Sometimes watching the price action is like watching a good film. EURCHF has a great plot and all the twists and turns of a Hollywood blockbuster

We’ve got a very interesting fight between buyers and sellers in EURCHF.

I learnt late last night that there was barrier action up at the big figure, and there were all sorts, from exotics to knock outs. We had our suspicions here at ForexFlow that such options existed but the info didn’t come to light until too late. That said, there’s a huge amount of selling still up around 1.20 and the buyers keep getting slapped down. They’re also picking themselves back up again to keep prodding. At some point something has to give, either the buyers win and properly break 1.20, or they give up and head to the exits, and we see a bigger drop. At the moment the sellers look like they just have a brick wall and they’re happy to sit there and keep supplying offers rather than trying to force the price lower. That smells of central bank messing but more on that in a bit. 1.2005 ws the latest high, and 1.1960/70 is where the buyers are regrouping.

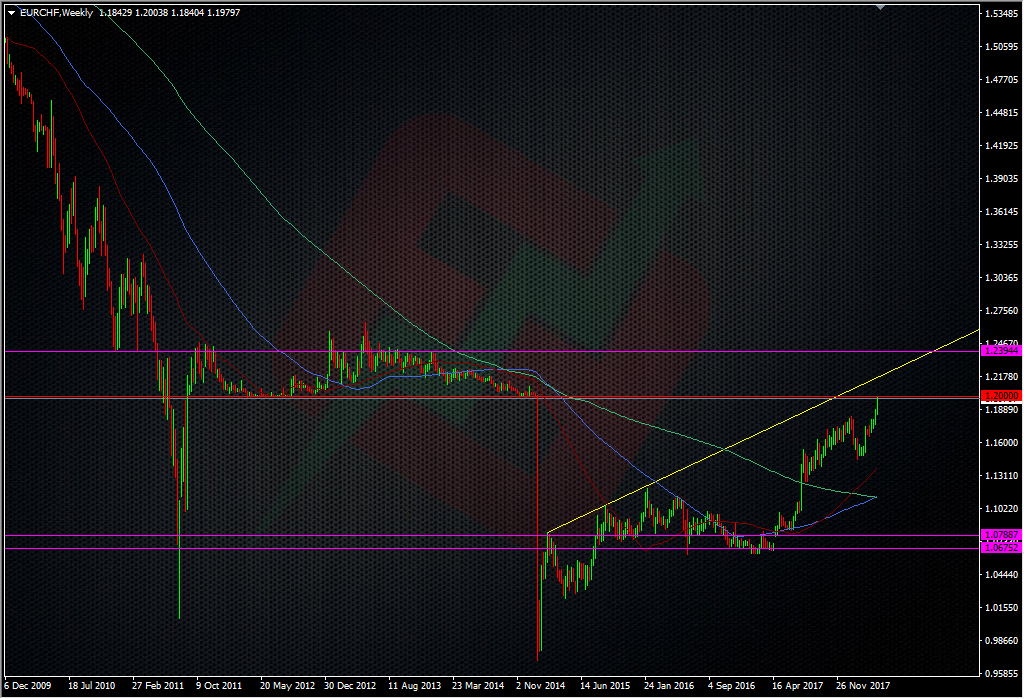

The wider technical picture is a bit more messy. Because of the prior cap put in by the SNB, the use of TA for that period is a bit flaky.

Trying to zoom in to that period and get a clear picture isn’t too easy, plus the market wasn’t really trading it technically at the time. Buyers lifted near 1.20 and sellers hit the rallies. There are some various levels that shown up purely as S&R points so I’m mainly sticking to those, and I’ll list a few here, just to keep note of;

- 1.2050

- 1.2100

- 1.2140

- 1.2240/50

- 1.2400

Those are just some standout levels, and maybe need a few pips room but keep them in mind.

So how do we trade a break?

With this 1.20 level being so big for so many reasons, we’re likely to see it become very solid support if it goes properly. That will become the line in the sand for longs, so a good place to look at longs on re-tests. Outside of that, the tech will have to develop, just like it has done for the last 3 years, so let the price action do it’s thing and watch for signals that new highs are developing, and the same for support. Let the picture be painted for you rather than trying to guess what it’s going to be.

Now, of course we may not break 1.20 and that will mean we head lower again.

That will bring the 1.18 area into play and where longs might look to park the bus .Again, we’ll have to let the picture develop. Above 1.1800/30 we have some action around 1.1880, and we can probably safely assume that 1.19 will hold some support too.

At the moment, I’m happy top play a buy stop still at 1.2010 but I’m going to look at tight shorts into 1.20 for today. Usually I’d be worried about so many tests of a level but the sell interest here looks very strong and with the weekend coming, the buyers may not want to be holding a big whack of CHF shorts in the current geo-political landscape over the weekend. I have a mind to too look at 1.1995/99 shorts with a tight stop at perhaps 1.2005 or 1.2010. I may even revise my buy stop a bit higher just to stay out of any noise. So, that’s a look at the trading side but what’s actually going on in the market?

We had some indepth discussions in the Live Room yesterday about what might possibly be going on up here. KMan thinks that one possible aspect is that the SNB is could or should be playing both sides of the fence and is using the run up to sell some of their prior EUR holdings but also diversifying into other pairs. One aspect is they roll out of EURCHF buys by selling other EUR pairs like EURUSD and EURGBP. Basically they’ll spread the EUR load into other currencies. But, they could also just be selling some EURCHF too so there’s less need to hold other currencies. I’m hoping he’ll pop into this post a little later to give us a bit more on that. It’s also obvious that the SNB would want EURCHF higher so they could just be sitting back and letting the market do its thing but perhaps could be lending a very small hand to the dips, and I mean very small but just enough to keep the buyers thinking they still have the ammo.

There’s lots of arguments and conjecture to be had and it does us no good to get bogged down too much in that. If you want the simplest view of all, we have 1 line (1.20) and either the price will go above, or it won’t, and so we trade it accordingly. Until we get to the end of this film, we have the ways and means to set our trades up with low risk so we can sit back and watch the show knowing we can catch whatever ending we may get. There’s no need to be a hero in trading, and the scars still run deep for some people, who traded this pair 3 years ago.

To get right to the heart of all the discussions among the ForexFlow traders and hear them first, sign up for a trials of our Live Trading room here.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

Great piece mate. I have a feeling there will be quite a few stops thus a sharp jump if 1.2010 goes. I have a buy stopb

In place for said blow.

Does it feel dirty for you too? ?

Just a tad! Trying returneth what Mr Jordan taketh!!

SNB setup as per experience: Main mandate with their interventions is to keep EURCHF from going down. SO they buy EURCHF but they don’t hold 100% EURO as there are diversification quota for foreign reserves ( https://www.snb.ch/en/iabout/assets/id/assets_reserves )

So basically (apart from that day in 2015) the mechanism is :

1. BUY EURCHF

2. SELL EURUSD

3. SELL EUR vs a basket of other currencies, GBP an JPY , although I thought they took some JPY off for CNY, a bit surprised JPY still at 7%.

So if and when they will be satisfied with the level of EURCHF and sell for take profit , they will need to “BUY” EURO crosses to keep their reserve basket at same weight, NOT sell as I read some comments. So clearly the move we’ve seen in EURUSD yesterday and today is not related to SNB taking profit but is a USD move (looking around USD stronger across the board) or some medium term long EUR money managers taking profit on EUR longs as EURCHF hit 1.20, possible. If anyone has ears on some walls, please don’t hesitate.

My take is SNB won’t want to be seen at 1.2000 selling EURCHF as the market would dump so there may be a case for it to rise a little further. But, using submarines and white label e-commerce accounts, they may start to give liquidity to further buyers, thinking about the Russian CHF selling after US put up sanctions, causing the EURCHF to jump from 1.18 to 1.20 in a few sessions for instance. In that case they would deflate the intervention amounts in their balance sheet and create some space in the books in case of need to support it again, let’s say from 1.1750 ish , where it held rock solid before the final jump. If for any obscure reason they would be visible sellers, it should actually put a bid under other EUR crosses as per above.

Last word about today’s price action , I’m taking to much of your time ..

Barriers and KO’s have been done as the high was 1.2005 but there must be loads of simple calls/puts been traded at 1.20. If that’s the case we may be entering a period of relative calm as the gamma longs will be more than happy to buy/sell 30/50 pips outside the 1.20 to repay for premiums paid and give liquidity to the gamma shorts not wanting to spunk away premiums received.

Vols may head south

Stay safe, happy hunting and karaoke on , it’s Friday !

Thanks, k, great stuff.