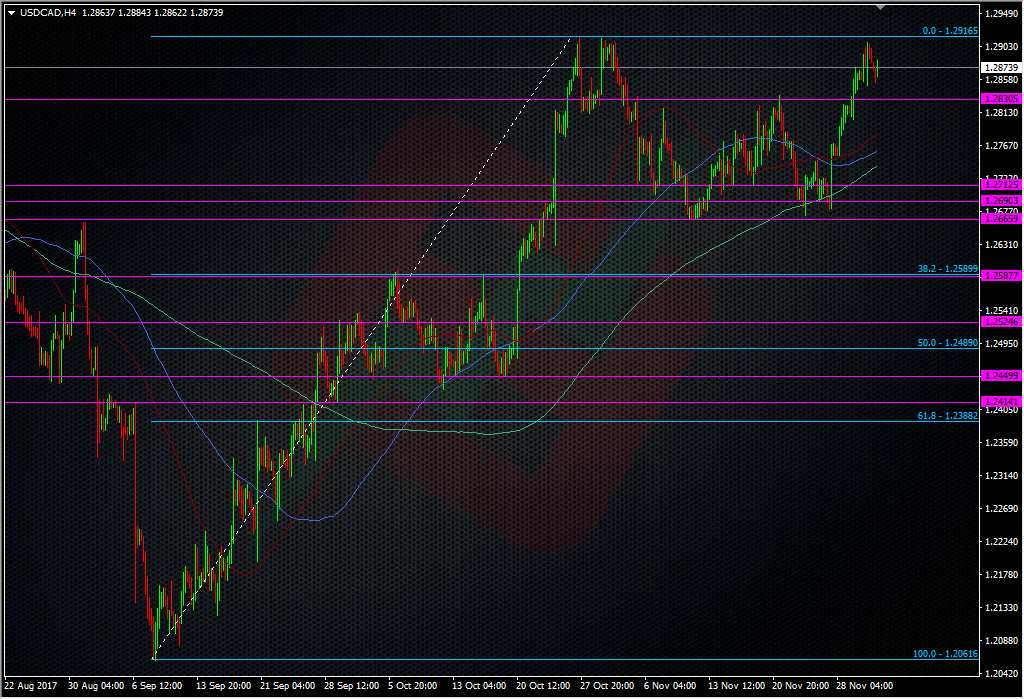

USDCAD levels and a possible trade opportunity over the Canadian data

Yesterday a mentioned that I was looking for a potential opportunity in USDCAD over today’s data. The loonie has been mad as a bag of spiders around data points and we get some big numbers today. Here’s what’s due at 13.30 GMT;

Labour report

- Employment change 10.0k expected vs 35.3k prior

- Unemployment rate 6.2% exp vs 6.3% prior

- Full-time employment change 88.7k prior

- Part-time -53.4k prior

- Participation rate 65.7% prior

GDP

- Q3 2017 GDP 1.6% exp q/q ann vs 4.5% prior

- 1.1% prior q/q

- September 2017 GDP (this is the monthly number) 0.1% exp vs -0.1% prior m/m

- 3.3% exp vs 3.5% prior y/y

We can pretty much ignore the monthly data as that just closes the 3rd quarter, so those are the numbers to watch. Employment can be a volatile number at the best of times.

Although there’s next to no expectation of any action at next Wednesday’s BOC meeting, the market will be watching the data closely to try an interpret whether the BOC lean hawkish, neutral or dovish in the meeting. On the basis of no action next week, I’m looking to fade a good batch of data that will see CAD gain (USDCAD fall).

Looking at the chart, and knowing how USDCAD has acted over previous data, The mid to low 1.27’s could well be reachable on decent numbers as the algo’s go to work.

I’m really only looking to trade from the long side as not only will that play into an unchanged rate meeting but it will also mean I’m long USD for a potential USD run higher into the FOMC the week after. I’m basically seeing two reasons why USDCAD would go back up after a fall.

Should the numbers disappoint, these strong looking 1.2900/15 area will likely get smoked and the next resistance is around 1.2940. However, a break at 1.2900 may have enough in it to have a close look at 1.30. I would consider a small short into there just to catch a ‘first test’ big figure rejection.

That’s the plan anyway so I’ll see what the data brings and trade (or not) accordingly.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022