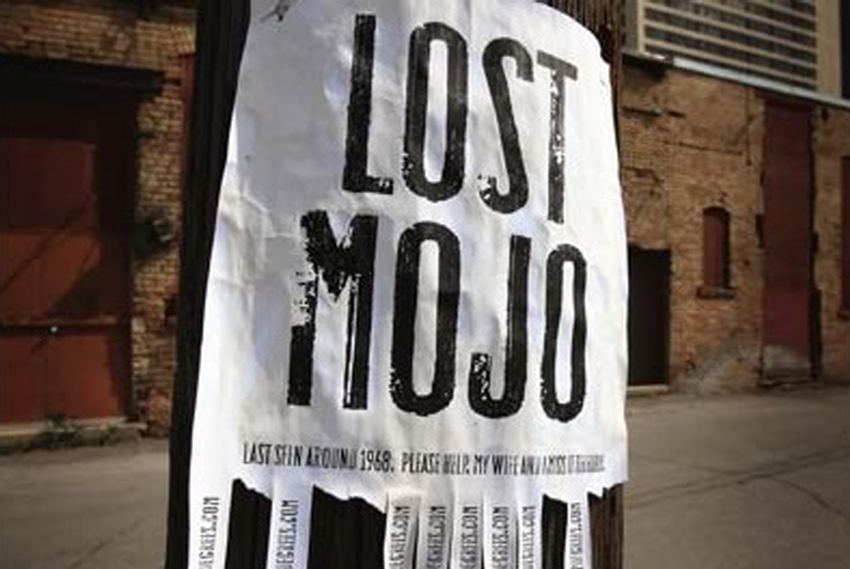

Watch that Mojo

My aim in trading is to NOT lose net for the week, each week, as it goes by.

I can never expect to avoid being stopped out. Obvious statement I know. As each day progresses, I keep a note, a simple note of stops that are triggered. I don`t look at pips, I look at cash only.

My simple strategy for account management is to take specific trades to claw back stop money as each day progresses. I look for moves in various pairs or indices try to capture the perceived middle 3rd on the move, avoiding the 1st 3rd and final third. I call these take-off and landing.

My inspiration for that comes from flying. Take-off and landing are well known as being the overwhelmingly risky times during flights. It`s one thing only risking a maximum percentage of my account per trade, but it`s equally risky just letting those stops hang around running into the following week. I might have a bad performance the following week and as we all know, that can form a habit. Mojo`s gone, out of nick, call it what you like, so rather than think “I will trade my way out of these losses with good, profitable trades.”, I develop the mind-set to retrieve those stop monies and THEN move forward with profitable trades. It`s an important mind-set to me and one which has stood the test of time.

After a string of good profitable months, March got off to a bad start. I had the 1st week off away on business. I got back and racked up a cautious but reasonable week. I had some catching up to do to get the month off to a good start and make some ground up. I didn`t put myself under much pressure. That`s important in itself. I finished the week with a fair but small profit and managed to stay out of trouble. I retrieved a few stop monies. Ok!

Last week started off reasonably well Monday and Tuesday. Wednesday and Thursday were bad days. I had already retrieved stops. My account was back in shape but I fell for the weakness that gets us all from time to time. I needed a winner with all thirds taken. I crashed on take-off both positions on Cable and SnP`s. Confused, chasing and reckless trading.

Nothing measured about it. No rhyme and reason. I got cocky. Felt invincible after retrieving stops. I spent the rest of the day, no take-off, no landings, nothing. Sat on my hands realising finally that I was out of nick, losing my Mojo.

Friday was more measured. I retrieved one stop which was a big amount by trading 3 middle-3rds again using Dollyen, EURGBP and EURUSD while my colleagues were cleaning up on all 3rds on these pairs. As flagged in our live trading room, I took a long on Cable from 1.38906. By close of play Friday night, I had a choice. Take the profit and retrieve the final stop money or hold the position into the weekend. I did what I should have done right through the week. I followed my reasoning and held what looked like a good value trade.

Today, I was in that frame of mind again. Back in business. Mojo back. held the Cable into 1 .40777 for a great start to the week. Sat on my hands with the hefty chunk in the bank. Chasing nothing this time. So what if I have a lean week. It happens. I retrieved the stops and my account remains healthy looking. Learned all the old lessons.

Look after your account.

No chasing.

If you feel that your Mojo has deserted you. Stop! Sit on hands and remember that “if you`re not sure what to do, then do nothing. Your account will love you for it.

Good luck

- Why is the Buck so strong? - May 2, 2018

- What have we on the board today? - April 18, 2018

- A time-tested strategy for account management - March 19, 2018

Nice post! I like all, specifically I like the most this one which is a lesson to me:

“I look for moves in various pairs or indices try to capture the perceived middle 3rd on the move, avoiding the 1st 3rd and final third. I call these take-off and landing.”

March also started in the red for me, the main culprit was the 1st third :), well, let’s say, the main culprit was… myself 😉

We can be our own worst enemy Vitor but we can also be the best trading system in the world ?