July 2018 Canada CPI inflation data 17 August 2018

- Prior 2.5%

- 0.5% vs 0.1% exp m/m. Prior 0.1%

- CPI common 1.9% vs 1.9% exp. Prior 1.9%

- CPI median 2.0% vs 2.0% prior

- CPI trim 2.1% vs 2.0% prior

- BOC core 1.6% vs 1.3% prior

- 0.2% vs 0.1% prior m/m

Big jump in inflation on the headline and BOC core. Possibly trade war related as prices rise. Will look into the dets. USDCAD hits a low of 1.3073.

From StatsCan;

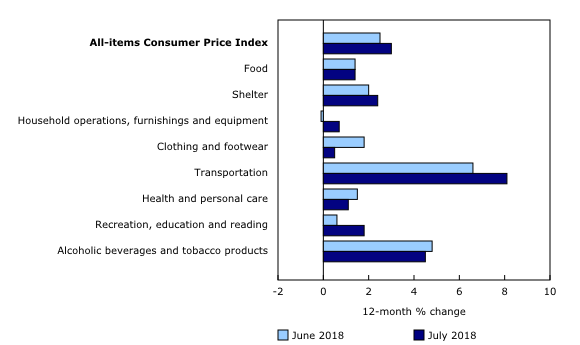

All eight major components rose year over year in July. The transportation index (+8.1%) was the largest contributor to the year-over-year increase.

Energy costs were 14.2% higher compared with July 2017, after increasing 12.4% year over year in June. Consumer prices for gasoline (+25.4%) and fuel oil and other fuels (+28.1%) continued to increase on a year-over-year basis, amid rising global prices for crude oil following recent supply disruptions.

Consumer prices for transportation rose 8.1% in July, following a 6.6% increase in June. In addition to gasoline, the purchase of passenger vehicles index rose more on a year-over-year basis in July (+2.0%) than it did in June (+1.8%). Prices for passenger vehicle insurance premiums were 3.5% higher compared with July 2017, following rate increases in several provinces.

Year-over-year gains in the price of services were higher in July (+3.2%) than in June (+2.2%). Month-over-month increases in the air transportation index (+16.4%) and the travel tours index (+13.9%) reflected higher prices during peak travel season. Prices for telephone services increased 2.2% on a month-over-month basis following declines in May and June, when a series of industry-wide price promotions took place. Recent interest rate increases continued to impact the mortgage interest cost index, which rose 5.2% in the 12 months to July.

Nothing much in the way of explanation. Transport costs up, energy up. If it was purely down to trade related price rises then that’s not something the BOC could really counter with a rate move. This doesn’t look like that so could lead to a more hawkish BOC.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022