Last night’s impressive jobs data has lit the fuse for expectations of a more hawkish RBNZ

A 1.1% jump in employment vs an expected 0.5% jump, and a drop in the unemployment rate to 3.9% vs 4.5% prior gave the kiwi a big lift last night. That theme has stayed in place today as USD weakness adds to the move. The market is now looking for a more hawkish, or at least, a less dovish RBNZ tonight.

TD securities are one such bank looking for that in their latest note;

- They see the RBNZ bringing forward a rate hike by 6 months

- RBNZ will keep language on rate moving up or down as it would be too hawksh too soon to remove it

- Should drop the “and into 2020” part of the “keep OCR at an expansionary level for a considerable period”

- Will bring the OCR hike forecast forward by 6 months to reflect higher inflation profile

- Will drop the scenario where the OCR could be cut if growth disappoints

- To repeat that the OCR could be 0.50% higher than the base case if inflation remains to the upside

It’s going to be pretty hard for the RBNZ to try and remain neutral, at the least, with the recent numbers out. Q2 GDP and Q3 CPI were well above the RBNZ’s estimations, as was the unemployment rate well below. Sticking to rate cut language is going to be a very hard sell at this meeting. The RBNZ are going to have to acknowledge the data but how positive they are is going to be the deciding factor.

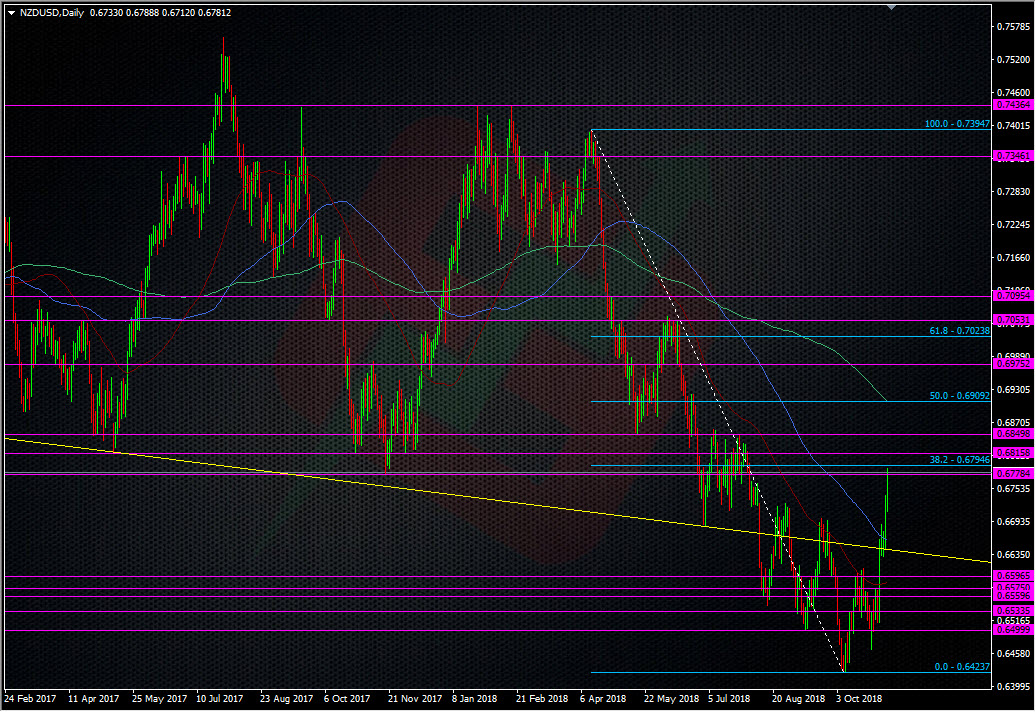

For NZDUSD, it’s going to be hard to keep a lid on it in its current mood. Even if the RBNZ pump the downside risks and try and keep feet on the ground, it’s likely that kiwi longs won’t be swayed too much and any dips will be met well.

The 0.6800 area might offer enough technical resistance to draw a line ahead of the RBNZ but as mentioned, a lot of that is going to come down to how the US dollar plays out after the elections today.

The topside tech is going to stand for very little if the RBNZ does shine a more bullish light on the New Zealand economy so this might not be a train you want to stand in front of. It looks like a dip buyers market and the low 0.67’s look ripe for that.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

I tip for disappointment tonight. Above mentioned data was positive, but there was a string of miserable data before, for example business and consumer confidence, not to mention almost free falling dairy prices.

I can’t see them turning hawkish either as they won’t want the kiwi running away either. The question is whether the market will ignore them.