Here’s your trading guide to today’s Non-Farm payrolls report

I wonder how many people I hook going “WTF?” with that headline? 😉

For some reason, I haven’t got the same excitement for this report as I do most months. Maybe that’s because there’s so much geopolitical stuff being traded, the economic fundamentals have taken a bit of a back seat. The Fed is resolute in its hike path and although the market may have had some recent expectation wobbles, it’s still going to take some really really bad news to change the hike path. Outside of some immediate volatility, I can’t see the NFP bringing a big trending move today. But, as we learnt from the BOC this week, always expect the unexpected.

To the numbers;

- April NFP 164k

- NFP expectations: BBG 190k. Hi/lo 250k/150k. RTRS 188k. Hi/lo 250k/148k

- Average earnings y/y exp: BBG 2.6%. RTRS 2.7%. Prior 2.6%

- m/m 0.2% exp vs 0.1% prior

- Average hours 34.5 exp unch

- Unemployment rate 3.9% exp unch

- Participation rate 62.8 prior

- U6 underemployment 7.8% prior

- Private payrolls: BGG 190k exp. RTRS 183k exp. Prior 168k

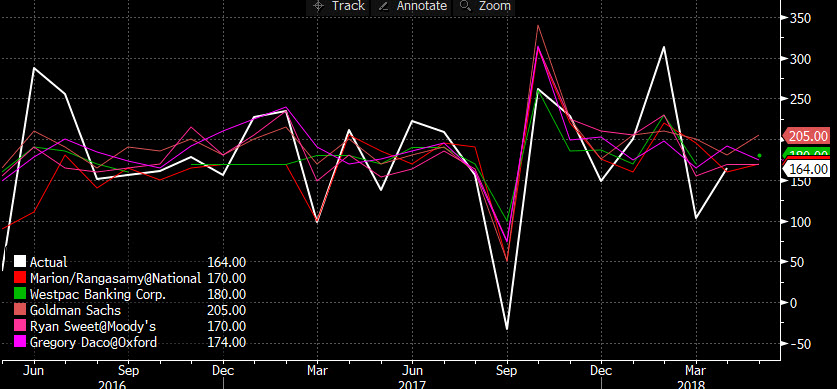

Here’s the top 5 NFP pickers as per BBG. Goldies is still up ther in 2nd place.

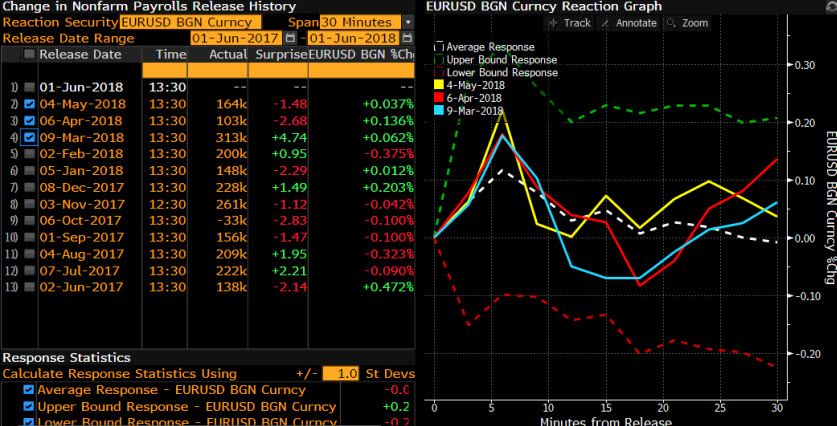

This month, I’ve taken a look at the reaction in EURUSD. It’s not looking too hot as the last 3 releases haven’t been that volatile over the first 30mins after release.

To trading it then.

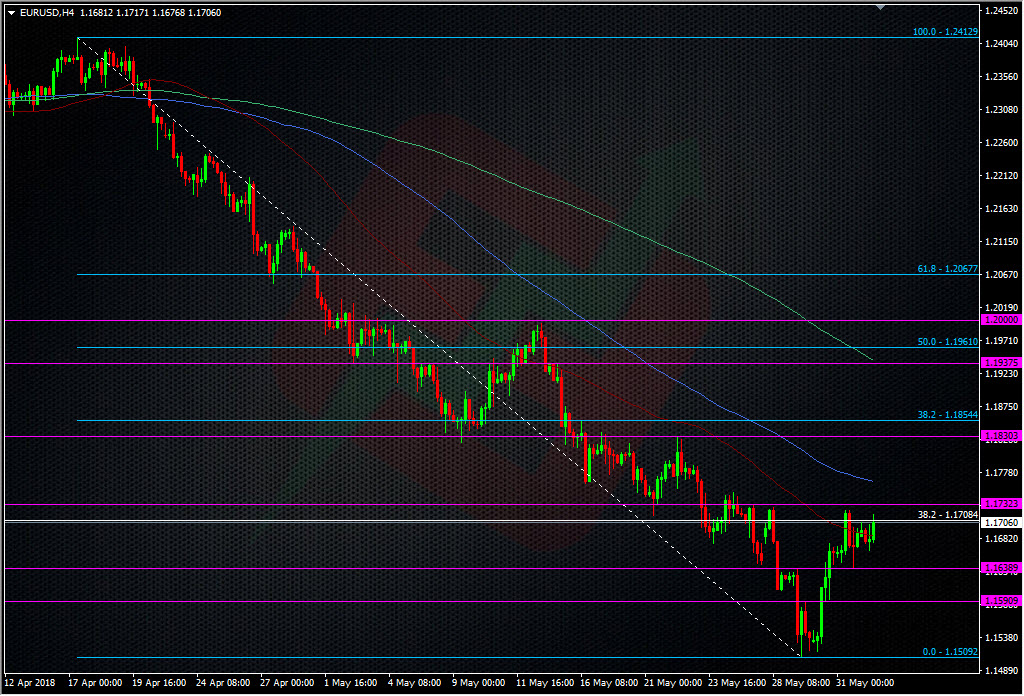

EURUSD is currently knocking around the area where we have a massive expiry. So far trading has been pretty slow and fairly tight. The Rajoy result was expected and the Euro hardly pulsed on the result. We could well have an opportunity to fade an NFP move if the price goes up because there’s 3bn’s worth of puts sitting at 1.1700 that someone folks would like to get paid out on if the price is below at expiry. However, looking closer at the trades themselves, there’s a total of 51 trades, and none of them are over 220m, so it doesn’t look like there’s one big holder but I can’t confirm that. Also, 1.02bn of these options we’re put on at the back end of 2017, so they could be well hedged out and are just going to expire without a fuss.

Still, the PA around the 1.1700 handle is indicative of options magnatism so perhaps we’ll see that happening again if the price has moved on the NFP.

Options aside, I’m really only going to look at trading the edges if we get any decent moves. That will be up to 1.1800/30/55, and down to 1.1635/40, 1.1600 and 1.1580/90.

As usual, wages will be the main talking point. Given the slight dip in market hike expectations, a decent beat could the dollar rally quite well today. Anything from 2.5% or less is going to cause more angst for the hike mob. The headline NFP is still going to be a lottery so if it is well out of whack check it against the wages and use them as the main guide to possible price action. A wages beat will likely trump a big NFP miss.

Don’t forget to enter out NFP compo to win a free 2 month pass to our live trading room. As it’s Friday, it’s karaoke day in the room so there’s plenty of tunes flying about with the trade talk.

Have fun, trade safe, and good luck.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022