Fixed Income Research & Macro Strategy (FIRMS) from 4X Global Research

- In principle, the United Kingdom (UK) will officially cease to be a member of the European Union (EU) on 29th March 2019, regardless of whether:

1. The UK and EU reach agreement on the terms and conditions of the UK’s exit from the EU (the “Withdrawal Agreement”) and importantly of the UK’s new deal with the EU and;

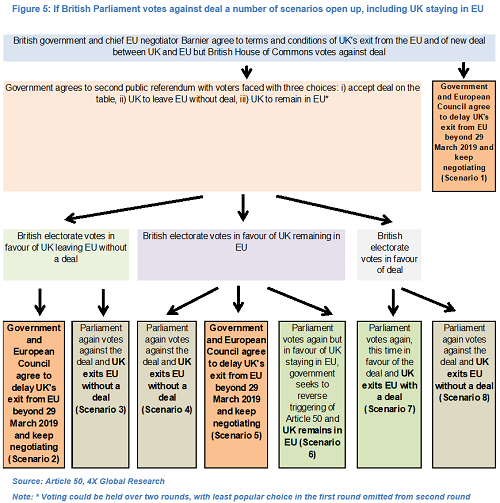

2. The British and European parliaments vote in favour of this new deal in votes likely to be held in November. - In practise, however, we think there are a number of possible scenarios whereby the UK would remain an EU member for the foreseeable future.

- For starters, the UK and EU could fail to agree on a post-Brexit deal. The British government will be reluctant to materially water down the already unpopular proposal which it put forward on 12th July while the EU will be wary of offering a deal which incentivises other member states to leave the EU on better terms and conditions.

- Moreover, there has been vocal opposition to this deal in the UK, from both Remainers and Brexiters. While parliamentary arithmetics are complex, a majority of House of Commons members could vote against such a deal.

- In this scenario, an already weakened Prime Minister May and Conservative government short of a parliamentary majority could put political survival ahead of ideology and hold a second referendum – a path backed by a majority of British voters and trade unions and by a growing number of MPs across the political spectrum.

- Opinion polls suggest that British voters favour the UK remaining in the EU over leaving the EU without and in particular with a deal. In this scenario, the British government could, with the EU’s blessing, seek to reverse its decision to take the UK out of the EU which would likely have a material impact on UK yields, equities and in particular Sterling.

- At the very least a turn of events regarded as very unlikely before the summer is now at least within the realms of the feasible, in our view

For the full research note, a free 30-day trail is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022