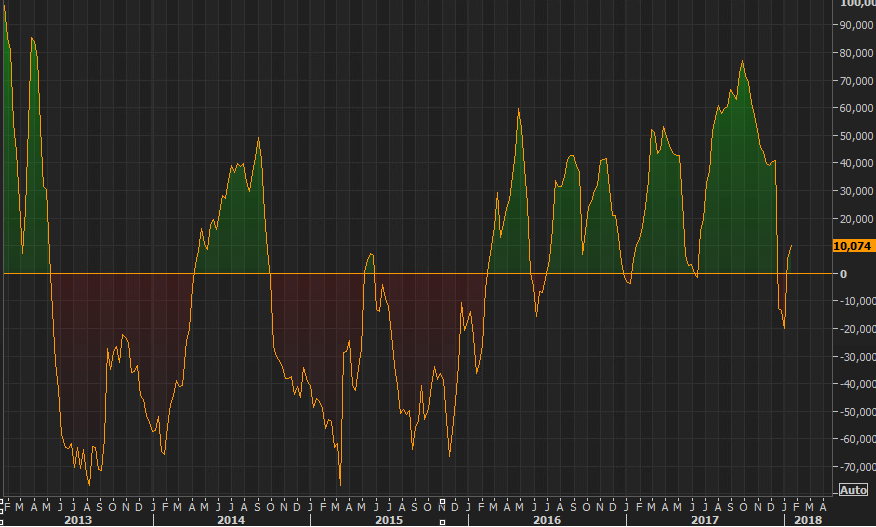

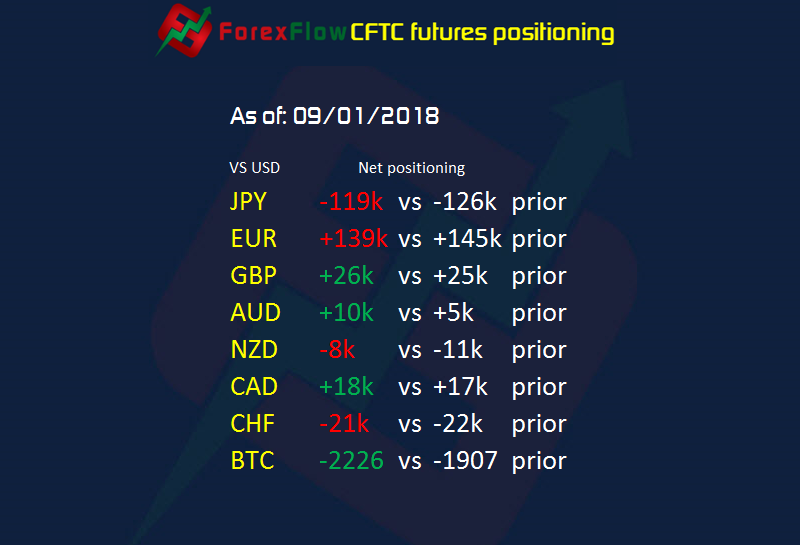

The Commitment of Traders net speculative positions report from the CFTC as of Tuesday 16 January 2018

- JPY -119k vs -126k prior

- EUR +139k vs +145k prior

- GBP +26k vs +25k prior

- AUD +10k vs +5k prior

- NZD -8k vs -11k prior

- CAD +18k vs +17k prior

- CHF -21k vs -22k prior

- BTC -2226 vs -1907 prior

EUR and JPY net positions scale back a touch, while AUD longs pick up once again. They didn’t spend too long short did they? BTC shorts continue to grow.

One thing I want to highlight about the report. What’s often incorrectly assumed is that the net position is assumed to be the amount that traders might need to covered. For example, EUR longs of 139k looks big but that’s the net. Overall, there 254k longs, and if we’re worried about seeing covering moves, it’s more likely that the 115k shorts will be the one’s to cover if the price keeps going up, thus actual longs, and net longs will go up. I will also add that the commercial net poistion is short 182k with total shorts at 413k. It’s something we need to bear in mind with this report, that it’s not a full reflection of the market but merely a small snapshot of one piece of it.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

Hi Ryan,

Forex market is huge. What percentage of this huge Forex market is made by the US Future Forex contracts?

What platform do you use to get CFTC charts like the one you have shown above? Thanks.

Hi John

I don’t actually know the percentage but it’s not as big as the OTC market.

The main news wires (Reuters, Bloomberg etc) detail the numbers but they’re freely available from the CFTC here http://www.cftc.gov/MarketReports/CommitmentsofTraders/index.htm

The exact report is the CME legacy report, long format, here

http://www.cftc.gov/dea/futures/deacmelf.htm Just scroll down and it’s the difference between the non-commercial shorts vs longs.