Be self-aware when planning trades

I’ve just been reflecting on my trading for the last few days and I’m conscious that my discipline might be slipping.

I don’t trade a lot. I’m a cautious trader by nature and probably talk myself out of more good trades than I actually put on. That’s my style. You won’t see me doing 10/20/30 trades a day. I like to pick my battles and squeeze every ounce of reasoning out as to why I should trade anything. Part of the reason for this post is because my last few trades have mainly ended up with my stops getting hit. Now, that’s not a problem in itself because I’m always prepared for losses before I event hit the button on any trade. Also, the trades that have lost have been small scalps on things like big figures and barriers, which have had very tight stops and are not damaging in the slightest, except to my morale.

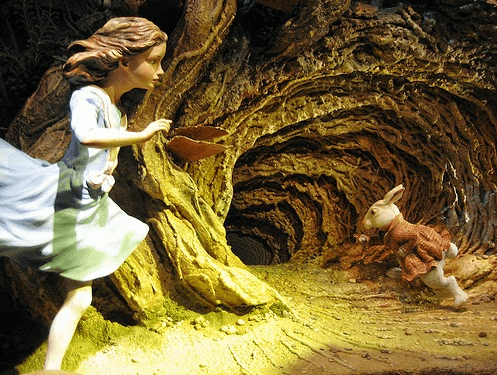

What’s got me thinking is that I’m getting very tied up in this US bond move, and that’s just getting me feeling like I’m trying to chase a potential pot of gold. I reversed into a USDJPY long at 109.10 after my shorts sub-109 failed, and I added at 109.12 when US 10’s were trading at 3% because I thought they were going to break. And therein lies the problem. I don’t like chasing trades and I’m finding that I’m getting caught up in some of these moves and starting to chase rabbits. That’s often not good for discipline nor account balances because you can find yourself buying tops and selling bottoms and constantly trying to reverse trades to catch what you’ve been wrong about previously.

If this USDJPY long goes against me then I’m taking that as a sign and I’m going to sit on my hands for a bit or get myself back on track with look at trading breaks the way I prefer. That means keeping patience in looking for either re-tests of broken support/resistance levels, or going with confirmed fresh breaks. I’m not out of my monetary comfort zone in this trade at all but I am out my discipline comfort zone a tad, so the fact I’m aware of that will give me the kick up the arse I need to rectify it.

All traders have different styles and systems and ways to deal with their own discipline. Some of the traders in our trading room are in and out of trades like a revolving door. As traders we all need to know and hone our own methods and make sure that we stick to them because going off track can be dangerous.

Get to know your own style and learn how to notice the signs when you’re slipping, and if necessary, stop trading and take a moment to think about what you’re doing.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

Don`t get married to ideas that just aren`t working at the time. The same ideas might start to work and bear fruits if you sit on your hands at the right times. Get divorced and then make up.when you`ve sorted it out . Just one of my little analogies 😉

Just as long as the divorce doesn’t cost you an arm and a leg eh? ?

Ah yes! That`s the great thing about getting divorced and then making up…you get your money back 🙂

Hahahaha

I can only say simple patterns along with logical S/R on the 4hr (Lazy Z, 1-2-3, Horizontal Breakouts) has changed my life in terms of both my results and my stress.

With the 20 EMA for direction, and the RSI just to see momentum, at this rate I’m well on my way to get back my 5K lost from last year

LOL!!

Good stuff Jack

That’s great to hear Jack and I hope you succeed in getting all that loss back and then some good profits. Don’t forget that even when you’re discipline is tight, you can still lose trades, so knowing how to deal with that is just as important. Taking your foot off the peddle for a bit or scaling down trade sizes is a great way to get through those moments when it’s not working no matter how solid your discipline is.

Yes sir, and your points are very well taken. I did anticipate any losses I incurred before I could be consistently profitable were, and are 😉 education costs.

I will say the part I WAY underestimated was the Psych that I tell my friends can literally destroy your mind LOL