There’s no let up in the bearish trend

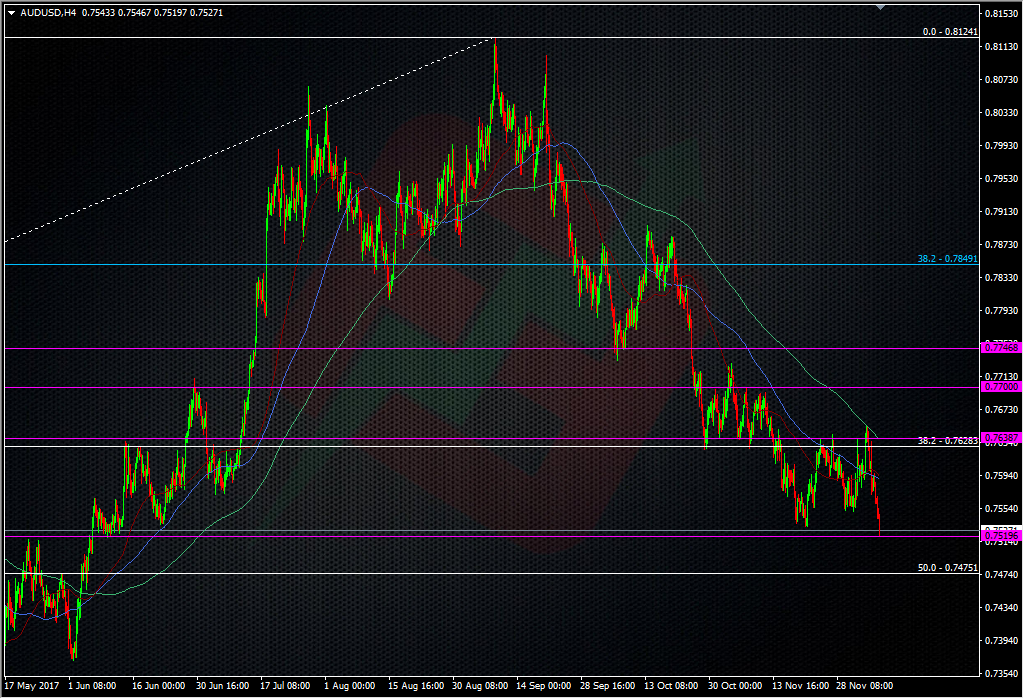

There’s no let up in the bearish trend in AUDUSD and we’re close to a level that could be a big decider in whether we stay in the recent range or take another leg lower.

We’ve broken below the Nov lows around 0.7530 but have held old S&R from back in June. This could be a potential line in the sand here but just under we have the 50.0 fib of the 2016 swing up at 0.7475. If we’re going to see a real break lower, then the fib needs to be taken out. This is going to be an interesting area to watch because if we get a false break of 0.7520 and 0.7500, the 50 fib holding will be a signal for that. It’s not often we get something that could define a false break, usually it’s just in the laps of the trading gods whether we see a stop run through a big level and then a reverse. This time there’s something to lean on.

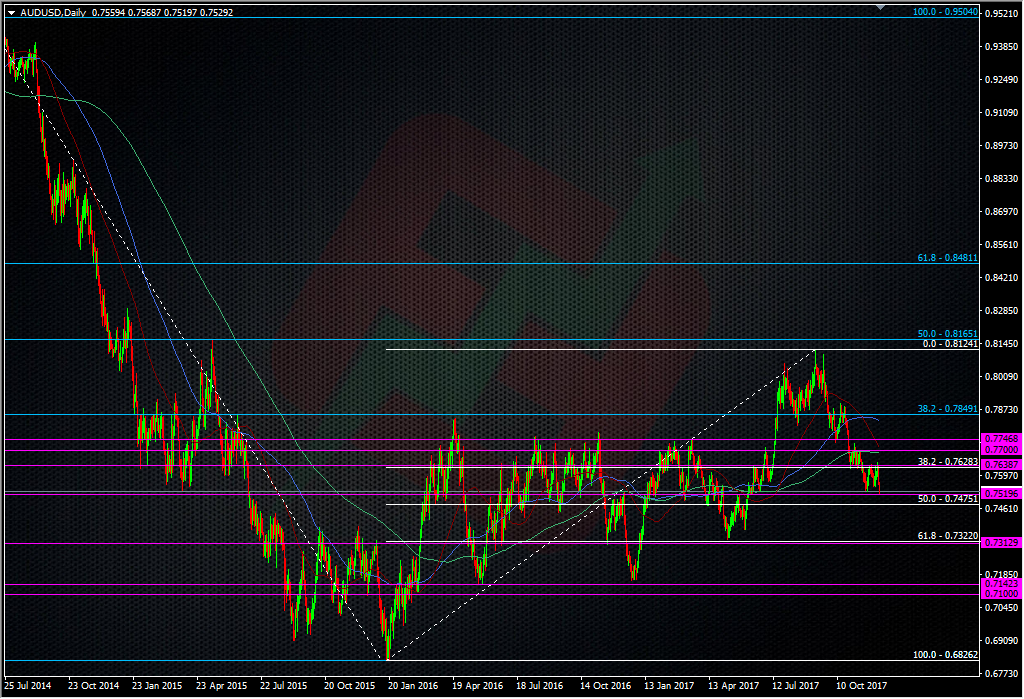

Clear the fib and we could have a relative air pocket down to the 0.7360/70 area, with perhaps a quick stop off at the low 0.74’s. The 0.73’s is another big area of support that’s shown it’s hand going all the way back to 2015.

These longer-term levels have worked very well in this pair so I’m going to be looking at taking a long from the low 0.73’s, near the 61.8 fib, should we get there, and as usual, depending on why we’re there. It’s a similar looking level to the 0.7700/50 area that was such strong resistance. Trading these levels

In the meantime, there could be some mileage in a small break short of 0.7520 or 0.7500, with a view to watching closely how that 50.0 fib reacts. It might be preferable to wait for a confirmation of any break before trying a short. This one will need to be kept very tight around those levels.Alternatively, resistance is showing at 0.7550, 0.7570/75 and strong at 0.7600, where my colleague Horatio has only gone and picked and traded another top.

As we’re striving to show and teach here at Forexflow, trading doesn’t have to be difficult if you’re disciplined and plan well.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

Gold down, NZD breaking It sounds like bearish right now.

It looks very ugly.