I’m entering a trade with a view of running it into the BOC

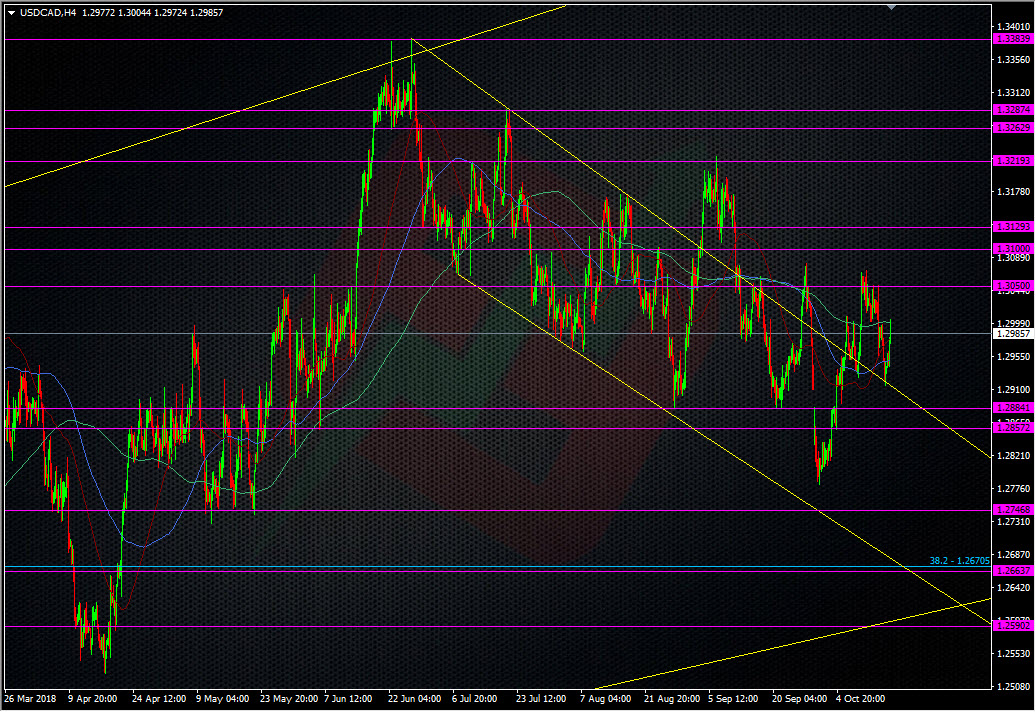

I’ve been eyeing a short USDCAD strategy into the BOC for the best part of October so far. What’s held me back is that I didn’t want to have a big gap between entering and the BOC but that risked missing better price levels or missing it altogether. While it dropped to the low 1.29’s this week, I thought I might have missed out. This run up to 1.30 might be the just the opportunity I’ve been looking for so I’m scaling into a short. I’m in at 1.2997 and will add if it goes higher. I’ve got a disaster stop in at 1.33, just in case Canada falls into a firery hole before the 24th.

Technically, the top of the down channel has played its part in support and the 1.3050, 70/80 levels is where I’d look to add next.

I’m planning on two things really, to catch some CAD expectation buying closer to the BOC meeting, which will then give me some margin to lock in, then for any kneejerk move on the announcement or further hawkishness from Poloz. Even without the BOC factor, again technically, shorts up into 1.31/1.32 look good. With NAFTA deals and a hiking BOC, I want to lean the same way as the fundamentals, which point to CAD strength more than weakness.

There’s a long way to go so until we get closer to the BOC, I’ll be watching and trading it the same as I would any other trade, and keeping aware if there’s anything game changing that would get me bailing early.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

doesn’t it look like the back test of the channel was the buying point? we just legalized weed so raising rates wouldn’t be a good idea ~sarc

It sure does but I had no real interest in selling CAD into a rate meeting 😉

Maybe Poloz will be on the weed and stop waving his hands around so much 😀