I’ve just seen it’s been exactly one year since I started buying EURUSD

Exactly one year ago I started buying the euro on some fancy idea that Europe would see a further recovery and inflation would start rising. Here’s what I wrote at my old stomping ground 1 year ago;

These last couple of months I’ve been mainly sitting on my hands trading wise. For sometime I’ve been waiting for the right time to buy both the pound and the euro for a long-term trade. While the pound is still a work in progress, one element of the EURUSD long trade was the ECB. Now that’s passed, and gone pretty much how I was hoping, I’m starting to buy in.

My view has been that at some point the ECB won’t be able to ignore the path of the fundamentals. There’s certainly no ignoring the trend in inflation, low though it remains, the same for other data points. I’m not proclaiming boom times for Europe but what is happening is that we’re moving further away from the low levels that came from the crisis. Now we’re seeing real green shoots not more weeds. That’s what I want to trade.

The key to the trade is getting in early but only after certain conditions have been met. The ECB meeting was one, the next is the FOMC. These are/will be two big defining events and one’s that I feel could mark a significant bottom for the euro. Just as I can’t see the ECB going deeper down the QE rabbit hole, I can’t see the Fed giving us a hawkish hike. I’m going to use these two meeting to set me up as I don’t see much more downside once they’re over. Initially I’m looking for a similar reaction in USD to the hike last year but not as big. The market is always trading what’s to come and once it gets what it wants, it often takes profit then moves on to the next thing. I believe that next thing is the euro.

Why do I wait for these events?

I need the confirmation for my strategy. I need to know that I’m not just buying in willy nilly and then finding myself well offside and then having to face the added risk from these meetings. The ECB today gave me a level nearly 200 pips better to buy it at. It may still go down, and I expect it too but in my mind I’ve still made that saving and reduced my risk by a good chunk too. I’ll play the FOMC the same way.

What levels am I looking to buy at?

I took a small position at market at 1.0656 earlier(too soon as usual, that’s my impatience at work). I’m now looking down to 1.0500 and the 2016 lows. My next buy will be around 1.0550 and 1.0500, then down towards the 1.0460 lows. I’ll probably spread what I would normally buy at one of those level one their own and spread it between them. My prior wide look at the euro highlighted the area from 1.05 down to 1.03, so if that low end breaks, That’s where I’ll have my first assessment. If I’m happy for the reasons why we’re there, I’ll continue on if it heads towards parity, which will be the next big assessment point.

What’s my target?

My first target is not to lose money. My second target is not to lose too much money before I can make some profit. Easier said than done obviously. I’m not interested in picking numbers out of the air as profit targets because I don’t trade that way. What I’ll be doing is watching how the price reacts at certain levels I’ll highlight on the way up (and conversely on the way down). My final target will be where I decide to close the last of the positions.

I don’t know where the price will be tomorrow, let alone a year’s time so the only thing to guide this trade is the fundamentals, the technicals and ultimately the PA. There’s no point in me saying I’m hoping for 1.40 when there’s a thousand technical levels in the way and need overcoming. All I’m ever concerned about is what can go wrong with the trade, not what can go right. Deal with that and the rest should take care of itself.

What could go wrong?

That’s pretty easy to define. The Eurozone economy and inflation could go backwards. The US economy could accelerate. If that happens then getting out and taking a loss is the only choice. I’m sure it won’t be as black and white as that, it never is, so navigating the grey is what I’ll have to do day by day, week by week, month by month. I’ll be watching the data and feeling the sentiment and reacting accordingly.

Whatever happens to the trade there’s one important factor to consider, and it’s something every trader should consider, and that is that I’m am prepared to lose what I am going to stake on this trade. When I trade long-term I’m prepared to risk a bit more than normal but nothing excessive. I will know what I may lose from the get go, and I will be prepared for that. There will be no shocks, no ‘deer in the headlights’ moments, no “what now?” questions if I go offside. I’ll know where I want to get in, and I’ll know where I’ll throw in the towel. I may win, I may lose, that’s trading but at all stages of the trade I’ll be in control of it, not it in control of me. If I avoid the long road to ruin, I’ll be a happy man at the end 😉

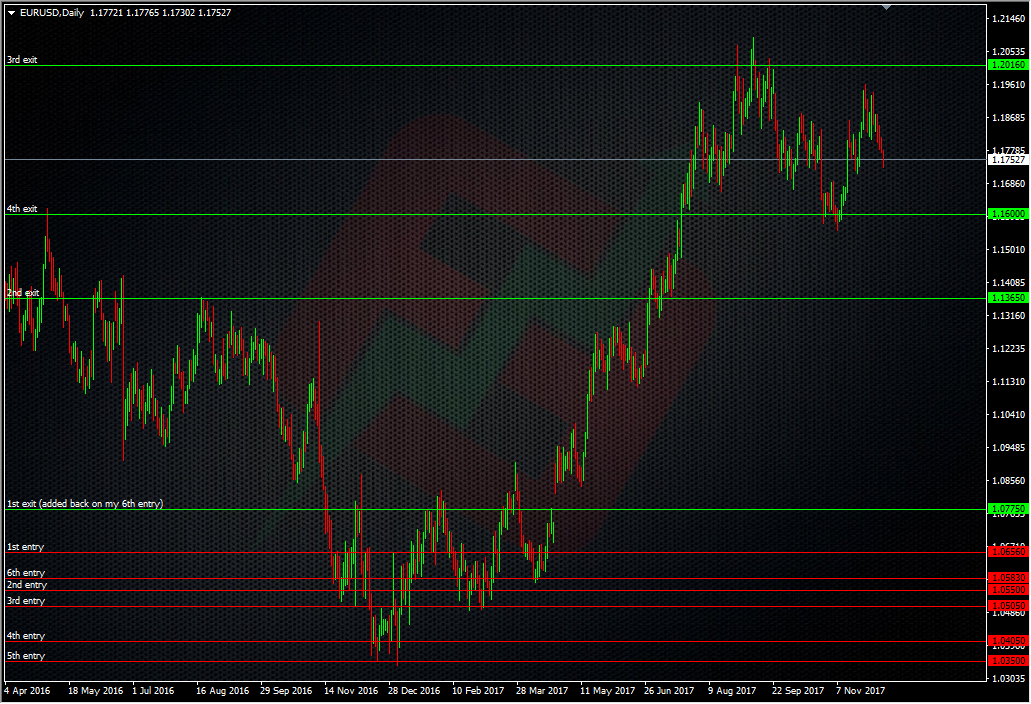

As much as ithis post might look like I’m giving myself a pat on the back, that’s not my intention. I couldn’t really give a toss whether the trade is 1 year old or 10. What I have turned this into is an exercise (and thus the reason for this post) in analysing what I did, to perhaps learn about the things I did right, and the things I did wrong. We can’t make money with hindsight but we can reflect on our actions to see where improvement might be needed. To aid that, I’ve plotted all my entries and exits on the chart.

What I’ll try and do is reflect on what I was thinking at each stage.

- I was pretty happy with my entry levels, though as per usual, I went too early on the first trade. That’s a habit I really struggle to get over with a lot of trades and strategies. It’s that fear of missing out.

- 1.03/1.05 was a huge historical level and 1.03 was my big assessment point. A break there could have fulfilled all those forecasts about the euro hitting parity. At the time I was thinking about whether to bail if it broke or carry on buying.

- I remember the 1.05 area being my emotional pivot point. Above I was happy, below I was nervous.

- I was very worried that I’d cocked up not taking some profit when we first broke up through 1.0800/50 as this had been a big S&R area. I remember kicking myself as we fell all the way back to 1.0500. I didn’t need asking twice when we moved up through 1.08 a second time and I took some off at 1.0775 as we came back down. I added that position back on at 1.0583 after support came in ahead of 1.0500/50.

- The third time was a charm and we got the big move to 1.1365, which was the start of another huge level of resistance around 1.14/1.15. I wasn’t going to get caught again like I was at 1.08 so I took a bit off in the first move up at 1.1365. I needn’t have worried as the dip was minor and off we went again. The main point here is that I learnt from the 1.08 experience and made sure my discipline was tighter.

- The break through 1.14/1.15 was another big one and by this time the ECB expectation trade was in full swing. I didn’t take any off in the first break into 1.20 as at the time I remember thinking that this is exactly what I’d been waiting for and that the euro was going to remain supported. It was a different emotional/psychological situation compared to the 1.08 & 1.14 events, so I was less bothered about the first failure. One thing that eased my mind was that I had a lot of profit margin in the trade so I was far more comfortable. However, discipline needs to be strong at all times and so I took my next chunk off at 1.2016 when we failed at the highs again.

- The 1.20 highs came as the market’s expectations for the ECB were at their highest and I really thought hard about whether this was the end of the road for me. I’d been trading that expectation building up all year and now we had the expected outcome, I remember being worried that we’d follow the same path of the Fed in the market now fully pricing in future moves. 1.1700/1.1685/90 & 1.1600/1.1580 became the big support levels after the 1.20’s tops and I still hand some indecision about how much gas was in my trade. I set a stop to take off a bit more if 1.1600 broke and when it fell to 1.1555 I felt vindicated. I was hoping for a dip to test 1.14/1.15 where I was looking to load back up again but it didn’t happen, and back up we came.

What strikes me most when I look back is that I remember being reluctant to buy dips. I know I spoke about it, and highlighted it but I only did it the once. One reason for that was that we didn’t hit the levels I was watching but also some of the moves didn’t really offer any real dip opportunities. Again, that’s a discipline thing where I’ll only trade levels I’m happy with. We need to look at every trade like a fresh trade and define the risks accordingly.

I also didn’t buy into any breaks, which is surprising because I’m always looking for them. I think maybe the psychology from holding a position and seeing it go your way is vastly different to being out and wanting to get in. The euro move was massive and being on the outside of something like that again raises the spectre of missing out.

I’m certainly not complaining but I can see these are things to work on moving forward, to try and miximise on as many opportunities as I can.

Where are we now?

The latest ECB extension has seen the price consolidate and the 1.16-1.20 range is still firmly in place. The dollar isn’t so bullish on Fed or tax expectations so I’m happy that there’s no real risk there. If anything I’m getting the feeling that if the Fed do hike this month, that’s going to be it for quite a while unless the economy and inflation really does pick up. To that extent, I’m not overly concerened about the USD side of things. For now, I’m looking for the end of QE and perhaps signs of the first ECB hike, which I hope comes more sooner rather than later. The ECB can’s been kicked to next year but if the data starts picking up again, particularly inflation, we;re going to possibly see the same performance in 2018 as we’ve seen this year, though perhaps to a lesser extent. I’m still holding 2/6ths of my position and I’m happy to keep hold of those for the foreseable future.

Overall I’ve more of a neutral bias for FX into next year. I think monetary policy normality really hits home in the dollar and we settle to trading rate moves more normally than expecting a 500 pips move on everyone. The euro still has some legs as we’re not at the end of QE yet. I think the yen is going to be the big play next year, as K-Man has been whistling about recently. That’s for another post though 😉

For now, I’ll remind you all that it matters not where we think prices may go, it’s all about where they do go, so you won’t get price forecasts from me anytime soon.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

Happy BD to great trade! You should give the baby a name 😉

😀

top work mate as ever!! have a great weekend too, cheers

Well done Ryan! The lookback is also good for the psychic because I personally can quickly forget on successful trades which I concluded. Such a way you can remember on good decisions.

One question: if your expectation is not really bullish but rather sidewise for the upcoming month/s, is it worth keeping the position alive? By the way in such a nice profit the swap is really marginal but are you looking at what was the cost to keep the position for a whole year? Thanks

Hi Gaboss

I’m not sure if this reply will come through as it looks like there’s been an issue with disqus.

I still think there’s more upside to come for the euro and probably mainly from a mix of USD weakness as well as a better performance in the Eurozone. One of the reasons I’m keeping it is because I’ve got a good profit margin but if we do break that 1.16 area again, I might cut it all.

in terms of the swap, it’s not been a problem while the price moved up so much but it becomes more of one when prices go sideways. It’s not been a big cost at all though and it hasn’t been a factor when it’s added to all my other trades.

Happy Birthday To Your Trade Ryan Littlestone I still remember discussions of last year when you were preparing to get start into eurusd…Long Train…Eur Fundamental Trump Fed all were in your favour related to USD Weakness and EUR…STRENGTH…People says inbgames ..This is your day…I would say This 2017 Year was your year lolz…I am very happy to learn many things in trading from you… 🙂

Hi Ali.

I hope you’ve had a good year too my friend.

Yes Friend… I had but not like last year… Because I just buy $ in each dips since August 2015…But this whole year $ did not performed well across the board.. so I learnt from my mistake that market is two way so we should pick good levels not just side…$ or EUR…As you do.. 🙂

Well, as long as you made money, that’s the main thing. I suspect we might not see much USD strength next year either.

Yes that’s why I have changed my trading strategy little bit… 🙂

Another fantastic post – very interesting to learn what your thoughts are when entering a trade and how you manage it – seems you study fundamentals forming an opinion on where the currency is going then add to the trade if the data supports your view. I wonder how many pairs you study each day looking for a trade opportunity?

Thanks FXJ.

I use fundamentals a lot to give me a bias. I start by just taking a wide view of things like what central banks are/may do, what the economy is doing, whether the market is believing or disbelieving what interest rates will do. That helps give me a sense of the sentiment on many different timelines. I then use that to trade.

In the case of the EURUSD trade, it was simply about the ECB and Europe being the next economy to recover and change policy. These big macroeconomic changes don’t come around that often unfortunately. I’ve been lucky that we’ve had the crisis to bring these big events and I’ve just tried to trade them unwinding. At some point we’ll get back to normality where central banks just tinker around the edges of mon pol.

That said, we’ve potentially got some big action coming from the BOJ next year as they are likely going to have to change their stance somewhat. That might be a big trade to get on.

I wonder how many pairs you analyse everyday?

I have a free chart package called Netstation from Netdania. I have 10 pairs open, all on 15m time frames. It’s what I watch all day everyday. I just scroll around other pairs to see what’s going on. I try not to look at too much otherwise you end up looking at a lot and doing nothing. It also depends on what’s going on in the news.

interesting I focus on the euro the pound and the euro/pound just three pairs I also keep the 15m time frame open all the time and watch the news although I am looking for technical signals to enter a trade I know how important fundamentals are and of course the central banks.

It makes for an easier life only watching a few pairs. I’d be lost without my 15m charts. They are my life, when it comes to trading. I find they are the perfect indicator of price action and when I see something I like, I then look at the other timeframes to see what other tech or trends are there in the bigger picture.

I agree about the 15m they are my main chart and I have the three pairs open on the M15 all the time so I am watching and comparing all three at once. I also try and make sense of the news, data releases and central bank statements. The fundamental analysis I find more difficult I am happy with my technical side of trading but the fundamentals are something else.

You can get too bogged down with the fundamentals but it depends on how far you want to delve. I’m no economist and have no interest in getting into the finer intricacies of it either. As long as I know which way a central bank is leaning and what the general health of an economy looks like, that’s all I need to give me my bias.

Also, back in my floor days I could trade the data as it hit but in this algo led world, us mere humans can rarely get near a price move over data. so I just look for any opportunities after.

I agree about trading data I generally stay out 30 mins before and 30 mins after although if there is a negative bias and then the data is poor I will go in and vice versa. About the fundamentals I self study economics although many years ago I did evening classes for 2 years. When I look at the economic picture I can convince myself I understand it then I look at the amount of Government and private debt and quantitative easing and I can’t make much sense of it then the politicians interfere and do weird things so politics trumps economics.

Haha, now you know why I don’t go too deep 😉