EURUSD takes out the barrier at 1.2100 as German political parites come together, and USD weakens

- German political deal between coalition parties helps kick EURUSD higher through 1.2100

- Barrier broken and stops run to a high of 1.2134

- Worse than expected Italian industrial production and softer CPI in France & Spain ignored

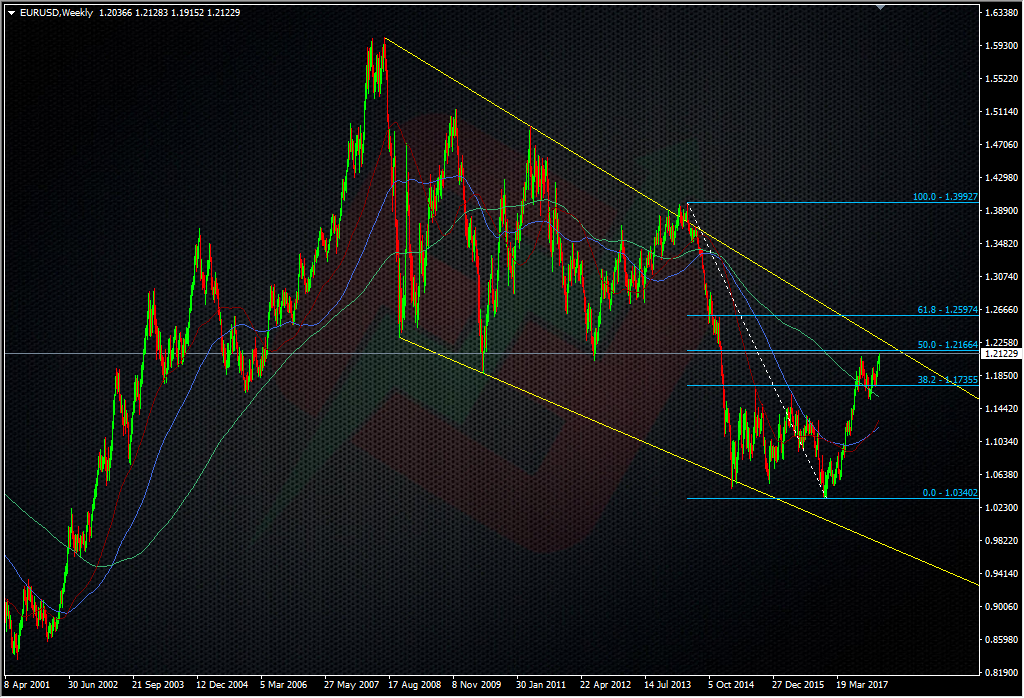

- 1.2100 break brings a big level into play, the 50.0 fib of the 2014 ‘Draghi drop’ at 1.2166

- On a wider view, resistance via the weekly chart is next at 1.2280 which is former S&R and also the top of the 2008 down trend line

- Above 1.2300 the big levels are 1.2418 (200 MMA), 100 MMA 1.2579 & 61.8 fib of 2014 swing down at 1.2597. The 1.2575/1.2600 area is also former resistance Nov/Dec 2014

- On the intraday side, support will need to show at 1.2100 to keep the break alive

- Under that 1.2080, 1.2060/65 and 1.2025/40 are support levels to watch

- US CPI data is the big ticket item today for Fed hike expectations and thus the dollar. A weak number would bring more woe to the buck and lift the euro further

- A jump in US inflation would test the resolve of this USD weakness, or whether it just encourages sellers to hit rallies

The German parties coming to an agreement paves the way for stability in Germany, and as the “growth engine” for Europe, stability there is stability in Europe. It’s not all about the euro though as the dollar is suffering on more than a few fronts. USDJPY is back down close to 111.00, while GBPUSD is off into 1.3600. US bond yields are on the lows with 10’s hitting a 2.54% low. US CPI is the big number on the calendar today

Latest posts by Ryan Littlestone (see all)

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022