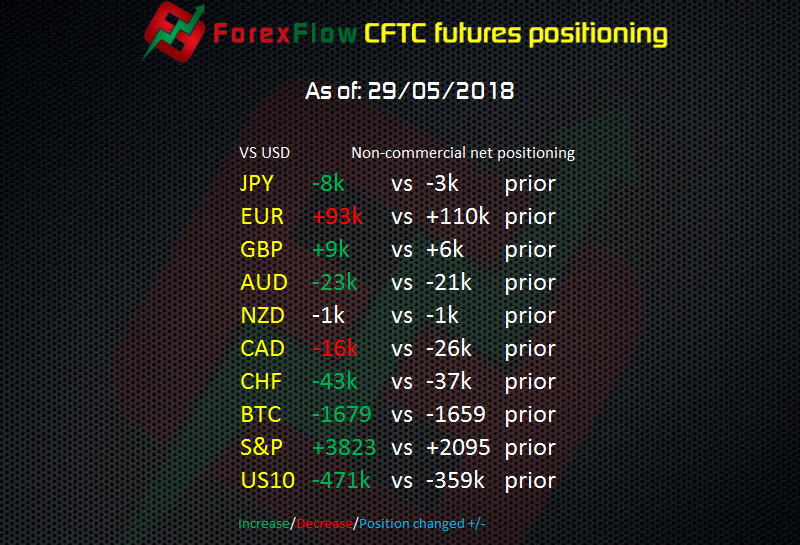

The Commitment of Traders net speculative positions report from the CFTC as of Tuesday 29 May 2018

- JPY -8k vs -3k prior

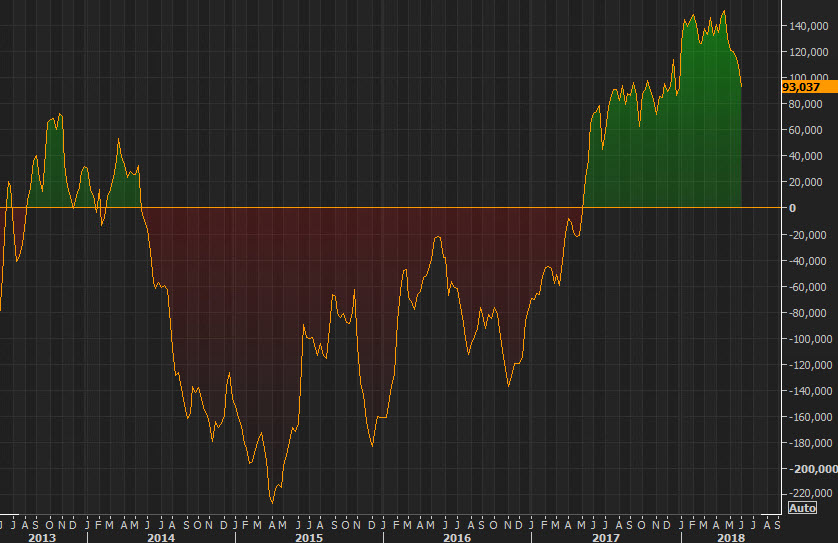

- EUR +93k vs +110k prior

- GBP +9k vs +6k prior

- AUD -23k vs -21k prior

- NZD -1k vs -1k prior

- CAD -16k vs -26k prior

- CHF -43k vs -37k prior

- BTC -1679 vs -1659 prior

- S&P 3823 vs 2095 prior

- US10 -471k vs -359k prior

The pain was too much for some Euro longs in a week that saw fresh lows, and around 15% closed up. CAD shorts lightened up, possibly with the BOC risk in mind, and they would have got it correct in part, though we’ve seen that move reverse.

Latest posts by Ryan Littlestone (see all)

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022