Morgan Stanley are stopped out of a long USDCAD trade

USDCAD has just dipped under 1.2400 by 3 pips and that’s probably enough to stop out a long USDCAD trade that Morgan Stanley took at the New York close last week. In at around 1.2520/25 on the 11th, they has a stop at 1.2400 and profit target at 1.3000.

“We enter a tactical USDCAD long targeting 1.30. Markets arebeginning to discuss a higher risk of protectionism which should benefit CAD shorts. The BoC expects that exports will be a key

engine of growth for 2018, meaning a headwind to trade couldweigh on the market-implied path for BoC rate hikes, which we argue are priced fairly aggressively as is. Canada’s current account deficit means that a sharp reduction in inflows could lead to CADweakness. Speculative positioning in CAD remains long, suggesting room for a pullback. Concerns over protectionism and stretchedpositioning in risk assets should support USD in the short-term.The risk to this trade is that the USD upside fails to materialize and the broader trend of USD weakness persists.”

They also went short GBPJPY at the same time (roughtly around 150.70/80), looking for 138.00 with a stop at 157.50. Again, the same day, and at the NY close, they closed off an EURUSD long entered at 1.2059 at pretty much break-even, missing out on the preceding rally, although this was a re-entry of a trade they opened 14th Dec when it was trading around the low 1.18’s, which they closed for the hols 29th Dec around 1.20.

“We look to close our EURUSD long. Markets beginning to discuss the risk of protectionism and stretched sentiment and positioning indicators in risk assets suggest a USD upside correction could lie ahead. EUR, given its sensitivity to trade, may similarly face a downside correction. We retain our longer-term bullish EUR and bearish USD views, though acknowledge short-term downside risks to our EURUSD long.”

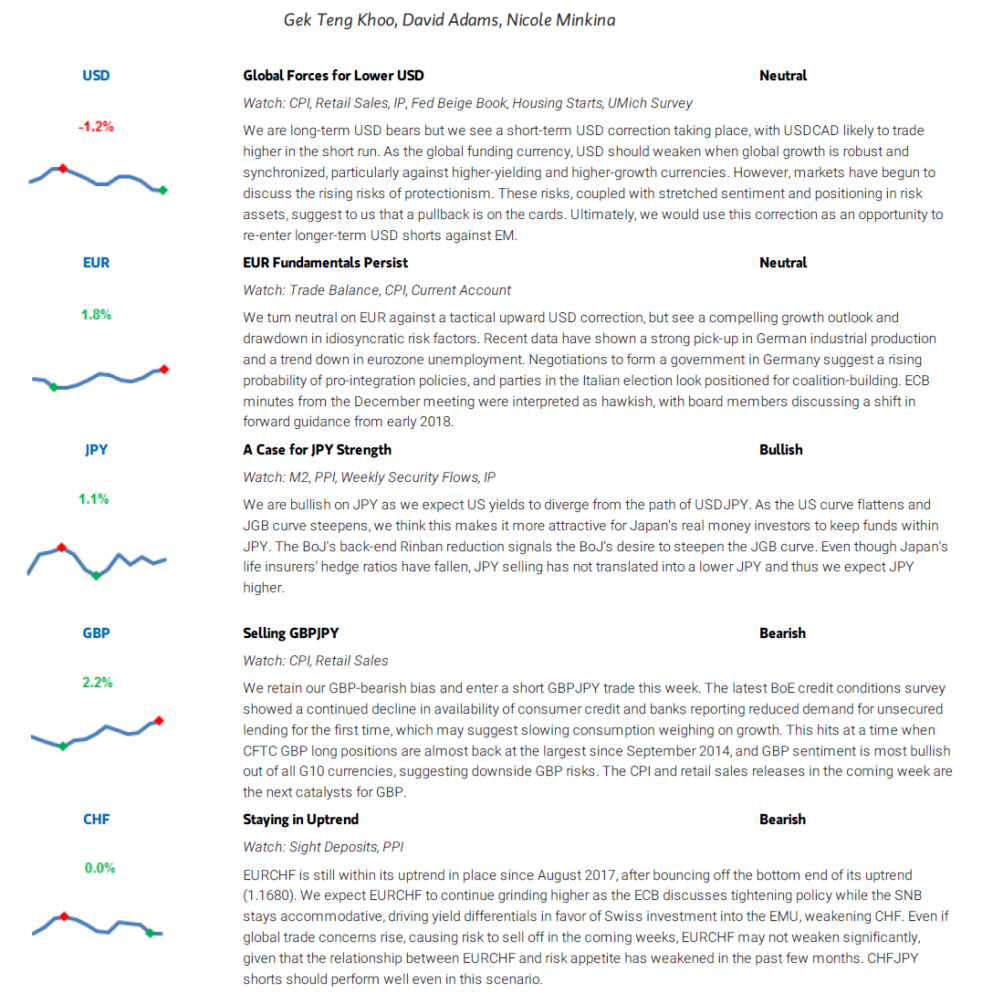

Here’s there outlook on some of the majors.

Although some of their tradiing decisions are questionable, their market analysis is very good. Morgan Stanley was one of the most bullish on the dollar but even they’ve seen the turn, and highlighted the possible risks coming from the yen, something the folks here at ForexFlow have been all over.

The JPY bull case: Global reflation has gathered momentum and markets are judging that it is here to stay. Japan is the best example here. In the past, Japanese inflation expectations were primarily driven by currency movements, which meant that significant JPY weakness was needed to keep inflation expectations sufficiently buoyed to avoid falling into a deflationary spiral. Now, instead, inflation expectations have rebounded due to strong domestic economic performance and higher commodity prices.

USD correction: Conditions for long-term USD weakness are in place, but within the downtrend, corrections can take place. A risk correction seems overdue, given extreme readings in momentum and sentiment indicators, with the US taking a tougher stance on trade, providing the potential catalyst for USD to regain some lost ground. USDCAD should rally in this environment. All this plays out as some Asian central banks are employing measures to prevent their currencies from rising too far.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022