Yen strength day 2

If there’s two things that the yen is famous for it’s doing nothing, or grinding. Right now we’re in one of those grinding moments where the yen is just going to go one way relentlessly. So it is we find ourselves with a second day of yen buying on the back of further bond moves with both JGB and UST yields continuing higher.

With JGB’s up at 0.089% it’s getting close to pushing BOJ’s boundaries of their yield control. The market is still huffing and puffing about the bond tinkering news yesterday and it seems to have spooked a lot of people. Last Friday’s CFTC futures position report showed that yen shorts increased once again so we may see some of those USDJPY longs unwinding into yesterday. Whereas yesterday we saw yen strength and some USD buying too, today the buck is looking a touch softer around the grounds.

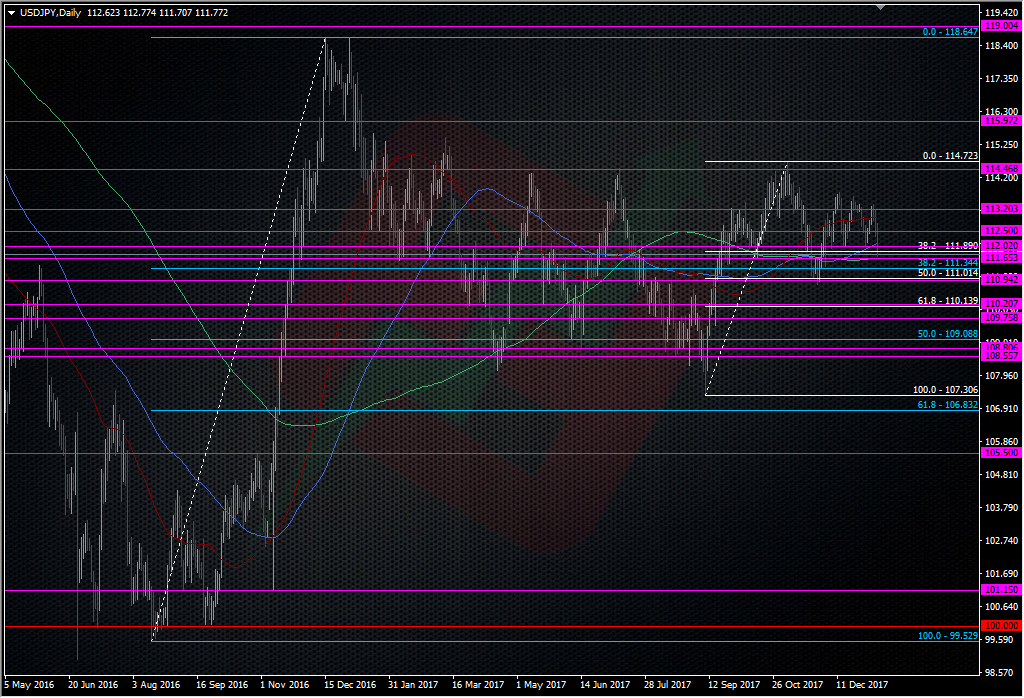

However, the important thing to note is that although these moves look strong on an intraday basis (considering we’ve spent a lot of time watching paint dry recently), taken in context with the bigger picture, we’ve not actually moved much at all. USDJPY has broken through some fairly substantial support at 112.00 down to 111.90 but in the bigger picture, we’re still well within the shorter term 113-113 range, and longer-term 108’s to high 114’s range.

Really, unless we see 111.00 and then 110.00 taken out, there’s not an awful lot to get excited about.

For the record, I went against my own discipline and left a 112.05 bid in overnight which was stopped this morning at 111.80. It’s a reminder that there’s a reason why I don’t leave entry orders in for short-term trades and that I prefer to trade manually so I can see what’s happening. I might have been a bit more cautious taking the trade on seeing the PA. We live and learn eh?

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022