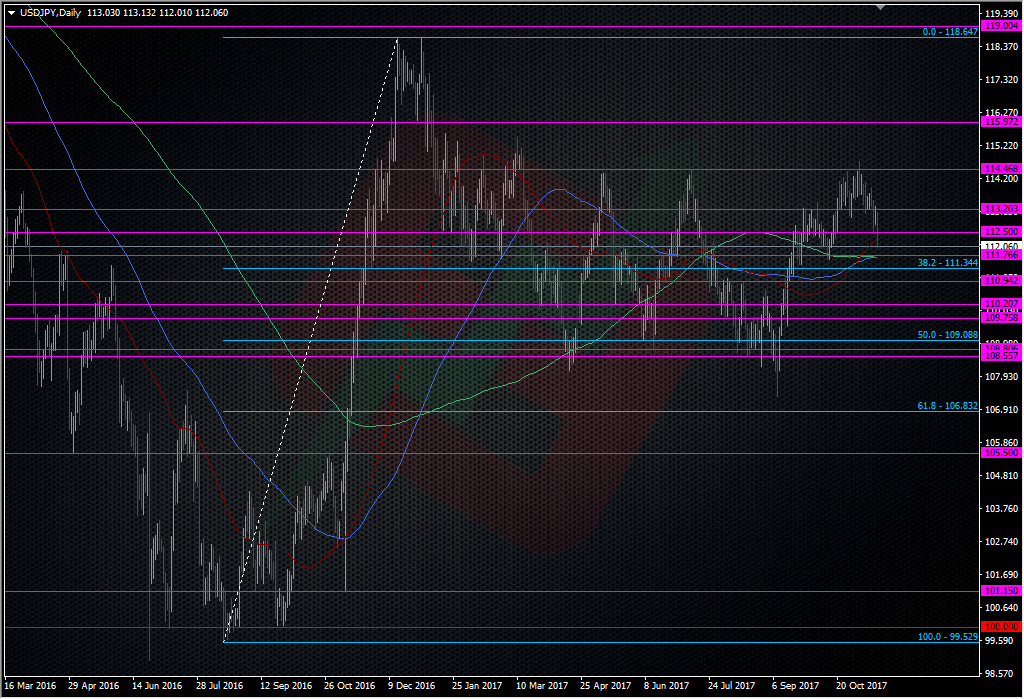

So, USDJPY is down close to the 112.00 handle and if it can’t hold up there, there’s some good looking support down around 111.70/80.

The confluence of the 200 & 100 ma’s at 111.71/74, plus the 111.75/80 level being a former S&R level makes it look enticing for a long. My main problem is that I’ve turned very bearish on this pair and would rather sell a decent rally, and so I wouldn’t trust it with a big trade. If it is to be strongly supportive, what I am expecting (should 112.00 break) is that perhaps we see a stop run through that area, which then reverses, and then builds support there. This is certainly something to watch and I won’t trade it this close to the weekend if it happens. I guess we’ll have to see how it goes from here.

Once again we’ve not got any headlines to drive these moves but the sentiment looks like it’s definitely bearish. In case you needed further convincing, we’ve got a Fed hike coming and the US tax Bill on its way yet the dollar has done nothing but head lower. As signals go, they don’t come much bigger than that.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

Hey Ryan maybe AUD and NZD trying to find a bottom … reached good targets in many crosses. Long NZDUSD at 0.6785 and short EURNZD at 1.7395. AUD I would like too but 0.748 would be better and maybe we’ll see it next week considering the slaps AUDJPY is taking

Also short USDCHF from high 0.99s … EURCHF rejected once more at 1.172. That flattening US yield curve is getting interesting … 2Y at 1.72 and running and 10y at 2.34, spread narrowing very quickly

Hi 5m.

You certainly seem to be picking those bounces well in a quite dangerous trend mate. I hope you’re not following Bud Spencer’s gap theories 😉

lol gap theories … that’s madness …

well I took a couple of kicks in the teeth going long AUDUSD at 0.763 and then again at 0.758 … but key is tp/sl, if that’s good that’s ok.

Anyway looking AUD and NZD to see if they’re basing. have a good weekend!

Ha agreed about gaps.

Hope you have a great weekend too.