Fixed Income Research & Macro Strategy (FIRMS) from Olivier Desbarres at 4X Global Research 17 August 2018

- Since 5th August the Turkish Lira is down about 17% versus the Dollar and 15% in nominal effective exchange rate (NEER) terms and the concern remains that any further Lira depreciation will again spread to other high-yielding emerging market currencies.

- Conversely, recent precedent suggests that renewed Lira weakness would result in FX flows to traditional safe-haven currencies – the Japanese Yen and Swiss Franc – but also to a Dollar now trading like a de-facto safe-haven currency given its status of a developed-market currency backed by a relatively high yield and fast-growing economy.

- Fears of contagion, however, have been overdone in our view. For starters, global FX volatility remains in line with its historical average.

- Moreover, the Lira had shed almost a third of its value between mid-September 2017 and 5th August 2018 and yet the Euro NEER gained nearly 4% suggesting that markets were (rightly in our view) not overly concerned about Eurozone banks’ exposure to Turkey.

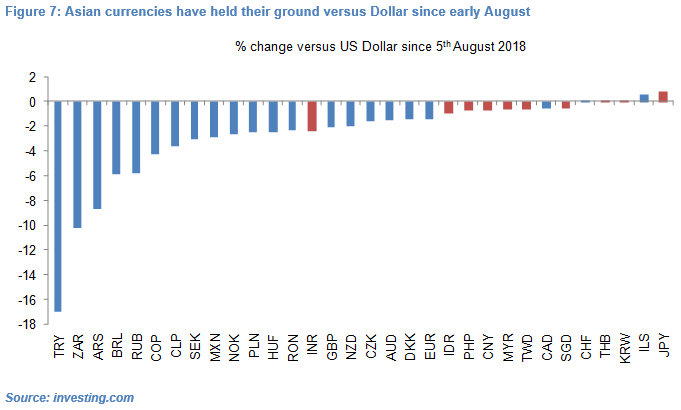

- Third, while there has clearly been a degree of contagion from the Lira towards other emerging market currencies it has largely been confined to currencies which had already been under pressure due to a combination of domestic economic and political challenges. These include other high-yielding emerging market currencies and to a lesser extent Central European currencies and Swedish Krona.

- Conversely, non-Japan Asian (NJA) currencies have proved reasonably resilient to both Chinese Renminbi weakness and the Lira’s collapse, thanks to NJA economies’ stronger macro fundamentals and NJA central banks’ greater inflation-targeting credentials and willingness to support their currencies via tighter monetary policy.

- Finally, NJA currencies may have recently benefited from the Renminbi’s relative stability, which would tie in with our view that “the People’s Bank of China may temporarily change tact, at least in the near-term, and use a carrot rather than stick approach to turn US President Trump around” (see Central Banks’ Guns & Roses (and inaction), 26 July 2018

For the full research note, a free 30-day trail is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022