UK CPI is coming up at the bottom of the hour and brings with it some big trading risk

The key here is to know which way the market is leaning. The market is expecting a May hike so the bigger price risk is that CPI misses and knocks those expectations.

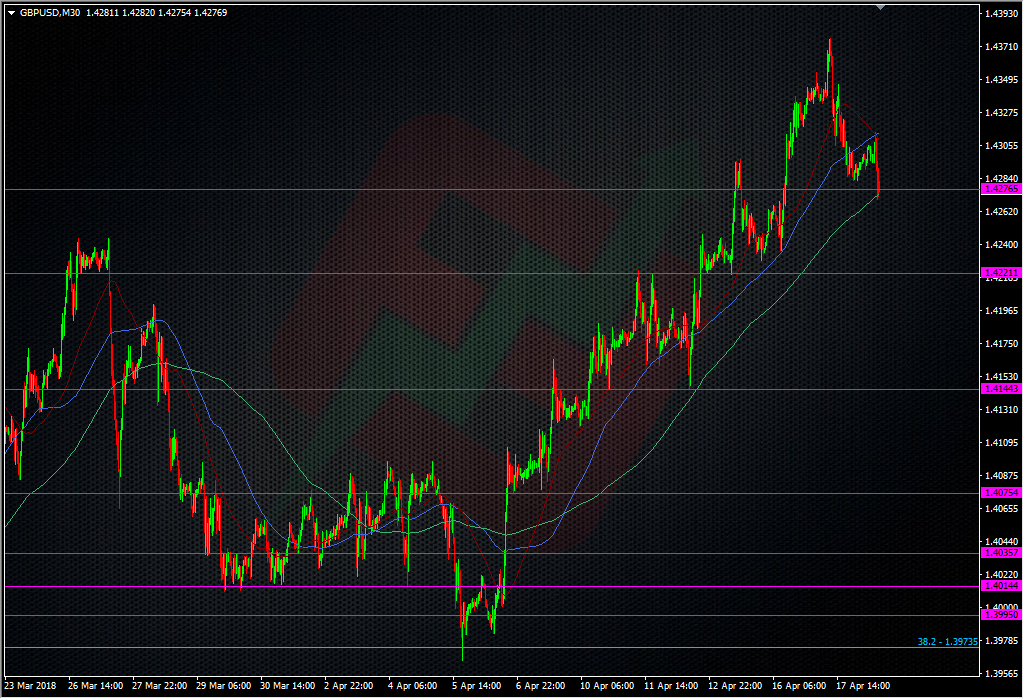

My usual rule of thumb is to look for a variation of 2pp or more +/- for the bigger price move but in this case, even a 1 pip miss on both CPI and core numbers will see the pound come off, but maybe not by that much. If the numbers are positive, we’re going to need to see whether we can have another run at the highs. Given the softness today already, seller might be lurking above 1.43 to hit any rallies.

Long and short, the bigger price move is more likely on a miss than a beat.

Levels wise, I see only minor support points at 1.4250 & 60 until a bigger one at 1.4220/30.

Also keep an eye on EURGBP as we may have an opportunity to see how the 0.8700 level plays out as that’s an area I wanted to short at.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022