Fixed Income Research & Macro Strategy (FIRMS) from Olivier Desbarres at 4X Global Research 13 April 2018

- Currency volatility remains subdued and European currencies, the Chinese Renminbi and even the Brazilian Real and South African Rand, have done little year-to-date.

- However, a number of developed and emerging market currencies have seen rapid appreciation or depreciation and a number of explanatory factors are likely, going forward, to keep influencing these currencies’ paths.

- These include the impact of commodity prices on trade balances, capital account flows, trade-war concerns’ bearing on global risk appetite, central bank monetary policy, including FX management, expectations for policy rates and country-specific issues.

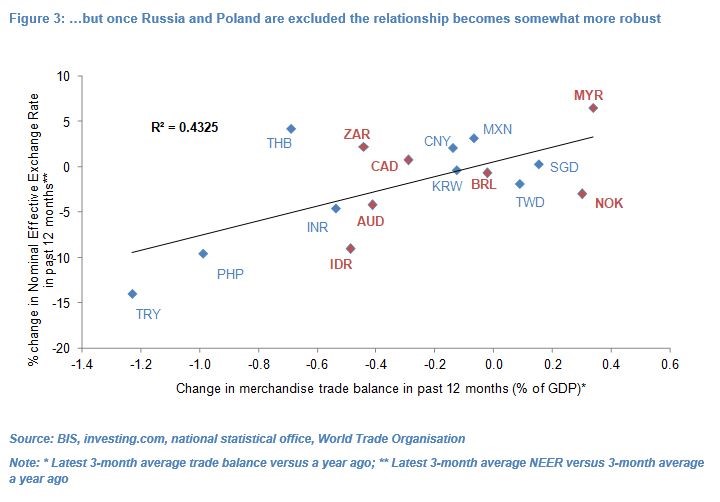

- The positive relationship between the change in merchandise trade balances and currency performance should not be under-estimated.

- Countries with trade balances which have only deteriorated very modestly (e.g. Mexico) or even improved (e.g. Malaysia) have generally seen their currencies outperform. Conversely, countries with significant and widening trade deficits (Turkey, Philippines) have seen their currencies depreciate the most in the past year.

- There are outliers, including Russia and Poland and to a lesser extent the Indonesian Rupiah and Thai Baht. The Rouble and Rupiah have underperformed due in part to capital account outflows while the Zloty and Baht have outperformed with the Zloty benefiting from Poland’s rapidly increasing outsourcing revenues.

- The significant rise in global commodity prices has driven very rapid export growth in most major commodity producers, bar perhaps Canada, and we remain bullish the Norwegian Krone. However, import growth has also been elevated, particularly in Indonesia and South Africa, which has weighed on these currencies’ trade balances and currencies.

- Conversely a number of non-commodity economies, including China, Korea, Singapore, and Poland, are riding the pick-up in global trade and recording strong export growth rates which has in particular provided support to the Singapore Dollar.

For the full research note, a free 30-day trail is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022