The Commitment of Traders net speculative positions report from the CFTC as of Tuesday 5 December 2017

- JPY -114k vs -111k prior

- EUR +93k vs +90k prior

- GBP +6k vs +5k prior

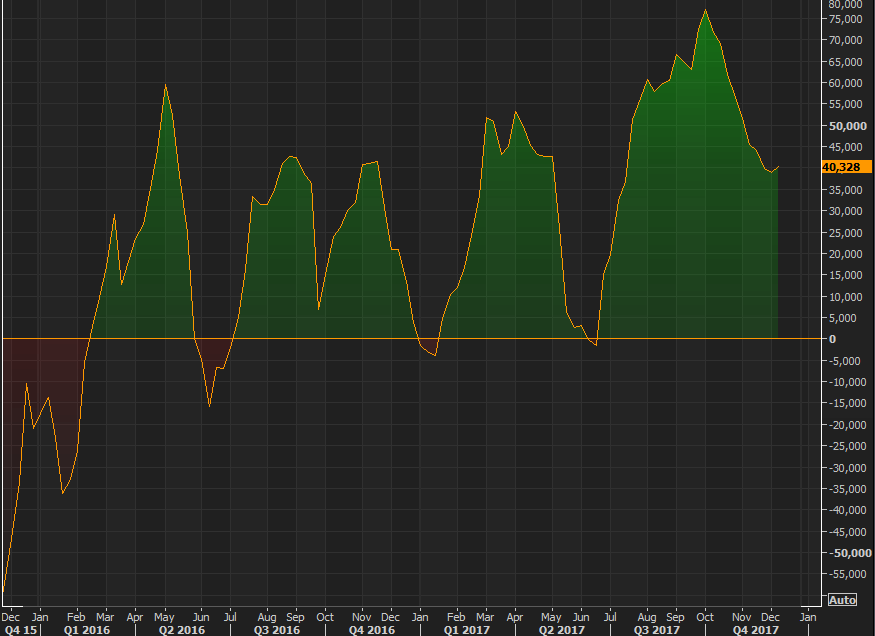

- AUD +40k vs +39k prior

- NZD -13k vs -14k prior

- CAD +42k vs +46k prior

- CHF -30k vs -31k prior

JPY shorts are back grinding higher but it’s the Aussie that’s playing the ignorance game.

The positioning turned long back in mid-June with the price around 0.7600. Early longs caught a nice rally up to 0.81 but they’ve been slow to bail, and AUDUSD has completed the round trip, and fallen under those June levels. That’s potentially putting all those longs under water and still they’re buying. The aussie has been held off by the barrier option at 0.7500 but the bounces are virtually non-existant. We could have a situation where a break might cause those longs to be squeezed.

Latest posts by Ryan Littlestone (see all)

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

In tecs, we are below the 0.7530, so it seems bearish. But…. I can’t really trade tecs before wednesday night, then okis. Buy blabla sell blabla, it could be 😉 U may interes in gbpchf… that’s a one nice tec…. I’ll will publish it. Have a nice weekend! And ya… I have to translate the bitcoin article!