The UK labour market report is the next BOE trading opportuninty as we roll towards tomorrow’s MPC meeting

The UK jobs report for Feb is out at 9.30 GMT and I’m going to be looking for a similar trading opportunity as yesterday. We’re expecting the Feb claimant count at -5k vs -7.2k prior, and the all important wages numbers at 2.6% vs 2.5% prior for the headline average earnings, and 2.6% vs 2.5% prior for the ex-bouns numbers. The unemployment rate is expected to stay at 4.4%.

The quid has put on a solid performance since falling yesterday afternoon and as buyers seem to have the upper hand, I’m going to look for buying a bad data dip (dependant of how bad the news is). Like yesterday’s CPI report, the dip buyers could be waiting down below and so we could see a similar quick drop which is hoovered up again. I just hope it isn’t too quick a move to jump on like yesterday.

This data could be a bit volatile too as although the claimant count is Feb, wages and the rest are for Jan, so they could still contain some seasonal factors washing out from the Christmas holiday period. It’s also when a lot of bonuses are given so we could see some additional volatility there too. In this instance, the ex-bonus wage number is probably the more important for this report, so if the ex-bonus numbers are soft vs the all-in number, that could take some steam out of any jump in the quid on the main number (with the opposite happening the other way around).

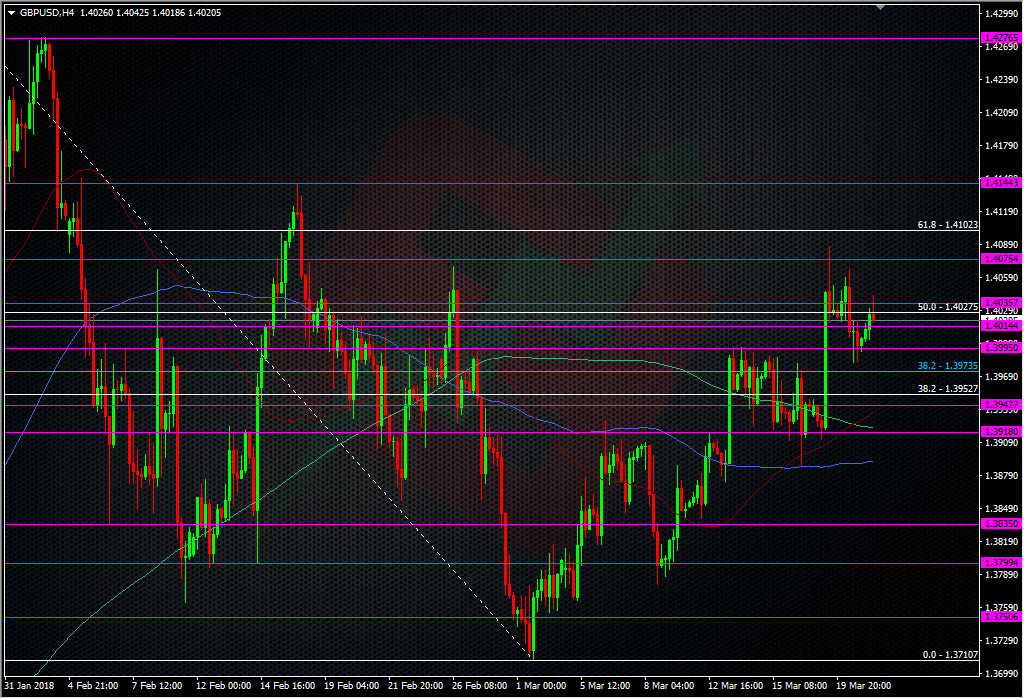

For trading, yesterday’s lows around 1.3980 and 1.4080-1.4100 above are probably the best consideration for a trading range. Given that 1.3980 is only 40 odd pips away, as I type, the 1.3965/70 & 1.3940/50 areas are worth watching on a bigger move south.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022