Do you want to raise your trading A-game?

Trading is tough. Every trade a retail trader takes is a leap of faith. It’s a leap of faith as to whether a technical level holds or whether the price goes in our favour. It’s a leap of faith whether you’ve been trading 3 days or 30 years. When we hit the buy or sell button we instantly lose control over what the price will do with our trade.

Here’s five simple ways you can improve your trading and retain control.

- Use stop losses

The single most control you can ever have over a trade is governing how much you’re willing to lose. When you buy or sell you are taking that leap of faith. What the price does is completely out of your control. The only thing you can control is your possible loss. It’s a trader’s aim to not lose money, or to lose as little as possible. So, don’t trade without a stop loss, even if it’s what I call a “disaster stop”. That’s a stop I put in if I’m not sure about the best place for a stop, or I’m building a position or leaving room on a trade overnight. I will always have a stop somewhere to cover any surprises.

If you don’t use a stop loss, you’re giving up the only part of your trade you have the ultimate control over.

- Define your trading levels

Sounds easy eh? Pick a level and trade it. If only it were that simple. Finding levels is easy. Finding the levels that will give you a good trade is harder. If it were that easy, we’d all be sitting on our yachts spending our winnings, not trading. Choosing which levels we should trade and which ones we should leave alone is very difficult. It takes time, it takes work and it’s often confusing and unclear. We want to pick the strongest looking levels so try and find reasons why a level won’t work. If you have one level with 6 reasons not to trade it and one level with 2 reasons, the latter is potentially the stronger one to trade.

Define as many levels as you want then weed out the weaker ones until you’re left with those you feel more confident in trading. Will they work every time? Nope but then that’s why refer back to lesson 1 above.

- Understand the market conditions before trading

You’ve defined your levels but what about the market conditions. Let’s say we’ve picked a level on a 30-minute chart you want to trade. It’s a strong support point you want to trade against. You’ve been waiting for a move there to trade it. The price then moves close but then you look at the clock and the data calendar, and it’s half an hour until the NFP. Are you still going to trust that level and that trade into something like the NFP?

You may be a purely technical trader who doesn’t give two hoots about fundamentals. You may not even understand economic data. However, you know the NFP is a big event and you know it can be volatile. If you know the market conditions for that event, you can choose to leave the trade alone until the event has passed. Or, you move on to another trade and/or go back to lesson 2, ‘Defining trading levels’. If you still want to trade it, protect yourself by referring to (guess what?) lesson number one.

- Use the best information for trading, and use it correctly

There are thousands of news outlets, websites, tweeters, tv stations, web videos and commentators offering news and analysis on trading and markets. Everyone has an opinion and a view. 99% of it is meaningless. But, finding that 1% that isn’t is hard, but using it to trade is.

I read and listen to hundreds of headlines, opinions and analysis every day and from experience I can know within a second or two whether the information means a trade or not. I’m conditioned to read and react, and as I say, 99% of it flows through without a second thought, if it’s not tradable.

How you find and use your information is important. Don’t agree with analysis just because it sounds smarter than something you could think of. Don’t just follow opinions just because they fit in with your ideas. Don’t also dismiss ideas and views that don’t fit in with yours as they may alert you to something you hadn’t thought of. Question everything and what it might mean for your trading. Just because someone is sitting on a website all day writing about markets, doesn’t automatically make them smart or the best trader in the world, and I fully include myself in that bracket too.

Understanding the information flow and analysis is hugely important. My opinion might not be your opinion. Both of us might be right but we can also both be equally wrong. Don’t lie to yourself that a trade is good when a headline tells you something that makes you and your trade wrong. Use the information you get to see if there’s something you’ve missed, or something that can make the difference between your trade winning or a losing.

- Don’t trade alone

Many retail traders think they are alone with their fears, their mistakes, their lack of experience and not knowing how to find the light at the end of the trading tunnel. YOU ARE NOT ALONE! In my long years trading I have heard the same things from hundreds of traders. The questions are all the same, the indecisions are all the same, the fears are all the same, the lack of experience is all the same. Many traders think they are the only ones who have those questions and fears. Those feelings you have, we all have. They never go away, we just learn to deal with them better the more experienced we get.

Finding other traders to share those feelings and questions with does two very important things. It shows we are not alone and it helps us to deal with our demons. Being able to ask a question, or air one’s fears can unlock the answers we need. It allows us to receive help from someone who has been in our shoes, and it cements and strengthens our own knowledge if we offer something we’ve learnt to someone who hasn’t. It’s a circle of positivity that feeds on itself.

I know first hand how a community helps. There have been times I’ve been off my trading game, and talking it out with my fellow traders helped me strengthen my resolve by identifying exactly what had been bothering me. That doesn’t mean I won’t ever lose a trade again but it does stop the emotions of being wrong from building and leading to even worse outcomes. Identifying what you’re doing wrong is the first step to be able to put things right, and that comes about through talking it over with others.

So, there’s your five simple, easy ways to improve your trading. Now you can all go off with those lessons and instantly become better traders than you were before reading this, can’t you?

Absolute rubbish. Those 5 lessons are very simple things but what’s not simple is putting them into practice on a consistent basis. I’ve been trading for many years and yet, from time to time, I still fail at keeping to those lessons. Where I have succeeded is that the times I’ve failed have become more infrequent. I’ve grown with experience, learnt from mine, and other’s mistakes. Has it made me the best trader in the world? Not in the slightest but it’s helped me have far more winning trades than losing ones, and if we all get to that point, we’ll have nothing to worry about.

My last lesson to you is to offer you the chance to become a better trader.

For more than two years I’ve been developing a community platform for traders. It’s a platform that brings you the right news and analysis from inside and outside the market. It strives to bring you the 1% of information that might actually be tradable. The platform also brings you the tools to help with your trading and put you one step ahead of the crowd. It levels the playing field between the big boys and the retail trader.

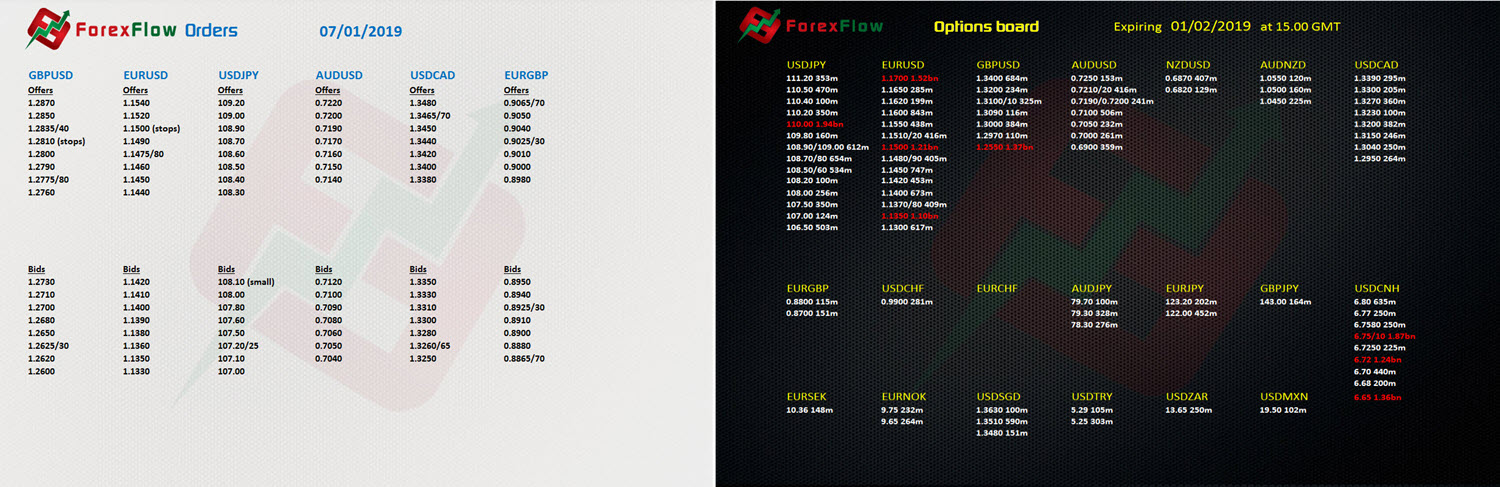

We have dedicated rooms for learning, trading and community-only market information like enhanced forex orders and options.

But, far more importantly, it’s a place where the lessons above are taught and enforced every single day. They are enforced by a single comment or piece of advice, or detailed in a longer discussion. It’s a community that actively helps each other, creating that positive feedback loop. It’s where traders are encouraged so they are not afraid to ask a question because they’re shy or embarrassed that they might be the first one to ever ask it.

What’s really special about our platform is that it binds traders of all levels of experience and knowledge together in a fun and friendly environment. It’s where trade ideas are shared and discussed, and advice and opinions are offered. There is no hierarchy or competition in the platform. We are all there for the same reasons, to succeed as best we can at trading. The community shares the joys of traders who have winning trades, and more importantly, offers a strong support network when things don’t go to plan.

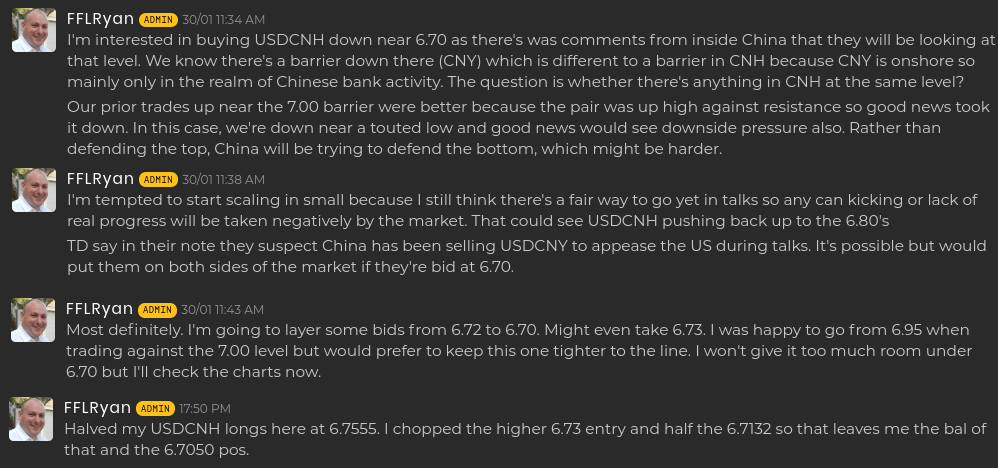

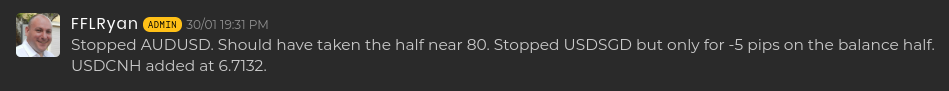

The traders in the platform record their trades and strategies live. There’s no hindsight trading or trading after the fact. Here’s an example of a live trade done this week and some profit taken today (1 Feb 2019).

There’s no hiding either. Honesty is at the forefront of our community so we hear about the bad trades as well as the good.

The platform has been running for several months now and is going from strength to strength. Over the last few months I have seen traders who have suffered from inexperience and making all the rookie mistakes, turn into far more accomplished traders. They’ve put in the work and heeded the advice offered from more experienced traders and the community in general, and they’ve developed their discipline so that they now make the mistakes less and less. They’ve grown to understand how the market really works and how to accept being wrong. I get great pleasure watching these traders see the pieces of the puzzle falling into place and looking at markets and trading with the same discipline the more experienced traders use. I’m also proud to play a small part in that and be part of a community that wants to help others.

So, if you’re seeking advice on how to improve as a trader, or want to be in an environment that will help with areas you struggle with, or whether you just want to mix with experienced traders to chat and bounce ideas around with, or whether you want some of the best trading tools and information in the forex world, the ForexFlow Platform is the right place to get it.

Right now you can take advantage of a 20% discount for two months.

For further information on the ForexFlow Platform, follow this link but also feel free to contact us with any questions you might have about our platform and services, either in the comments below or via our contact page.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022