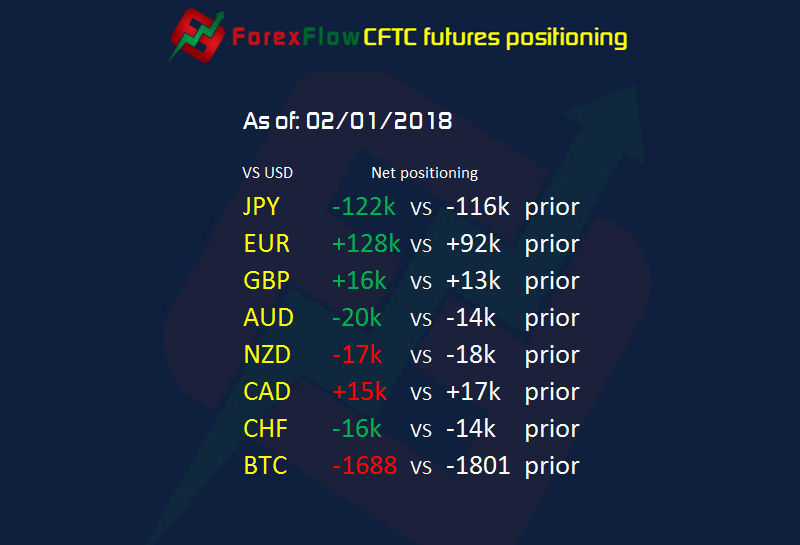

The Commitment of Traders net speculative positions report from the CFTC as of Tuesday 02 January 2018

- JPY -122k vs -116k prior

- EUR +128k vs +92k prior

- GBP +16k vs +13k prior

- AUD -20k vs -14k prior

- NZD -17k vs -18k prior

- CAD +15k vs +17k prior

- CHF -16k vs -14k prior

- BTC -1688 vs -1801 prior

The euro positioning is reflective of the price moves over the last week or so of 2017. Yen shorts piled it on too. Bitcoin shorts decreased a touch while its open interest rose to 4065 vs 3737 prior. It’s still a very expensive contract to trade so we shouldn’t be expecting volumes to balloon.

Latest posts by Ryan Littlestone (see all)

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022