Preview of the Bank of England June 2018 MPC meeting

I’ve got a bit of a problem. The market has put another target on the calendar for a BOE rate hike and this time it’s August. Not content with the arse whipping it got on its May expectations, it’s doing exactly the same thing (albeit to a lesser extent) in taking the language from the BOE and putting 2+2 together and getting 5. The BOE has been pretty straight forward, like it was late last year and early this year. “Rates might rise sooner than expected IF the economy improves”. Well guess what folks, it isn’t. Current growth of 0.1% isn’t hike material and so far, Q2 isn’t lighting any fires either. If we look at the large services sector, we reside two pips below the Dec read of 54.2 after all the weather related mess (that the ONS said had a marginal effect anyway). Growth back then was 0.4%. Manufacturing looked glum through April and the CBI data for May didn’t show an improvement, although it did for June. Overall, nothing that suggests that the economy will show a meaningful improvement in Q2.

In inflation, CPI and the core dipped again in May bringing it closer to target and yet another reason for the BOE to stay on hold. That can always change in a heartbeat, especially if energy prices keep rising and the pound keeps falling. That leaves the door open to some wild swings in inflation. Many folks say there’s a delay in the passthrough but trust me, petrol pump prices move with nearly the same speed as oil prices.Over this past week, I’ve seen pump prices from £1.39 to £1.49 a litre, near record highs.

Wages have held up ok as the jobs market continues to look solid, so that’s some crumbs of comfort. Throw that in with inflation though and again, I just can’t find a reason for the BOE to hike anytime soon.

So, there’s my problem with all these August hike calls. It all looks like hogwash. The market isn’t really heavily into an August hike though. Depending on your poison, Aug hike odds range from 32.3% (Rtrs) to 48.7% (BBG). The issue we face is how the market interprets the next lot of language from the BOE, and from that, August expectations will change accordingly. Even if the BOE are super hawkish today (but without actually saying that August is in the frame), I think the market is still over priced.

But, a lot can happen between now and August so maybe we’ll see 0.8% growth, 3.0%+ wages and 3.0% CPI. And maybe we’ll see England win the World Cup, and maybe my hair will grow back. You get where I’m going with this don’t you?

Just on today’s price action, I’d love to see a hawkish BOE and August expectations rise because that’s a potentially huge sell into August. The only fly in the ointment is Brexit, as usual. If I had to pick a trade for the August meeting, it would selling the quid into it if the expectations had ramped up significantly without the data backing it up. There’s no way I would position for August today with Brexit and everything else still hanging over us. I just can’t trust taking a long-term view in the quid still.

What about trading it today?

If we do get something hawkish that sends the quid higher, I might look to fade that move if the current market sentiment remains in place. A jump in cable would be out of sync with the theme of the day so I would look at a pure fade of that. I’ll be keeping a close eye on the yen crosses for a sentiment turn.

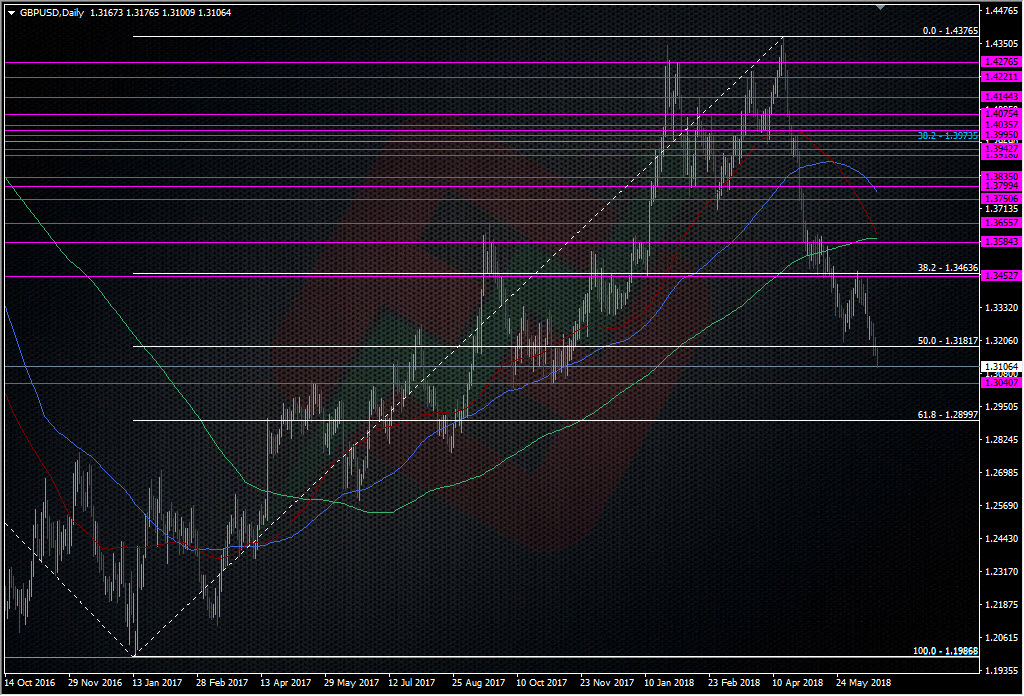

From here, into 1.3200/20 is the obvious area to look for a fade. If there’s anything dovish or not hawkish (there is a difference), then we’re likely to be under 1.31 (if we’re not already there by then anyway). In that situation, the 1.3040 level and then the 61.8 fib of the 2017 rally at 1.2900 look to be the bigger levels to look at purely from a technical basis.

There’s no presser, just the minutes/statement but the vote count is what matters today and whether there’s any changes. An unchanged 7-2 for holding rates is expected. One of those two looking for hikes is Ian McCafferty and he’s off after the Aug meeting so that’s another thing to consider later. If there’s any wobbles in those two (McCafferty has been known to change his mind quite frequently on occasion), then we can tip those August hopes into the bin, and the quid will drop as it gets priced out.

There should be something for everyone here today but trade safe and if it looks volatile, don’t guess, just sit out and wait until things are clearer. Good luck if you’re trading it.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

Nice one Ryan . I’m there, sell the rallies cable. 145.05 and 145.65 gbpjpy

great preview Ryan. Yes it could be a fade if it jumps above 1.32, depending on what Carney et al will say

Thanks for the summation Ryan. the question for me is will cable pull back at all??

Well balanced view Ryan, great stuff, except for one thing mate. The hair is a definite no 😉 OIS would stick 100% no on that one 😉

the biggest surprise to me here is 1.36 petrol prices :O I’m down on the Isle of Wight and it’s 1.17 on the supermarket forecourts, i suppose there has to be some positives living cut off from civilisation over here haha