What’s going to happen to GBP next?

Never a dull moment eh?

The quid is looking very weak but it’s not all of it’s own doing. The Brexit/political mess is obviously weighing heavily but we’re still seeing this re-allocation of currencies. Yen’s being bought, Swiss is being bought and EM’s are dropping. Once again there’s a lot of moving parts and no single main driver.

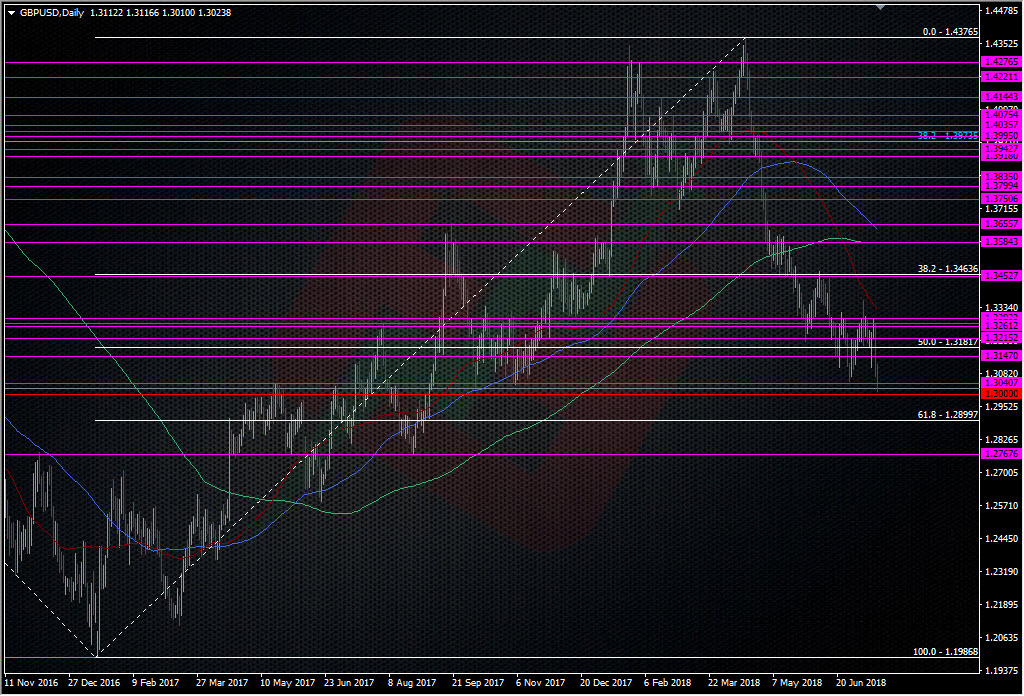

1.3000 marks a big level here. We’ve got a big barrier and it’s a big psychological level. I’ve been itching to catch a scalp long ahead of the barrier but with the price action looking very soggy, a move down to the big figure might spell trouble. Right here and now the 1.3020 level could be pivotal as a move and hold under would bring a test of 1.30.

In the bigger picture, a break is likely to take us down to the 61.8 fib of the 2017 swing up, and much further, with 1.2760/70 being the next big level.

So, I’m in two minds. I want to trade the 1.30 level for what’s there but the PA is warning me not to. What I have done though is place a sell stop entry at 1.2990 to try and grab a break. I may still try a long but it will be super tight to 1.30 and very tight on a stop, 5/10 pips max.

If we do find a bottom here, it could be quite a strong one. In that scenario, look for resistance into 1.3100 then a retrace to perhaps the 1.3040/50 area. If that holds then we’ll have that ‘stepping up’ pattern I watch for after big moves and 1.30 will solidfy further as a bottom. But, before that, the 1.3040/50 area is the level we need to get above to relieve some of this bearish pressure.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

Agree 100%