It’s nearly Draghi time so what’s the trading play for the ECB meeting?

I think we can all guess what’s going to be the big subject on everyone’s lips at the presser today. So, let’s get the easy stuff out of the way first.

Expectations;

- Policy moves = Zero

- Can kick of potential policy or language changes to March = Nailed on

Now to the all-important presser;

Draghi doesn’t like to do much in the meetings in between the staff projections. It’s his excuse to keep expectations firmly on the ground. Like every other CB, they’re data dependent and in the ECB’s case, strongly led by the beavers in the macroeconomic department who produce the projections. At any other time, this would be a boring, stocking-filler ECB meeting. What will make this one interesting is the near 600 jump in the euro in the last two weeks, and near 1000 pips since Nov last year. That’s going to be THE hot topic today but it’s going to be a pointless exercise, and here’s why.

If this EURUSD move was based on European fundamentals, Draghi would probably come out and stick a pin in the bubble. Because this is 99% USD led, he can’t do diddly squat about it. He has absolutely no power over this rout in USD. He can try and jawbone this move down but it’s really out of his hands. He can threaten more QE, lower rates, you name it but these moves are looking more and more like big fundamental flows, not mere short-term positioning on central bank policy divergence or Markit PMI’s. He can’t control this like he can’t control the oil/energy inflation that’s heading Europe’s way. This is one of those times where a central banker is powerless.

The only real trade for me is to grab a decent dip, if Draghi manages to pull one out of his hat. Unless we’ve naturally found a top here, or the dollar selling has run out of steam (always possible) there’s plenty more room to the upside. His only real argument today is to fall back on his old message a couple of years ago, when he said the rise in the currency hits inflation. If he takes that line, and says that a move up in the euro will mean a longer path to the ECB’s inflation target, and thus QE running for longer, that could hit the euro. But, he risks going against the positive effects that an improving economy brings, particularly in inflation.

Despite dip buying looking like the best play, we need to be cautious. We’ve see a big one way move and that leaves the door open for a big retracement. I’ll be looking for a dip but a substantial one, not some flimsy 50 pip drop. The big figures offer the best-looking dip buying areas and as they’ll have natural support, they could be the lower risk areas to look at.

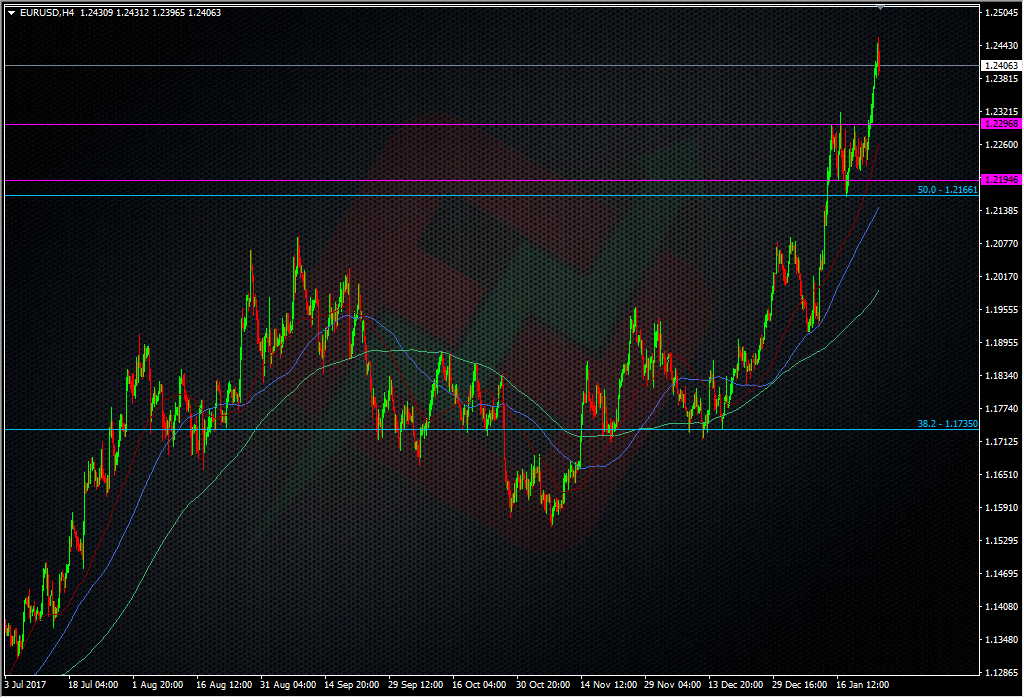

EURUSD H4 chart

The 1.2300-1.2200 levels would be my preferred choice, depending on the reason for the moves down there. Should we break there and the 1.2166 level, that’s a clear signal of a strong reversal of this move. Given the increased volatility, we need to look at giving trades a bit more room but to keep risk manageable, we can mitigate that with lower size trades.

If Draghi doesn’t try and strong arm the currency then we’ll get a big clue of how much strength is still in the rally, so watch carefully. If he shrugs these moves off but we can’t take out the highs, that’s a signal of exhaustion and a potential top, temp or otherwise. That could offer a decent tight short opportunity. As always, there’s going to be two-way trading opportunities.

One way or another, all will be revealed at 13.30 GMT (after the mon pol announcement at 12.45 GMT).

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

Made all the more difficult for him because he needs to manage yields as well

Good point but that’s also out of his hands because it looks like we’re in a big asset shift. That’s not a bad thing if it’s a sign of confidence in economies but it’s trouble if it’s not.

Hi Ryan.with new us policy in strong dollar are you still buying e/u in deep?thanks.

Hi Arash

I think the market is really only moving on these political strong/weak dollar comments day by day it’s not part of the overall trend. Look at the evidence. The dollar has been falling for sometime now and when Mnuchin said about a weak dollar, it was just more reason to sell. Even when the comments came to reverse what Mnuchin said, the dollar only popped a little bit. And then, even Trump spelling it out only brought a temporary lift, and it sold off again.

There’s bigger forces at work and because of that, I’m happy to hold my longs and look for good dips to buy.

cudos….everything clear in plain english what else would you want from someone of Ryan…. cudos again

Thanks Kerdi.

Great preview Ryan. I will measure EUR reaction more on crosses than vs USD. One trade I’ll have is long EURCHF if he manages to get it down to 1.162/1.16, lots of support there

Thanks 5M. And good point too, that there’s plenty of other pairs to look at to find those sweet spots. Good luck sir.