Miyamoto Musashi’s ‘The Book of Five Rings’ on strategy of Japanese swordplay is one of the best books on trading I’ve ever read

While on my break, I did a lot of reading and when searching for some books I came across this one, ‘The Book of Five Rings’ by Miyamoto Musashi, translated from his texts on Japanese Kenjutsu from 1645. I wasn’t expecting any trading connections but in the first few pages I couldn’t help but match his words on his martial arts and strategy to what we seek to do every day in markets. I can see why this book has been used for lessons in business. It’s short but worth a read. I read the Thomas Cleary translated version. Here’s a selection of text that stood out.

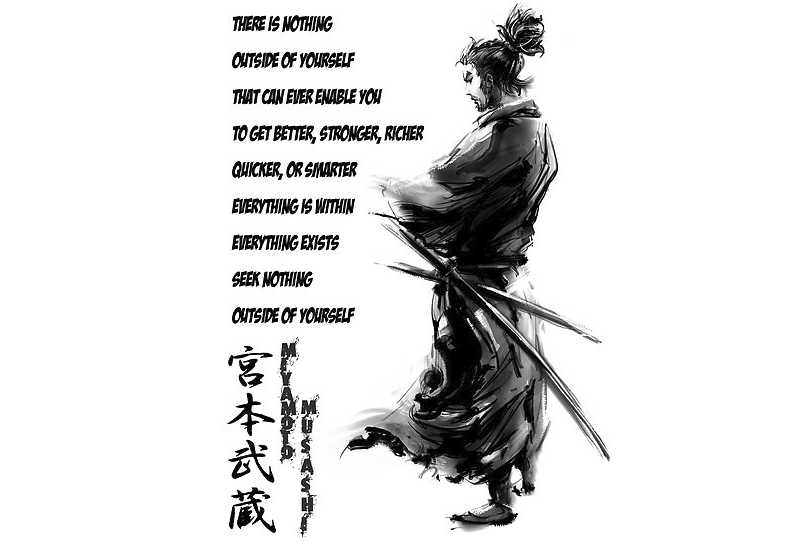

Miyamoto Musashi (宮本 武蔵, c. 1584 – June 13, 1645), also known as Shinmen Takezō, Miyamoto Bennosuke or, by his Buddhist name, Niten Dōraku, was an expert Japanese swordsman and rōnin. Musashi, as he was often simply known, became renowned through stories of his excellent swordsmanship in numerous duels, even from a very young age. He was the founder of the Hyōhō Niten Ichi-ryū or Niten-ryū style of swordsmanship and the author of The Book of Five Rings (五輪の書 Go Rin No Sho), a book on strategy, tactics, and philosophy that is still studied today.

There is no warrior in the world today who really understands the Way of strategy.

The same applies to every trader. We all find our niche within the many strategies and we all achieve various levels of success. There is never one strategy that works every single time.

It is said the warrior’s is the twofold Way of pen and sword, and he should have a taste for both Ways. Even if a man has no natural ability he can be a warrior by sticking assiduously to both divisions of the Way.

Trading is about learning how to read markets and learning to have discipline. That’s why anyone can learn to trade but few learn how to trade properly.

Generally speaking, the Way of the warrior is resolute acceptance of death.

One of the most standout lines in the book. If we can’t learn to accept that we will lose, we can’t learn how to deal with defeat (nor minimise it) when it happens.

You should not have a favourite weapon. To become over-familiar with one weapon is as much a fault as not knowing it sufficiently well.

This applies to technical analysis. Don’t be too quick to dismiss what’s happening with other indicators, nor become too blinkered with one time frame. There are many different stories happening on every time frame and they may match up to strengthen your thinking, or give you a reason why you shouldn’t take a trade you were looking at.

To all Ways there are side-tracks. If you study a Way daily, and your spirit diverges, you may think you are obeying a good Way but objectively it is not the true Way. If you are following the true way and diverge a little, this will later become a large divergence. You must realise this.

A nod to discipline. It’s hard to achieve and even harder to maintain. You need to know when it’s slipping or you lose your focus and your losses will increase. We’ve all been there and when it happens, sometime’s the best thing is to stop (or lessen) trading and refocus on getting the discipline back.

The Way of strategy is the Way of nature. When you appreciate the power of nature, knowing rhythm of any situation, you will be able to hit the enemy naturally and strike naturally.

How many times do you blame the “big boys” for market moves or nefarious market forces hunting your stops? If you know and understand how the market works (the Way of nature) then you should learn how to trade it within those conditions. If you place your stops where everyone else has them, don’t complain if they get hunted and tripped.

In short, the Way of the Ichi school is the spirit of winning, whatever the weapon and whatever its size.

When I set out to trade my first thought is not about winning, it’s about how not to lose. Winning can mean many things in trading. If I don’t like the price action and I take a small loss instead of leaving it to my stop that was further away, that can seem like a win if I acted correctly and my stop would have been hit. Conversely, if I take a small profit well ahead of my original target because I don’t like the PA, that’s still a win, even if the price went on to hit my target. It’s an even better win if it didn’t and would have gone on to hit my stop. Even taking a solitary pip by having a stop set one pip into a profitable trade is a monetary and psychological win. Don’t focus on amounts, focus on getting it right more than you get it wrong.

Every trade is different and every price move is different but even so, you can find patterns and moves that happen regularly. If you know this you can build a mental checklist of particular moves so that when you see an an opportunity, you can see (and plan for) many different outcomes. Take my strategy of trading big figures. I only usually like trading them when they’ve not been touched for a long time, I know the possible outcomes of where the protection will start, where the stops might be sitting, what might happen if we just see a stop run or whether it’s something more, where the price may hit trouble if I get the trade right. From one thing, I know many. Always try and plan for as many outcomes to your trades as possible.

The Way of the warrior does not include other Ways, such as Confucianism, Buddhism, certain traditions, artistic accomplishments and dancing. But even though these are not part of the Way, if you know the Way broadly you will see it in everything. Men must polish their particular Way.

There are many types of traders and while we must find our own particular way, we shouldn’t ignore all the other ways. A purely technical trader can’t ignore the fundamentals. That doesn’t mean that traders needs a degree in economics but merely understanding the simple factors like what a central bank or economy is doing can help you when you apply the tech to your trades. Would you trust a one day old fib on a 10 minute chart 5 minutes before NFP? That’s understanding the tech and the fundamentals.

Timing in strategy. There is timing in everything. Timing in strategy cannot be mastered without a great deal of practice.

The bane of many a trader, myself included. I have a weakness in going to early on some of my longer-term trades. No matter how much I try and hold myself back, I always get that pull of the ‘fear of missing out’, leading to me going too early. I’ve found that it mainly only happens in my first trade (if I’m scaling into something). After the first, I have more patience to wait for my other entries.

The Way is in training. Become acquainted with every art. Know the Ways of all professions. Distinguish between gain and loss in worldly matters. Develop intuitive judgement and understanding for everything. Perceive those things which cannot be seen. Pay attention even to trifles. Do nothing which is of no use.

This is all about experience. You can’t buy it, you can’t swallow it in pill form and you can’t take shortcuts with it. You can learn from others but unless you apply what you learn and hone it to your own ways, you can’t build your own positive experiences that overcome the negative experiences. Learn from the right people but do not just copy, you have to understand how they and their strategies work. If a way isn’t working, stop. Know why you want to trade and set reasonable targets for your self and your life. Every trade shouldn’t be a lottery win. Learn what would make a significant difference to your income. I’d wager it’s a lot less than you imagine.

It is important to start by setting these broad principles in your heart, and train in the Way of strategy. If you do not look at things on a large scale it will be difficult for you to master strategy. More than anything to start with you must set your heart on strategy and earnestly stick to the Way.

This one speaks for itself.

There is no blaming others in trading. We are the ones who push the buy and sell buttons. We are the ones who set profit and stop levels (or not in some cases). The buck stops with us and no one else so it’s up to us to learn the right ways from the wrong ways and to stick to that path. If we don’t, we lose, it’s as simple as that. Forget luck. It can happen but it’s not a trading strategy. Forget hope. If you have to hope for a trade, you’re not trading properly. Keep learning every single day until you find your “Way”.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

r u going to study candle stick and cloud too? ?

Candlesticks and clouds don’t make for good weapons 😉

Yet a pin bar in the double bottom can be painful ..

Confucius .

I suspect this book to be on the shelf of many of the biggest asset managers and macro hedge fund traders.

You have been busy Ryan over you hols.Very good analogies given.Combat with an opponent is using every advantage you have (skill set,discipline,experience and psychology)Sounds just like trading!!!

If you mean busy sitting by the pool with one eye in a book and the other on the kids, then yes, I’ve been busy 😉

Afternoon Ryan well you must have had a riveting hol mate 🙂 but seriously great thoughts and comparisons to trading. On a lighter note and in this spirt here is our rumoured new goalkeeper in action Ryan ,atvb Chris

https://www.youtube.com/watch?v=3-xVglD_dkk

Hi Chris.

I’m getting optimistic about the new season. I’m sure that will be burst after Sunday 😀

Hi Ryan me too ,could be good :). Anfield is not the ideal start but if the new manager/players hit the ground running sky the limit, atvb Chris