Fixed Income Research & Macro Strategy (FIRMS) from Olivier Desbarres at 4X Global Research

- The go-to buzzword of “Policy normalisation” in developed economies refers to the reversal of monetary loosening policies introduced during the 2008 great financial crisis to avoid a global recession and deflation, including rate cuts and QE programs.

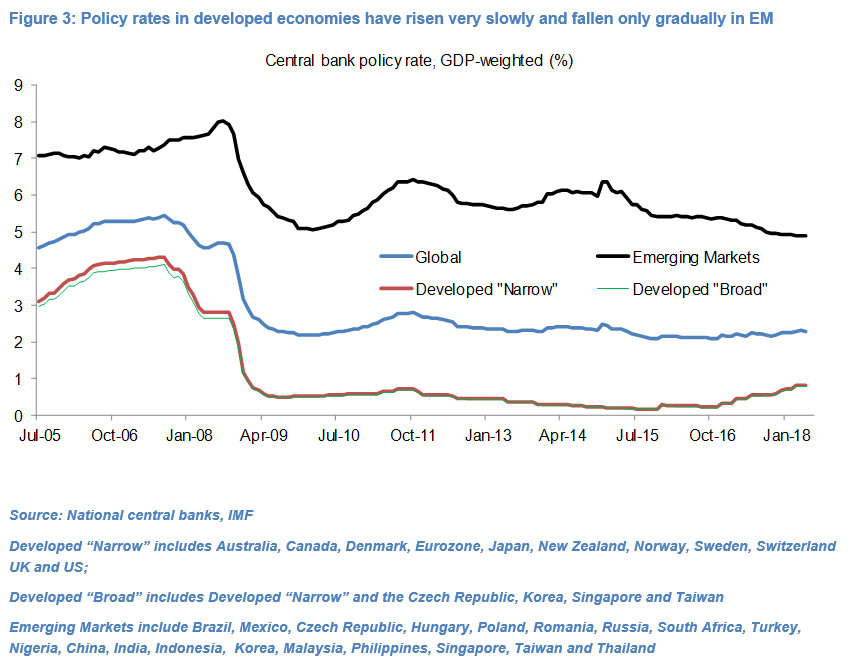

- In less advanced emerging economies it refers to a reversal of the monetary tightening policies introduced to support currencies under acute depreciation pressures.

- However, in developed economies this policy normalisation has so far proceeded at a very slow pace. A GDP-weighted central bank policy rate has only risen 60bp since October 2016 to about 0.8%, with the US unsurprisingly accounting for almost all of this rise.

- While global GDP growth has gradually accelerated in the past 18 months to about 3.8%, real wage growth remains modest and core CPI-inflation in developed economies has remained within a remarkably narrow range of about 1.2-1.7% year-on-year.

- We do not expect this pace of policy normalisation to pick up materially in coming months. The Federal Reserve will likely hike at least twice more before year-end and the Canadian and Norwegian central banks may each deliver one 25bp rate. But central bank policy rates in the Eurozone, Australia, New Zealand and Sweden are likely to remain on hold until 2019 and the ECB may well extend its QE program beyond September.

- The odds of the BoE hiking rates in H2 2018 are inextricably tied to the pace of economic growth in the context of the UK’s pending exit from the EU and are arguably still modest.

- In this scenario, the Dollar’s five-week old rally – which has stalled since 15th May – may extend a little further near-term while the Euro NEER may struggle to break out from its very narrow range. The Yen and Swiss Franc are unlikely to get much impetus from monetary policy but are at potentially attractive levels.

- Rising Dollar-funding costs, an appreciating Swiss Franc and a historically strong Euro increase emerging market economies’ foreign-currency debt servicing costs and are in turn likely to keep emerging market currencies under pressure for now, particularly in Latin America, Emerging Europe and Africa, in our view.

For the full research note, a free 30-day trail is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022