The BOC decision comes at the top of the hour

USDCAD is stil trading like an emerging market currency over some data points and we’re going to see a lot more volatility over the BOC announcement. Expectations for any policy change are very low but what the market does want to hear is whether they give a hawkish, neutral or dovish message.

The market got all bullish on CAD last week after the GDP and jobs data. Q3 GDP may have beaten expectations at 1.7% vs 1.6% exp but that came in lower than the most recent BOC forecast of 1.8%. The employment report looked very good but it’s also more than a little volatile. The main question is whether that data warranted the near 270 pip move south we saw then, and in the sessions after?

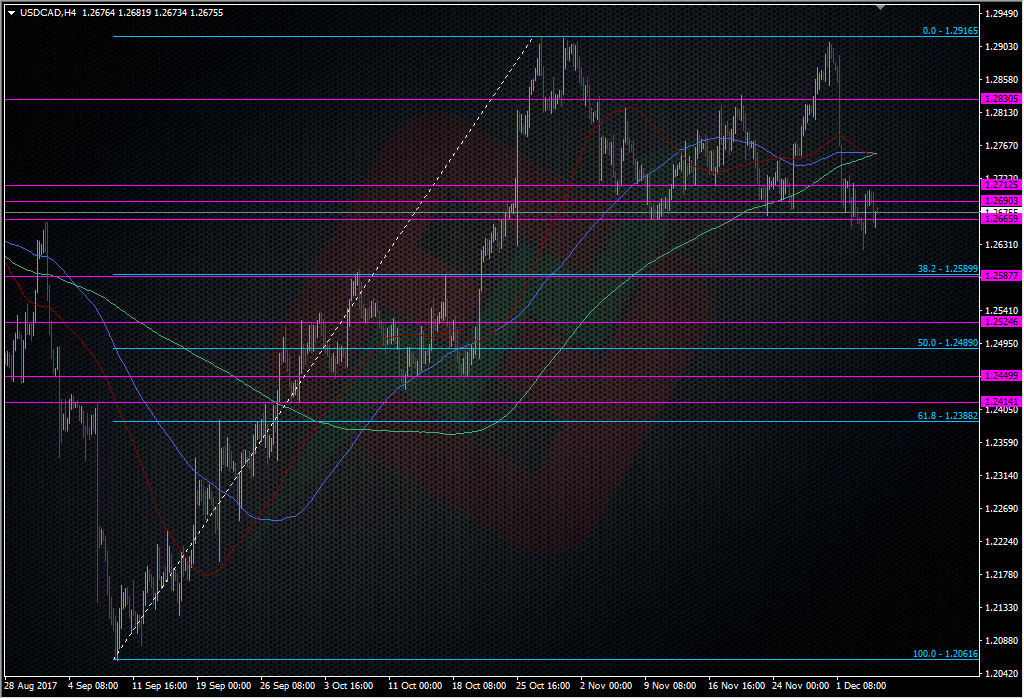

In my opinion, it didnt, which is why I started scaling in longs on Friday. However, I thought I was getting good value scaling in down to 1.2700, and had no idea we’d carry on going south, so I had a decision to make. I was originally going to set a stop under 1.2700 but I decided to keep adding as I feel strongly that the market has overreacted. I scaled in two more positions at 1.2674 and 1.2655 and I now have a stop for all of them under 1.2580. The 1.2685/90 area is the 38.2 fib of the Sep rally and it’s also a prior resistance area.

That said, the way this pair is behaving, the tech isn’t counting for much anywhere in a 200 pip range.

I’m going to admit to my discipline slipping on this trade but I faced a battle with being sensible and cutting the trade as it moved more than I expected it too, and sticking with my plan. We’ll, here we are now and I’m waiting to see what happens at 15.00 GMT like everyone else. I’ve got my stop in place and I won’t be moving it again. The most I’ll do is cut out the position manually if I don;t like the details from the BOC.

Right now, in some of the market’s mind, the BOC are still trying to justify the prior hikes so I think a very hawksih BOC now is a long shot. You never know with Poloz though as he changes his views like the weather. The market is set for a hawkish outcome so the main price risk is up if that’s not delivered. Given the vol in CAD, that could mean a quick move back to 1.28 or beyond.

Stay safe if you’re trading this one and be mindful of the increased volatility in CAD pairs right now.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

1.2567 also, the 100 day SMA, could be used to protect the stop

Closed my EURCAD longs at 1.5012 and decided to get in again here at 1.494. Not big cause Poloz is a crazy horse

Ride it cowboy.