The pound could be in trouble as the EU gets their position off first

Here we are back in the thick of Brexit positioning and it’s no surprise to see that the EU has come out with its latest position, just two days before Theresa May gives the UK’s latest stance.

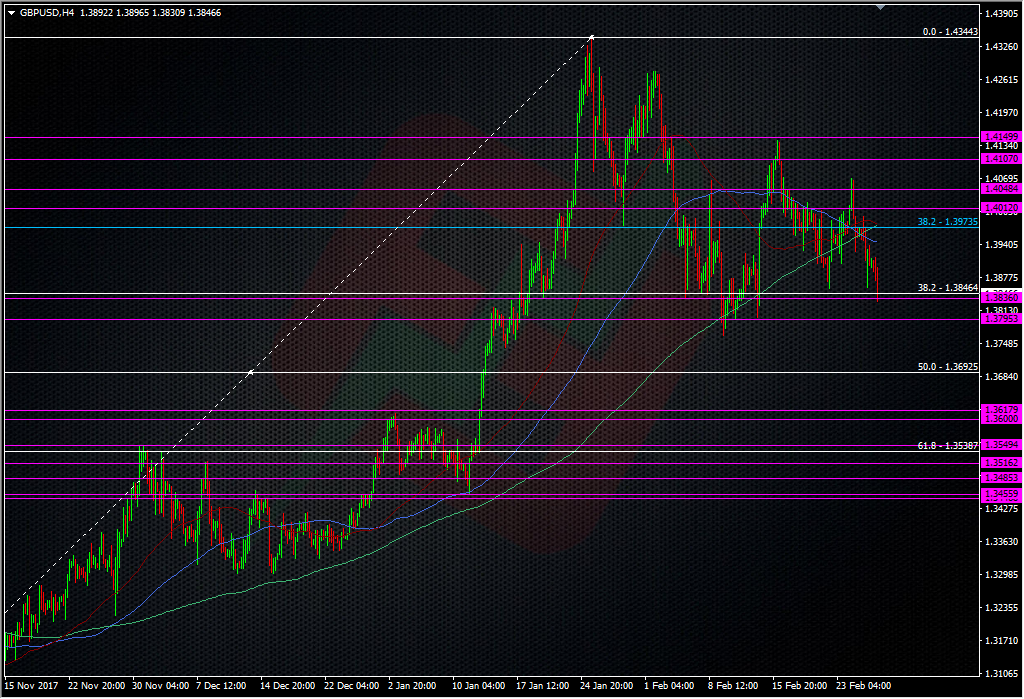

In politics, it pays to get the first shot in and we’ve seen this happening from the EU for a while. The big problem I have today is that I just can’t see Theresa May coming out with anything in her speech on Friday that will turn this around, and that means big trouble for the pound. That’s already being thought about as GBPUSD falls to a new low of 1.3827.

We could see the New Year rally take a serious dent by the end of this week, with the 1.3800 level being key to that.

The 1.3800 level could be very important here as a break could mean a quick move down to 1.37 or worse. Under 1.3800 we have the 55 DMA at 1.3771, and give or take a few pips, that coincides with the Feb low around 1.3765.

I was hoping for a decent rally yesterday above 1.40 to hit but alas it didn’t come. I’m still considering shorting into May but I don’t like chasing or selling current bottoms, so I guess I’ll have to see if we get one from the USD having a weak moment.

For now, we may see resistance building around 1.3850/60, and more likely at 1.3870/80. We know it’s already in place at 1.3900/20 from today’s PA. 1.3800 may be ripe for a first-test big figure scalp but it will be a very tight one if so.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

A timely post with levels to watch

Thanks