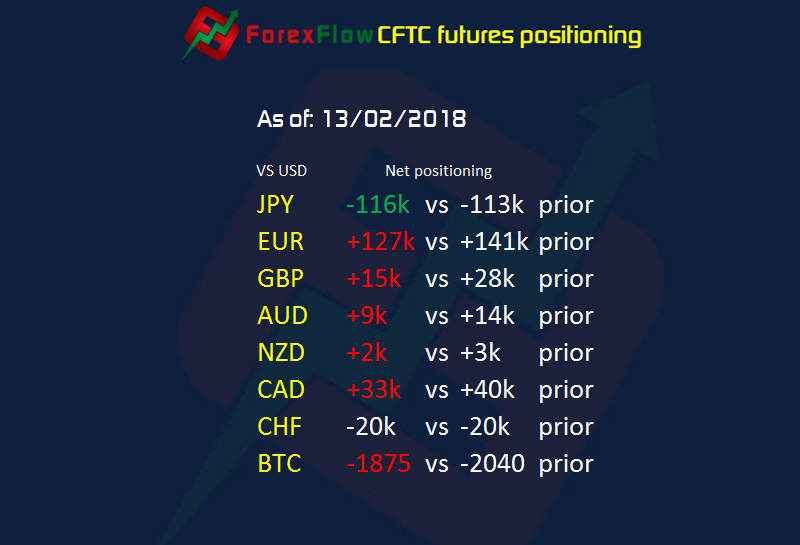

The Commitment of Traders net speculative positions report from the CFTC as of Tuesday 13 February 2018

- JPY -116k vs -113k prior

- EUR +127k vs +141k prior

- GBP +15k vs +28k prior

- AUD +9k vs +14k prior

- NZD +2k vs +3k prior

- CAD +33k vs +40k prior

- CHF -20k vs -20k prior

- BTC -1875 vs -2040 prior

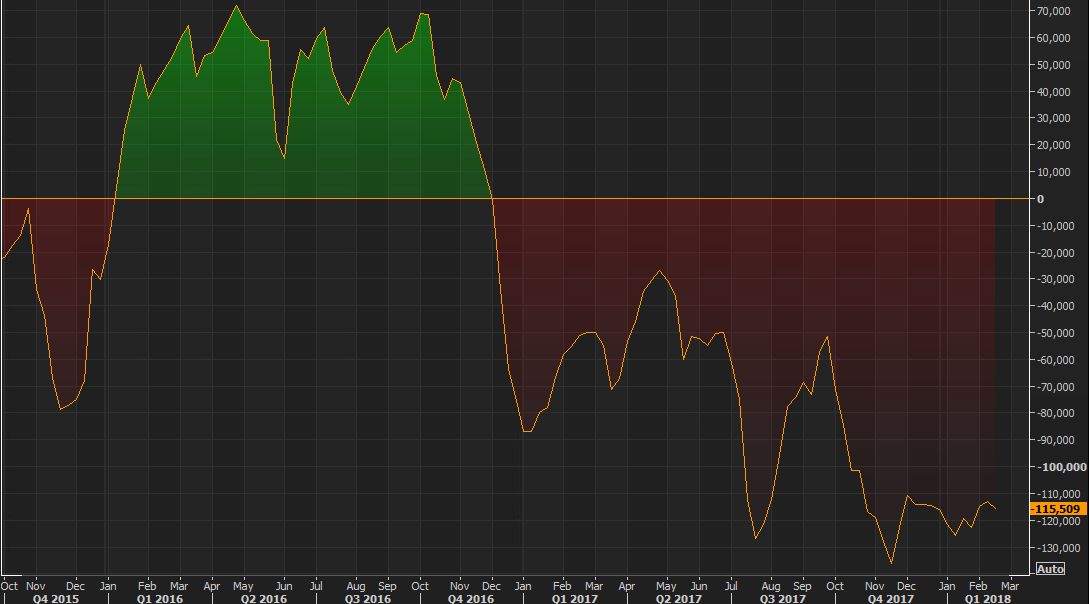

Even with USDJPY collapsing, yen shorts increased in the week to 13th Feb. There’s dip buying and there’s holding on for dear life, and pretty much all these shorts are under water, and the majority are from much higher levels. What’s also got to be a killer is the rollovers as remember, these are futures. I can’t help but think that perhaps a big amount of these are hedges of some sort.

CFTC JPY shorts as of 13 February 2018

Pretty much all the rest of the currencies saw cuts to positions and it looks like more Bitcoin shorts took advantage of the recent dump to lighten up further.

Latest posts by Ryan Littlestone (see all)

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

Thanks Ryan. “I can’t help but think that perhaps a big amount of these are hedges of some sort”, Spec had been reducing the JPY net shorts in previous two weeks when US stock markets fell and adding back new shorts the past week when stock markets recovered some loss, so if this is really because of the hedges, USDJPY will be dumped even harder when short sellers in the stock markets decide to take profit/loss and buyback their JPY shorts. There must be more scenarios, but this is what in my mind ATM, so I have to insert S&P into my USDJPY chart:-)

That’s a good assumption Chen. I’ll have a look into that.