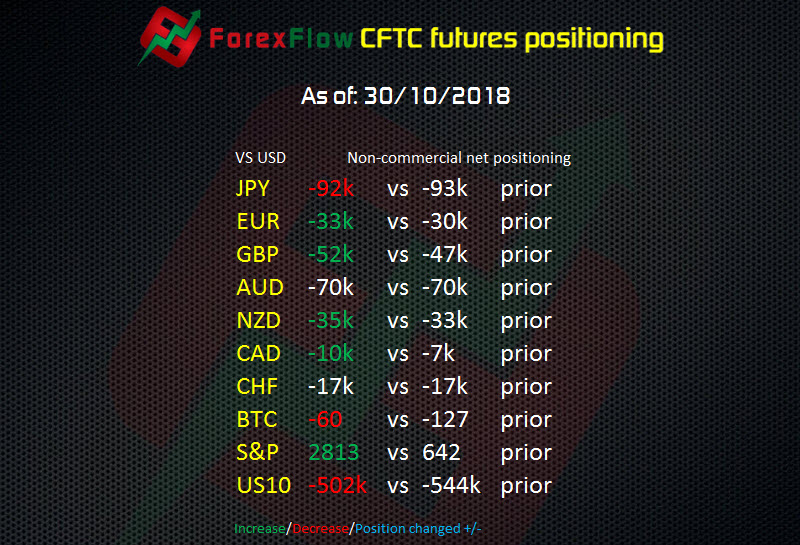

The Commitment of Traders net speculative positions report from the CFTC as of Tuesday 30 October 2018

- JPY -92k vs -93k prior

- EUR -33k vs -30k prior

- GBP -52k vs -47k prior

- AUD -70k vs -70k prior

- NZD -35k vs -33k prior

- CAD -10k vs -7k prior

- CHF -17k vs -17k prior

- BTC -60 vs -127 prior

- S&P 2813 vs 642 prior

- US10 -502k vs -544k prior

USD longs had added a bit more vs most currencies as of Tuesday but those extra cable shorts took a slap on fresh Brexit news. Bitcoin shorts have slowly been decreasing and now there’s just net 60 shorts. S&P futures traders haven’t known which way to go in the stock market turmoil lately but they added to longs from last week.

Latest posts by Ryan Littlestone (see all)

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022