When you are one with the market the profits come rolling in but what happens when you find yourself at odds with markets?

I’m in need of a bit of reflection as I’m feeling out of sorts with the market. Over my many years in this industry I’ve always been thankful for the ability to get into the groove of what the market is doing. I make it my objective to know what the themes, the bias, the sentiment are so I can set my trades up accordingly. If I’m going against a trend, I know to keep things tighter. If I’m going with the bias, I know where the risks are. It’s like dancing in step with a partner.

Being one with the market is valuable for trading. It’s ok knowing the overall fundamental/sentiment picture but when you have to pick trading levels to try and profit from that, that’s when you really need to be in step with the market. At the moment, I’m not in sync. Identifying that symptom early is very very important as if you catch it early, you can deal with it, and more importantly, it can stop you losing money.

In the latter part of last year, the market dynamics caused me to change how I was trading. The lower volatility meant that trading much more short-term was producing better results than sitting in a position for days. Taking quick profits and locking them in as early as possible meant good returns. More importantly, I was in step with the market. I was picking the levels well, they were playing ball and I had a good sense of when to go and when not to go, and I was right far more than I was wrong.

So far this year I’m not feeling so much in sync with the market. I managed to get a winner in my first trade of the New Year, which was good from a psychological perspective but last week I didn’t get much right at all. All traders have bad trades, it’s part of the process but when you lose, it’s all about how you lost that matters. Losing because you traded a good level that didn’t hold isn’t a bad thing, again, that’s what happens in trading. It’s when you trade good levels badly that the problems arise. Several times last week I picked good levels but traded them badly. I either missed trading them on the first opportunity, and then got caught out trying them the next time, or I picked good trades but didn’t manage them properly leading to lower profits or small losses. The feeling that I’m out of sorts with the market has been floating at the back of my mind all this week and I’ve only just realised it was there. Now I know it is, I can look to address it.

How do we get back on track?

I’m not alone, which in a bizarre way is good news. Some of the guys in my trading room are also feeling that way. That suggests that perhaps that the problem doesn’t just lie with me, and on further discussion and reflection, that reasoning has legs. The market has changed very quickly. From low vol and tight ranges last year, we’ve opened with higher vol and some big moves. Perhaps I, and others are struggling to adjust to that. It’s something I have mentioned this year already but perhaps mentally I’m not adjusting as well or by as much as I should be. Last year you could lean on the range levels with great conviction. Now it seems you get one chance (if that) and then it goes. Just look at GBPUSD and AUDUSD last night over the 1.39 and 0.80 levels.

Now I/we have identified there’s a problem we can look at how to fix it. I do that by scaling my trades right down, and even switching over to a demo account. That way, if I continue to cock it up, I’m not bleeding money.

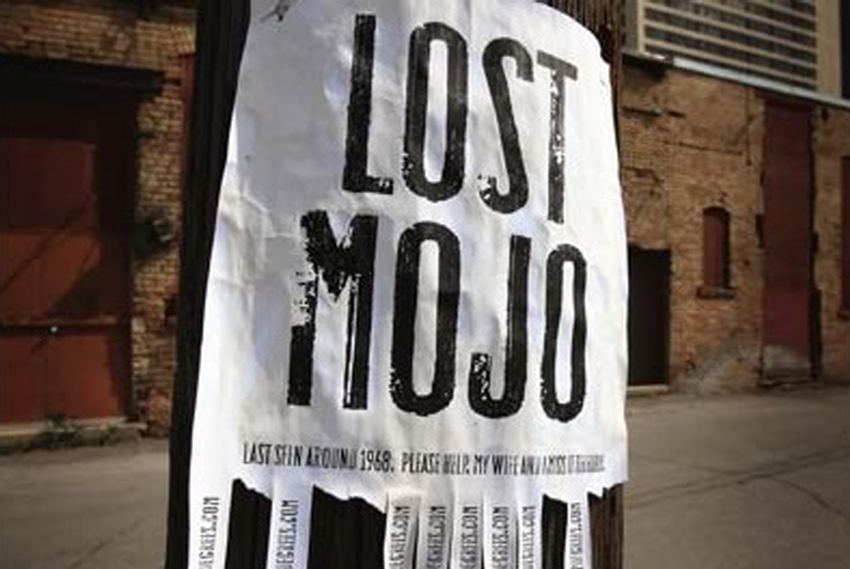

There’s never usually an easy or quick fix but I’ve been in these situations before and I know I’ll come out of it. That will be when I start to get my mojo back and the market performs as I expect it too, and thus so do my trades. I’m looking to get that feeling back where I can pretty much watch a 15-minute chart and know exactly what the PA is going to do. When I’m doing that, I know I’m in the zone and in step with the market. It doesn’t mean I trade every move or level but I know which levels I want to trade and I have strong conviction when trading them. It’s that conviction I’m lacking now.

Don’t be alone when you’re not in the Zone

Even as I’m writing this post I’m feeling better mentally. I’m also feeling more positive having chatted about it to the guys here at ForexFlow, and that’s an important factor. You should never try and tackle these problems alone. For many, trading is a lonely experience but there are options. We encourage open discussion here and so don’t be scared to come and air your thoughts. Go to forums, or chat rooms and you’ll see that you are not alone, that many traders all go through the same issues, even the most experienced ones. There’s an old saying that “it’s good to talk”, and in the case of your money being at risk because you’re not trading well, it’s a saying worth following.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

Fantastic thoughts and advice Ryan

Good post. There sure has been a change in markets and that takes a bit of adjustment. I can’t seem to figure out what is happening. My thoughts about where markets should be heading aren’t consistent with what is happening with the market. Unless my expectations and the PA are aligned, I find it hard to stick with a trade even if I am green on it. So trying to keep stops close and try to get a feel for the market.

Thanks Joshua.

You’ve proved the point that we’re not alone in having these feelings. You seem to have a sensible handle on it too in keeping your trades tight, well done.

Great article, thanks Ryan. It is encouraging to read that from an experienced trader like you. I think knowing one’s psychological condition at any moment is very imoortant.

Thanks Michael. It’s complete fiction if anyone says they don’t have these same issues when trading, from noobs to old time traders.

You’re right about identifying it and it’s one of the hardest things to do because you have to admit a weakness, and most people like to ignore those types of feelings.

Exactly. Actually, it makes one stronger and also takes a lot more guts to face and admit one’s weak sides than just to ignore them and pretend to be strong….

Very well said.

Great wisdom Ryan , not for nothing my motto is ” overtrading is bad for your health” , mainly as a reminder to myself that trying to hard when out of sync will hurt even more out of past experiences.

Ryan, you really fortify us. I hope never see you out of sorts.

Thanks Koorosh, and the same to you sir.

i lost the sense from 6months ago. That made me panic. Again, thanks to have me join the room, i’m having my confident back.